4 Pointers To Help You Understand the Bajaj Allianz Super Top-Up Policy

Key Takeaways

- Having a health insurance policy helps combat medical inflation

- Bajaj Allianz Super top-up policy offers up to Rs.25 lakh coverage

- You can avail health insurance tax benefits with a super top-up policy

Rapid advancements in the medical industry have made medicine a lot more effective. But, over the years, the cost of care has also risen. Medical inflation is a real problem and can be tackled quite easily with financial coverage. Health insurance combats medical inflation and is something you can rely on [1]. The specifics of your policy will dictate the coverage you get, but it is something everyone should have.

This is especially true when dealing with major illnesses. Having coverage ensures timely care, but it increases the premiums payable too. One of the best options available today is the Bajaj Allianz Super top-up health insurance policy. The super top-up health insurance plan is an additional policy added to the base policy. It offers coverage when your medical expenses exceed the base policy. As such, the super top-up policy comes in handy during emergencies.

Naturally, this is why the Bajaj Allianz super top-up policy is one of the best super top-up health insurance plans. Armed with it, you can address medical expenses with ease. Read on to learn everything you need to know about this super top-up policy.

Additional Read: How to Choose the Perfect Medical Coverage for Your Health Insurance Policy

What is the Bajaj Allianz Super top-up health insurance policy?

The Bajaj Allianz Super top-up health insurance policy is a policy that you can get in addition to your existing health plan. It has its own features and adds to your existing plan. It covers additional medical expenses that you wouldn’t get coverage for otherwise. For instance, a super top-up policy covers hospital bills above the deductible amount. It becomes active for subsequent claims once the deductible is paid. Unlike a regular top-up plan, where a single claim is covered above the deductibles, super top-up insurance covers cumulative expenses as well.

When should you buy a super top-up policy?

Buying a super top-up policy offers you many benefits. If you increase the sum insured on your base plan, the annual premium increases too. On the other hand, buying a super top-up policy is cost-effective as its premium is comparatively lower. It is especially beneficial for senior citizens where the premium amount is usually on the higher side. You can also upgrade your corporate health insurance policy in case your sum insured is not sufficient.

As medical inflation is steadily rising [2], buying a super-top-up health insurance policy early is key. It is best to get it whenever you feel that your existing health insurance won’t cut it. Be it due to a low insured sum or a lack of benefits, a super top-up policy bridges these gaps.

What are the differences between top-up health insurance and super top-up health insurance?

The deductible is applicable on a per claim basis for regular top-up health insurance. If every claim amount doesn’t exceed the deductible, you will not get the claim. Super top-up health insurance covers cumulative expenses. This means the deductible is applicable on total claims made during the policy year. What’s more, you can make only one claim under normal top-up health insurance. With super top-up insurance, you can make claims multiple times.

What features and benefits does the Bajaj Allianz Super top-up health insurance offer?

A super top-up health insurance policy offers the following features and benefits.

- Coverage for preventive care checkups.

- Discounts at network healthcare centres on consultations, hospitalization, and room rent.

- Easy customizability on the super top-up policy and choose the limit for deductibles as per your existing plan and sum insured.

- With super top-up health insurance, your sum insured can be increased over and above your corporate plan at a lower premium.

- OPD benefits include reimbursements for consultation costs.

- A wide network of teleconsultation options.

- Access to health insurance tax benefits. The premium paid on super top-up health insurance is tax-deductible under Section 80D of the IT Act [3].

- Cashless claims at network hospitals and even file for reimbursement.

- Online provisions to purchase and claim the super top-up health insurance policy digitally.

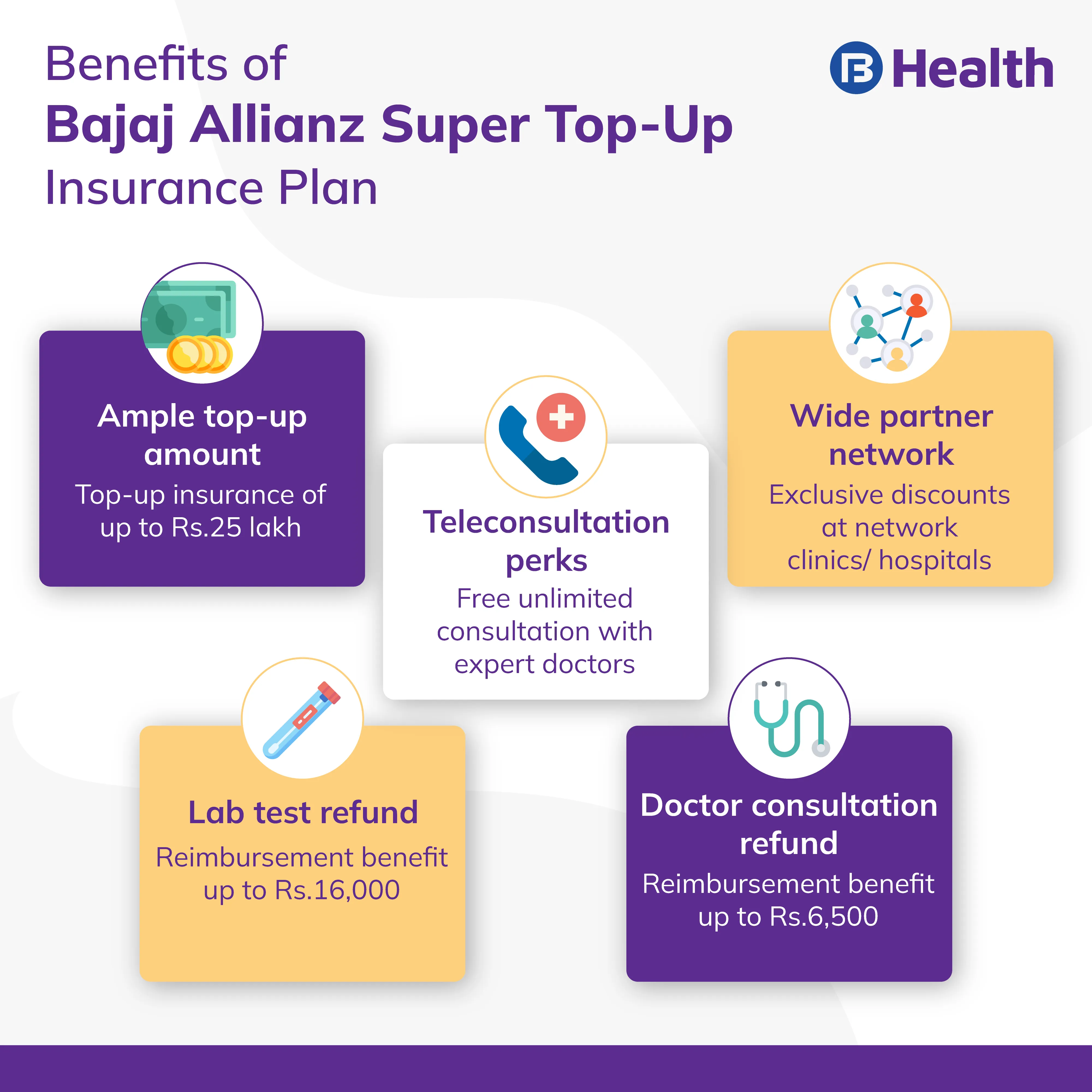

Whether you have a mediclaim top-up plan or any other, a super top-up policy is something you should opt for to get comprehensive coverage. One smart option is the Aarogya Care Health Plans by Bajaj Finserv Health. It has a high claim settlement ratio and a range of features. These make access to medical care easier and more affordable. The benefits are as follows:

- Lab test refunds

- Unlimited teleconsultations

- Consultation refunds

- Network discounts

- Free health checks

Protect yourself and your family with this policy and be assured of care with Bajaj Finserv Health!

- https://www.careinsurance.com/blog/health-insurance-articles/how-to-curb-medical-inflation

- https://www.thehindu.com/data/data-medical-expenses-climb-after-second-wave-adds-to-financial-stress/article35375720.ece

- https://www.incometaxindia.gov.in/Pages/tools/deduction-under-section-80d.aspx

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.