Aarogya Care | 6 min read

7 Important Health Insurance Questions and Answers You Need to Know!

Medically reviewed by

Table of Content

Key Takeaways

- Making a checklist before buying health insurance is a smart step

- Sum insured and copay are things to consider before buying health insurance

- Heed these health insurance questions and answers to take the right decision

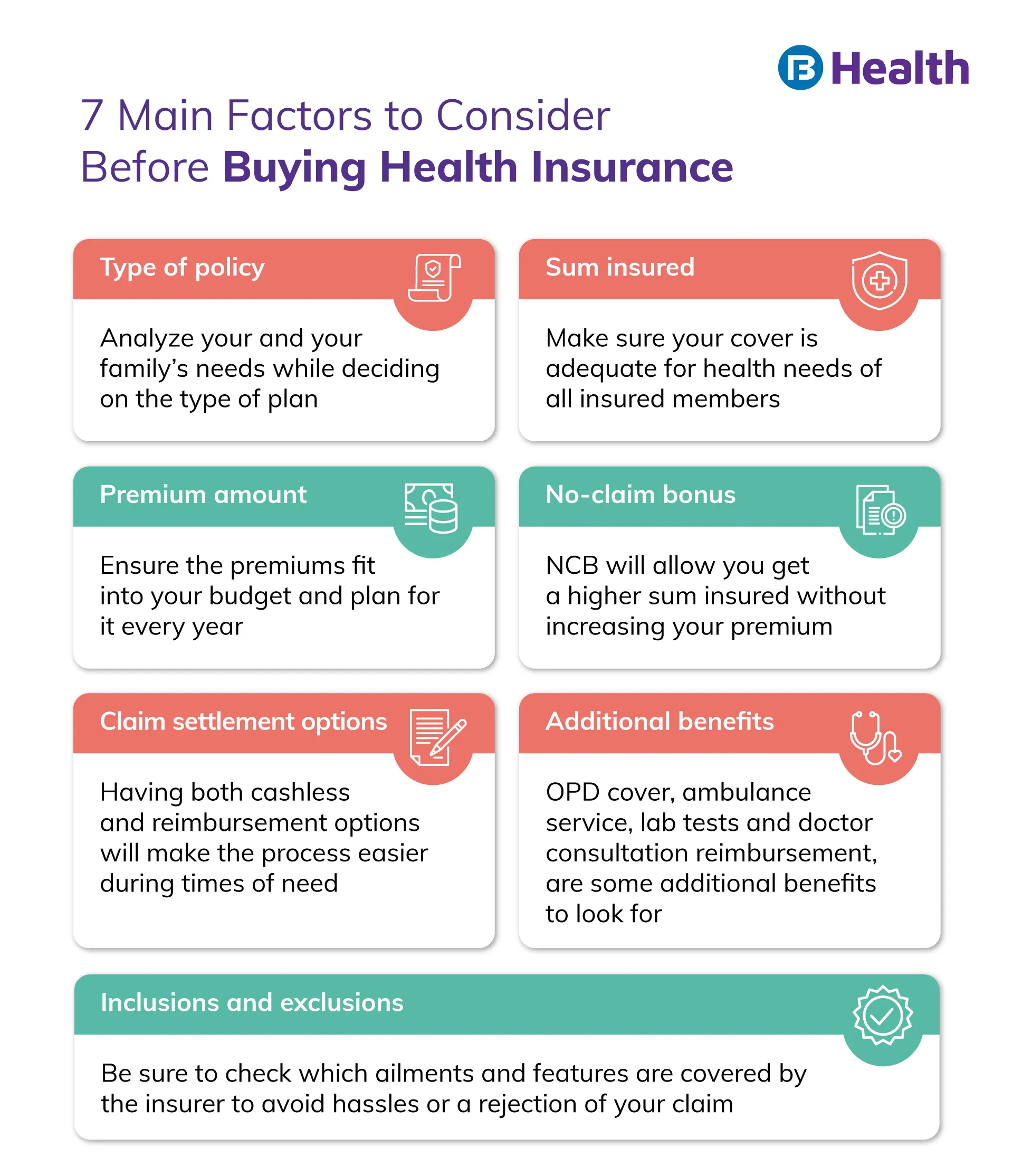

While buying health insurance is important, making sure it is the right one is more important. One of the ways you can ensure this is by making a checklist before buying health insurance. This checklist should be based on important factors to consider before buying health insurance as well as the questions to ask about healthcare services offered.

Although every checklist is different, there are some common questions to ask before buying medical insurance policy. Read on to learn more about the things to consider before buying health insurance in India.

List of Important Health Insurance Questions and Answers

Which Type of Policy Best Meets Your Needs?

The type of policy you need is the most important factor to consider before buying health insurance. There are different policies from individual health plans to critical illness cover that have unique benefits. Some common types of health insurance policies are:

- Individual health insurance

- Family floater policy

- Maternity Health Insurance

- Senior citizen health insurance plan

- Critical illness policy

Based on your age, needs, family set-up, pre-existing conditions and more, getting this choice right is your first step.

Additional Read: Type of Medical InsuranceIs the Coverage Amount You Have Selected Enough?

Underinsurance is one of the factors that result in high out-of-pocket expenses in India [1]. Out-of-pocket expense refers to the costs that are not covered by health insurance. Underinsurance also raises the possibility of future financial burden. To avoid this, the coverage amount becomes an important question to ask before buying health insurance.

The coverage amount refers to the sum insured in your policy. It is the amount that your insurer will cover in case of a claim. Any expenses over the sum insured amount will have to be borne by you. To ensure that you do not fall short, make sure this amount is sufficient for your needs. The factors to consider before deciding your sum insured amount include:

- Age

- Gender

- Medical and family history

- Area of residence

- Number of people under one policy

- Budget

Does the Premium You Need to Pay Fit into Your Budget?

Premium refers to the amount you pay at the time of purchasing health insurance. There are many factors that affect your premium. Some of these are your age, your policy type, and sum insured. A policy purchased for an older person with a high sum insured will come at a higher premium. Your premium may be on the lower side if you buy health insurance at a young age with a lower sum insured. Your premium has a direct effect on your finances and you have some control over it. This makes it one of the deciding things to consider before buying health insurance in India.

Should You Opt for Co-Pay or Deductible?

Insurer will either have a mandatory or voluntary copay clause in health insurance. Co-pay refers to percentage of the claim amount that is to be paid by the insured. On the other hand, deductible is the fixed amount that you will have to pay for your medical expenses. The insurer will be liable to cover your expenses only after you exceed the fixed amount.

For example, say you have a claim of Rs.40,000 and your deductible is Rs.50,000. In this case your insurer will not be liable to compensate you for your claim. Instead, if you have a claim of Rs.40,000 and your co-pay is 10%, you have to pay Rs.4,000 and your insurer will cover the rest. As these clauses may increase or decrease your financial burden, deciding whether to opt for deductible or co-pay is one of the important questions to ask before buying health insurance.

Is Your Insurer Offering a No-Claim Bonus?

No-claim bonus (NCB) refers to the bonus you acquire in a claim-free year. This bonus can get accumulated over the years. It allows you get a higher cover without any addition to your premium amount. Even when you port your policy to another company, you will also not lose your NCB or other renewal benefits [2].

Does the Network Hospital List Work for You?

Network hospitals are the ones that have a tie-up with your insurer. At these hospitals, you can avail a cashless claim benefit. If you prefer a particular hospital for treatment, be sure to check if it is in the network list of your insurer. This will help you avail seamless treatment benefits and claims.

What Are the Settlement Options and Csr of Your Insurer?

Generally, insurers offer two types of settlement option: reimbursement and cashless. In reimbursement, the insurer will pay you back after your treatment. In a cashless settlement, the insurer will directly make payment to the hospital. You do not have to pay anything unless it exceeds the sum insured or other terms. But for availing the cashless mode, your treatment has to take place at a network hospital. So, keep your options open by ensuring that you have both modes available to you.

Additional Read: Cashless and Reimbursement ClaimsClaim settlement ratio (CSR) refers to the number of claims settled by the insurer. For example, if the insurer has a CSR of 90, then they have settled 90 out of 100 claims. A high CSR implies that the insurer settles a high number of claims. This is a positive sign for you.

To have the most feasible claim options and reduce the possibility of your claim getting rejected, make sure you also add the following questions to your checklist before buying health insurance.

- What are the additional benefits offered in your plan?

- How do the inclusions and exclusions affect you?

- Do you need any add-ons or rider in your policy?

Remember, these are the general questions to ask before buying health insurance. Your health insurance questions and answers should cover your and your family’s needs. Doing your research and discussing terms with your friends or family can help you make the right decision. You can also check out the Complete Health Solution plans offered on Bajaj Finserv Health. The plans come with additional benefits of preventive health check-ups and reimbursement of lab tests and doctor consultations. Along with a simple 3-step buying process, you also have the option of talking to an expert before buying your policy. There are so many health insurances available in the market Ayushman health account is one of them provided by the government. So, get all your questions answered and choose a plan that best caters to your and family’s health needs!

References

- https://bmchealthservres.biomedcentral.com/articles/10.1186/s12913-020-05692-7#:

- https://www.policyholder.gov.in/you_and_your_health_insurance_policy_faqs.aspx

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.