5 Reasons Why a Health Insurance Policy Is the Best Christmas Gift!

Key Takeaways

- End the year on a healthy note by gifting your family members a <a href="https://www.bajajfinservhealth.in/articles/">health policy</a>

- The right policy helps you address your health from illness to wellness

- A <a href="https://www.bajajfinservhealth.in/articles/individual-vs-family-floater-insurance-plan-which-one-is-a-better-option">family floater plan</a> protects the health of your whole family more affordably

The season of merriment, gifts and jingling bells is here! Winter ushers in the festival of Christmas and the New Year is around the corner too. The whole world looks joyful and lit up with Xmas decorations signifying fresh beginnings.

This Christmas, while you pray and hope for the wellness of your loved ones, you can also gift yourself and your loves ones a health insurance plan. This way, you can all start the new year stress-free [1]. With fear of new infections spreading, this can be the best way to protect your family [2, 3].

Read on to know why you should gift an individual or a family health plan for those you care about.

Additional Read: 7 Important Factors to Consider Before Buying Health Insurance Policy For Family

Medical Treatment Expenses Have Become Costly

Healthcare expenditure since the last decade has skyrocketed due to several reasons [4]. These include new medical technologies and drugs, inflation, and lack of enough numbers of doctors. Rising numbers of infections and diseases nowadays can deplete your savings in no time. The cost of treating critical illnesses such as heart disease and cancer has also gone up and out of reach for many. So, health insurance with critical illness benefits can be a lifesaver.

Pre-Existing Diseases Have a Waiting Period

Do you have a family member with pre-existing diseases like asthma, diabetes, or hypertension? If yes, then it is a good time to buy them a health insurance plan with pre-existing disease cover at the earliest. Managing these existing conditions can be quite expensive. Besides, insurance providers with such plans usually have a waiting period of 2 to 4 years before they cover these diseases. So, it is a wise decision for you to get your loved ones the cover they need as they age.

You Can Avail of Cashless Claim Settlement at Network Hospitals

Did you know that health insurance companies offer cashless claim settlements? Here, you do not have to arrange for emergency funds or pay out of your pocket. Simply get the treatment done at any of the network hospitals of your insurer. Your health insurance company will directly settle the bill with the partner hospital based on the policy terms. Provide safety and convenience to your loved ones by buying a health plan that has a large network of partner clinics and hospitals.

Health Insurance Protects Your Family at an Affordable Premium

With many companies offering a wide range of health insurance products, getting one is a cakewalk. Several health plans offer coverage at low premiums. However, while purchasing a health insurance policy for your family, choose one that suits your specific requirements. Today, you can easily get a health cover for your family with a high sum insured at affordable premiums.

You Can Save More This Financial Year with Tax Benefits

How great would it be if you could save on your taxes by investing in your health? This is possible with a health insurance plan! You can avail a tax rebate on the premiums you pay on your health insurance policy. Claim this benefit under section 80D of the Income Tax Act [5]. Thus, the benefits of a health insurance policy make it a perfect Christmas present for your family and your finances.

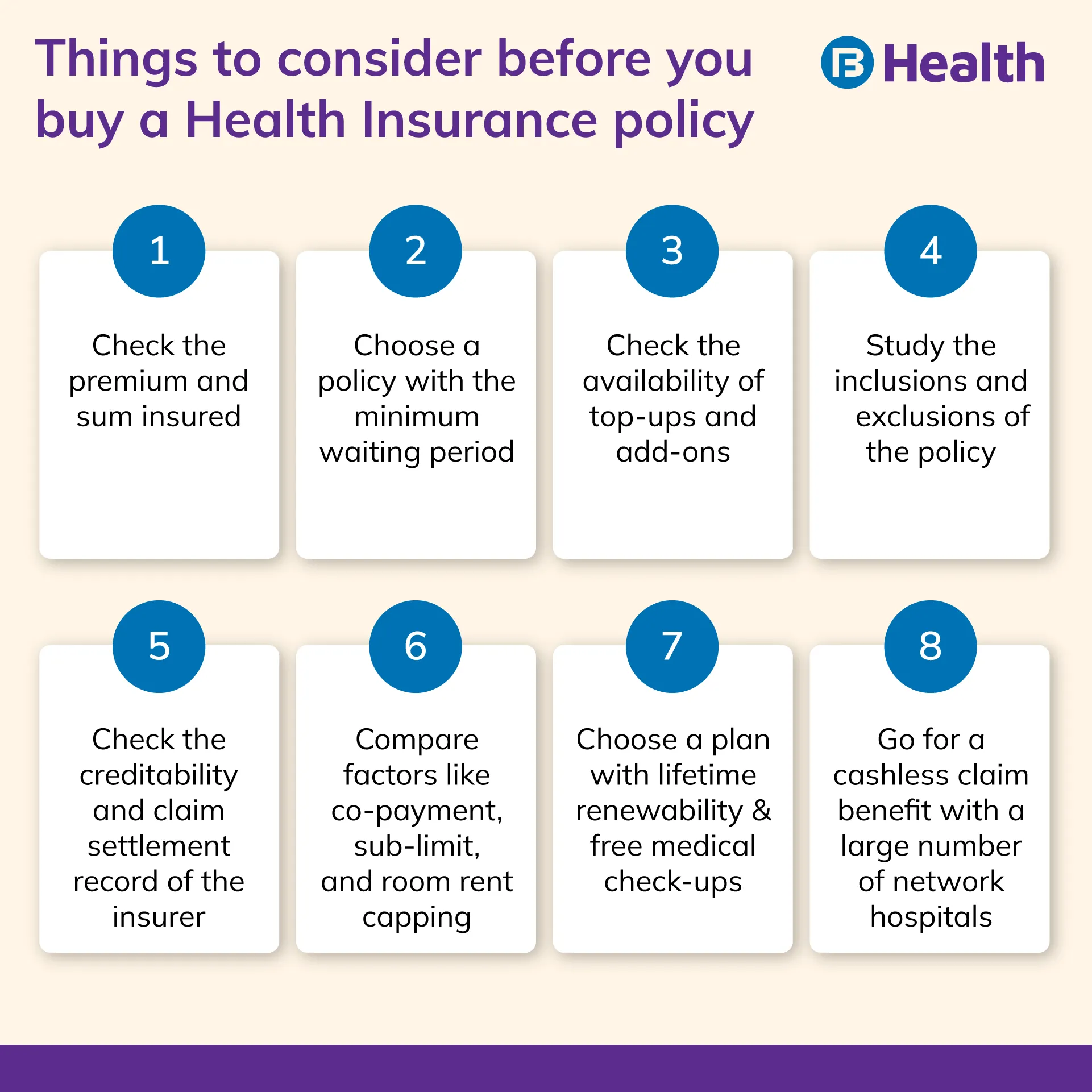

Make sure you consider important factors to buy the right health plan to meet the needs of those it is meant for. For instance, go for a policy that offers wide health coverage, top-up plans, lifetime renewability, and more. Also look for the credibility of the health insurance provider, their claim settlement percentage, and the inclusions and exclusions of the plan.

Additional Read: Making Preventive Care More Accessible – Bajaj Finserv Health and Bajaj Allianz General Insurance Team Up for a New LaunchMake choosing the ideal policy easier on yourself by checking out Aarogya Care Health Plans on Bajaj Finserv Health. These plans offer you a customized benefits with a high sum insured, network discounts, free preventive test packages, and reimbursements on doctor consultations and lab tests. You can conveniently buy individual or family floater plans at affordable premiums and put your health first this Christmas!

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.