Top 9 Things to Consider When You Decide the Sum Insured Amount

Key Takeaways

- Sum insured is the amount of health cover provided by your insurer

- Age, income, & policy type are a few factors that affect your sum insured

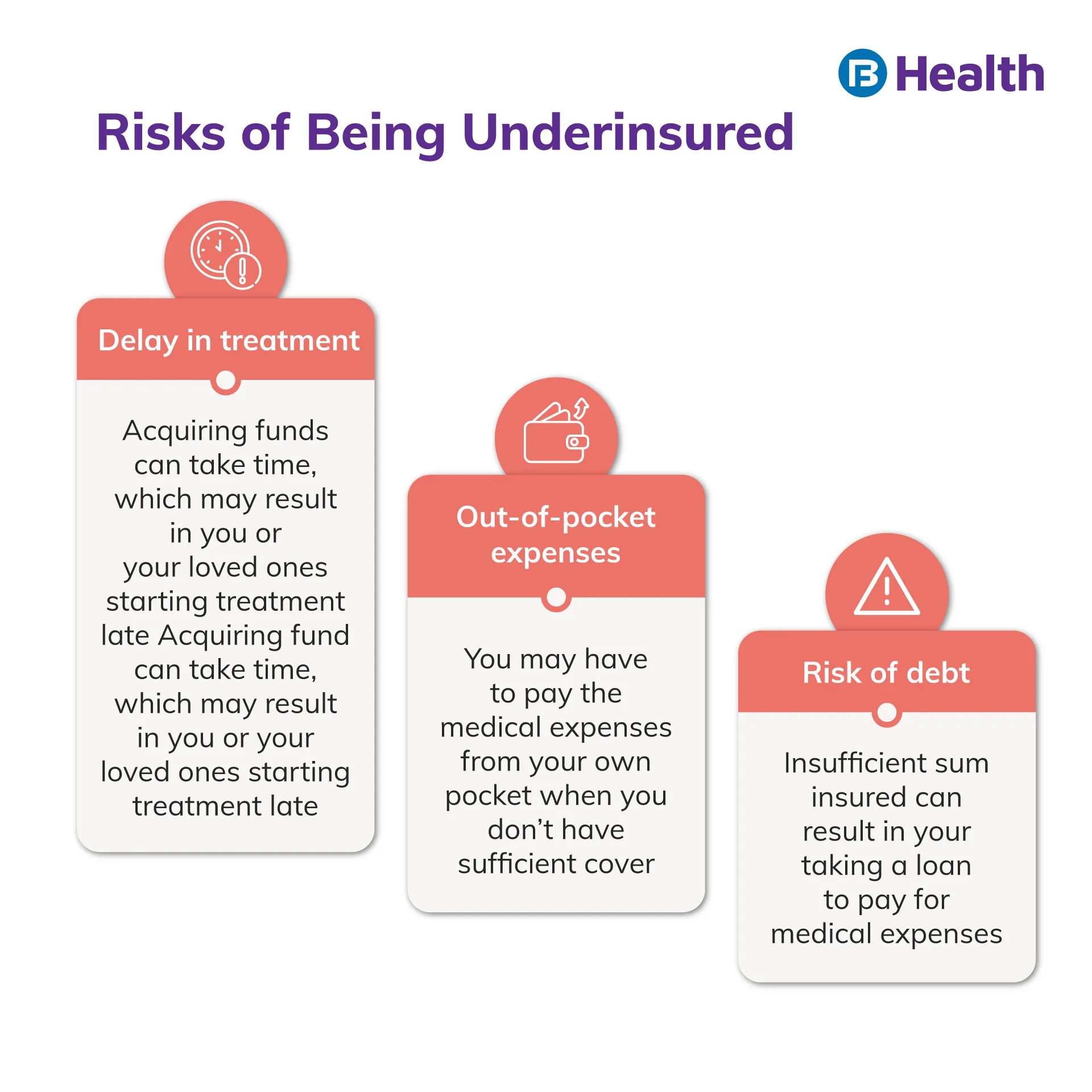

- Insufficient sum insured may lead to an increase in out-of-pocket expenses

In India, approximately 63% of health expenses are made out of pocket [1]. And it is not always a wise decision to deplete your savings to pay for expensive medical procedures. Rather, you can buy a health insurance policy and make sure that the ideal sum insured under your policy meets all your and your family’s medical needs.

Having an adequate amount of sum insured eases your worries about finances. It also ensures that you do not have any or less hefty out-of-pocket expenses regarding your health. Usually, out-of-pocket expenses occur because of inadequate health insurance cover.

How would you determine how much coverage an individual should have? The answer lies in the factors that affect your sum insured. From your age to ongoing medical inflation, there are a lot of things you should consider before finalizing your cover.

9 Factors to Take into Account Before Deciding the Sum Insured of Your Health Policy

Your Age

Age is one of the most important factors that affects your health policy, including the premiums you pay, your policy type, and your sum insured. At a young age, you can select a low sum insured because you may have fewer health risks. After a certain age, usually after 45, you may have more health risks. As a result, you will need a higher sum insured to meet your current and future health needs.

Additional Read: Type of Medical Insurance

The Number of People Under One Policy

If you are buying health insurance policy for yourself, you can have a low sum insured. In case of a family floater policy, your sum insured will be based on how many people need to be covered. While deciding the ideal sum insured for your family, make sure you consider the medical history of individual members and decide accordingly.

Your Lifestyle and Medical History

Your lifestyle has a direct impact on your health. A sedentary lifestyle may increase your risk of various health conditions such as high cholesterol, diabetes, blood pressure. Apart from inactivity, taking too much stress also affects your health. Leading a hectic life may put your heart health at risk.

Your food and other personal habits also have an effect on your health. Unhealthy food habits or excessive consumption of alcohol, tobacco, or other substances may affect your heart as well as other organs. Having high health risk will demand a bigger sum insured. For low health risk, a relatively smaller sum insured will do.

It is best to determine the ideal sum insured for health insurance as per your medical history. If you have or were diagnosed with any health ailment, you will require a high sum insured to meet your treatment costs.

Your Family History

Checking for hereditary diseases like diabetes, blood pressure, heart ailments is important before deciding your sum insured. If you have a family history of developing such conditions, you may want to opt for a higher sum insured. This will help you meet the treatment costs of these conditions in case they are diagnosed in the future.

The Purpose of Buying a Health Policy

A health insurance policy serves many purposes, from providing cover for specific ailments to tax benefits. While deciding the ideal sum insured for health insurance take into consideration what you intend to do with it.

If you are buying a health policy to cover specific diseases, make sure you have an adequate cover to meet treatment costs. If you are buying it for tax saving, make sure that your premium amount is eligible for deduction under the Income Tax Act, 1961. Under section 80D of IT Act, 1961 the premium paid for health insurance policy for self, children, spouse, and parents is eligible for a deduction of up to Rs.1 lakh [2].

Potential Future Expenses and Inflation

Base your sum insured on the possible future expenses that you may incur. This will help you be protected even in uncertain times. A factor to consider while deciding the ideal sum insured for health insurance is inflation. With rising medical expenses, it is important you have enough cover for your current as well as your future health needs.

Your Preference of Hospitals

If you have a preferred hospital, consider its approximate treatment costs while deciding your cover amount. This will help you get treated at the hospital of your choice without a worry. It is also important that you know the average treatment costs at the hospitals in your locality to avoid being underinsured.

Additional Health Insurance Policies

If you have any existing health insurance policies, you can divide your sum insured among your old and new policies. For example, if your ideal cover is of Rs.10 lakh and you already have a policy with a sum insured of Rs.5 lakh, having a new policy with a cover between Rs. 5-6 lakh would help you meet your medical needs.

Your Annual Income

Your bank balance affects your ability to pay premiums. Paying a premium that strains your finances beats the purpose of buying a health policy. So, ensure that your ideal sum insured also comes at an affordable cost. In general, your sum insured should be between 50-100% of your annual income. Setting aside a certain percent of your annual income to pay premium will also help you determine the ideal sum insured for health insurance. Usually, investing 2% of your yearly income in health insurance will help you get a sufficient and affordable sum insured.

Additional Read: Here is What Will Happen If You Do Not Pay Your Premium on TimeWhile the above parameters can help you decide your sum insured, you should check a variety of factors before buying health insurance. These include the premium, claim settlement process and ratio, waiting period, and list of network hospitals. By analyzing all this, you can ensure that your health policy does not fall short at the time of need. You can also check out the Complete Health Solution plans on Bajaj Finserv Health. With them you can get a comprehensive cover of up to Rs.10 lakh at an affordable cost. This way you can protect your health without having to worry about hefty out-of-pocket expenses.

- https://data.worldbank.org/indicator/SH.XPD.OOPC.CH.ZS?locations=IN

- https://www.incometaxindia.gov.in/Pages/acts/income-tax-act.aspx

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.