General Health | 4 min read

Guaranteed Savings Plan: 6 Features and Benefits

Medically reviewed by

Table of Content

Key Takeaways

- The right investment plan helps you fulfill long-term financial goals

- Guaranteed Savings Plan provides guaranteed maturity benefits

- You can avail network discount benefits with Super Savings Plans

It is important to consider both short-term and long-term goals during your financial planning. While the short term implies addressing your immediate monetary needs, long term plans provide you financial stability and security for future expenses. For instance, planning for your child’s marriage or education requires you to invest in insurance like the Guaranteed Savings Plan to achieve your goals. It protects you against market inflation, volatility, and unforeseen events like COVID-19.

A Guaranteed Savings Plan is a non-participating insurance cover that provides assured returns on your savings. The plans require you to pay premiums monthly or annually for a certain tenure. The premiums and maturity amount of the Guaranteed Savings Plan have tax benefits [1]. However, the terms of the policy may differ with each insurance provider. Read on to know more about the Guaranteed Savings Plan and Super Savings Plans.

Additional Read: Health Insurance Questions and Answers

Features and benefits of the Guaranteed Savings Plan

Protection

With the Guaranteed Savings Plan, you get cover for the whole term by paying only once or for a certain period. It also provides a lumpsum amount to your family members in your absence. With this plan, you or your family can get up to Rs.10 lakh as the maturity sum.

Policy term

While buying the Guaranteed Savings Plan, you can choose a suitable policy term that compliments the financial goals you want to fulfill. Note that the policy term is usually between 10-15 years so you can fix your goals accordingly. For instance, if you need money after several years for your child’s marriage, you can buy a policy that matures during that time so that it becomes easier for you to channel your finances.

Premium payment

Paying for this investment plan does not feel like a burden as you can choose a flexible payment term. Select a premium term that suits your financial abilities. Top insurance providers allow you to pay once or split it over 5 to 7 years. The starting premium can be as low as Rs.5572. This way, you can manage your finances better.

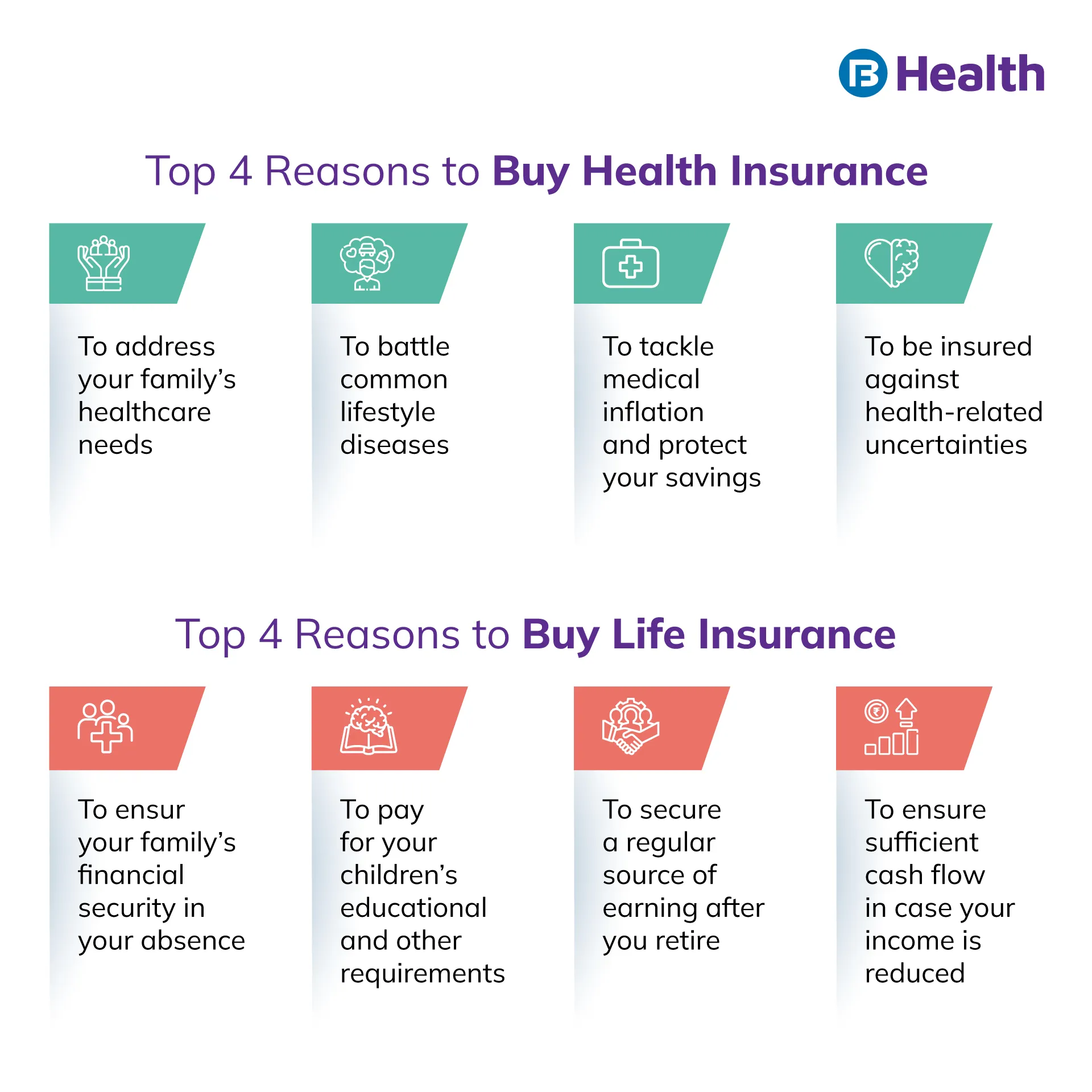

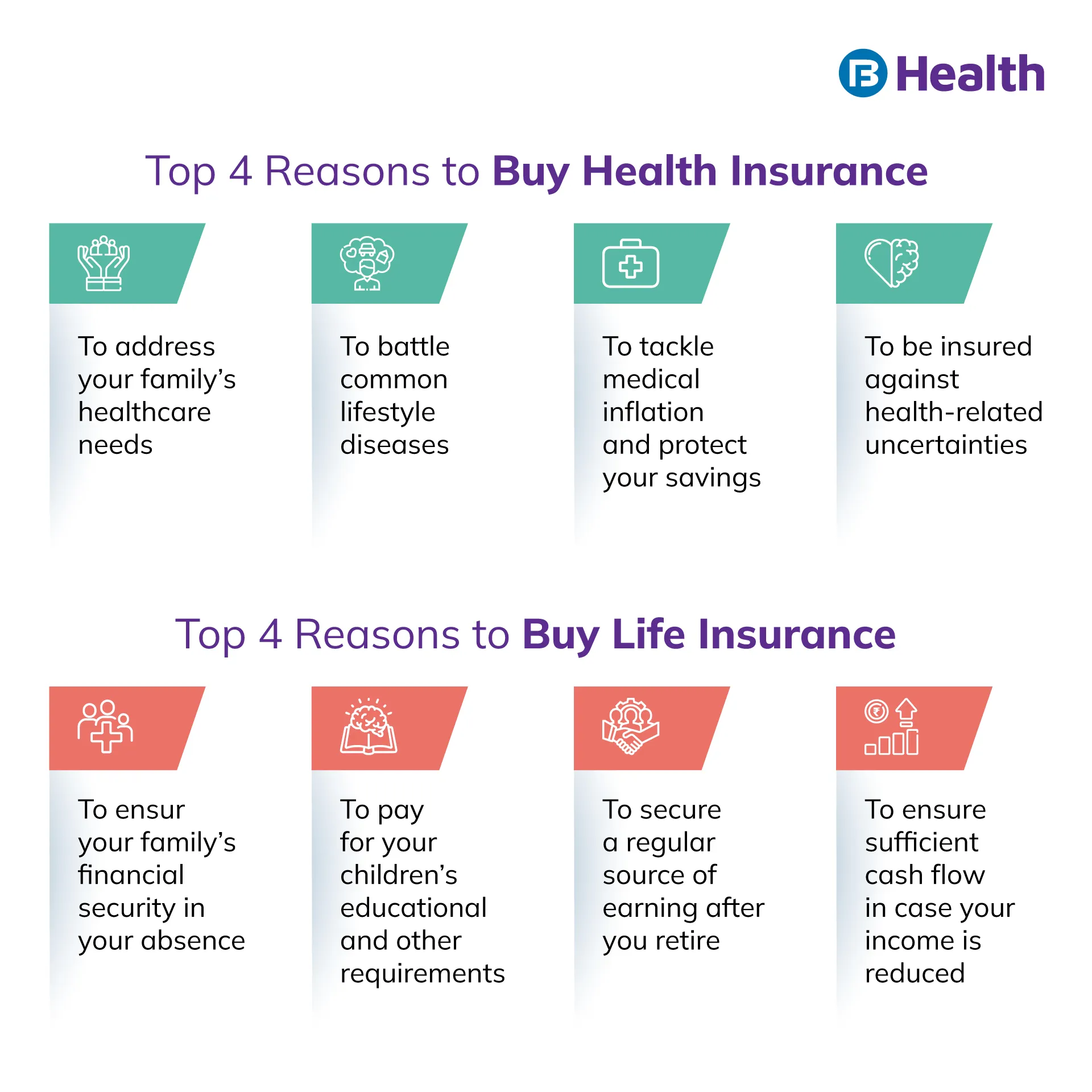

Difference between health insurance and life insurance

Loan against policy

As a policyholder, you can apply for a loan against the Guaranteed Savings Plan. Note that top insurers can approve up to 80% of the surrender amount as loan, which will depend on the terms and conditions set up by these companies.

Tax benefits

As with all other insurance policies, the premium you pay for the Guaranteed Savings Plan is exempt from tax under Section 80C of the Income Tax Act. Similarly, maturity benefits are also tax-free under Section 10 (10D). Keep in mind that the tax benefits on insurance policies are subject to amendments.

Surrender value benefit

Surrender value is the exact sum of money you can receive by accessing the cash value of a plan. For this policy, the surrender value will be same as or greater than the Guaranteed Surrender Value (GSV) and Special Surrender Value (SSV).

What are Super Savings Plans?

Super Savings Plans are health insurance policies offered by Bajaj Finserv Health that provide exclusive savings benefits at network partners. In these uncertain times when contagious diseases are on the rise, these plans suit perfectly to protect your family’s health. You can sign up for them to complement your Guaranteed Savings Plan and enjoy the following benefits.

Membership discounts

With Super Savings Plans, you can avail the best discounts at over 5,000 partner clinics, hospitals, and pharmacies. For instance, you can avail of 5% discounts on diagnostic packages, cardiology, and lab tests, book lab tests now with ease.

Cashback

You can get 100% cashback on certain health services. For instance, you can reimburse your medical bills.

Preventive health check-ups

In present times, it is better to take preventive measures to keep yourself healthy. With these plans, you can keep your health under check by benefiting from complementary health check-ups.

Doctor consultation

You can consult with any doctor and specialist of your choice and get heavy discounts.

Additional Read: Discount Offers by Health Insurance ProvidersWithout a doubt, health and life insurance are two investments you cannot avoid today. Buying the Guaranteed Savings Plan to fulfill your long-term financial goals can be a wise investment choice. You can also check out the Aarogya Care Health plans including Super Savings Plans offered by Bajaj Finserv Health to cover the healthcare expenses of yourself and your family members. Enjoy benefits like high sum insured on health insurance, preventive health check-ups, doctor consultations, lab test reimbursements, and network discounts. To lead a hassle-fee life, start these essential investments if you haven’t already!

References

- https://economictimes.indiatimes.com/wealth/insure/life-insurance/know-how-investors-can-lock-returns-today-and-save-tax-too/articleshow/90267051.cms

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.