Aarogya Care | 5 min read

7 Top Discount Offers by Health Insurance Providers

Medically reviewed by

Table of Content

Key Takeaways

- Get discounts when you add a family member to your insurance policy

- You can also get a discount on cumulative premium payments of your plan

- Health plans also offer big network discounts to save you money

Who does not love Discount on health insurance? The market thrives on discounts with the buyers and sellers both benefiting from them. This is no exception when it comes to purchasing health insurance! With rising inflation in the healthcare industry, opting for discounts on check-ups and other treatments can help you save more. You can get personalized offers and discounts by subscribing to health plans offered by top insurers.

Though most people are well aware of the importance of buying a health plan, 30% of Indians still don’t have health insurance [1]. In such a situation, discounts provided by insurers may motivate you to buy a health policy and enjoy comprehensive benefits. Read on to know more about some discount on health insurance.

Policy Discounts

Discounts for Adding Family Members

When you add family members to your policy, you may get exciting discount on health insurance from your insurer. This discount is not related to the number of members you add to a family floater. Instead, it depends on your insurer’s policy. For instance, consider a case where you get a discount by adding your spouse to your health plan. Adding your children and parents to the same plan may not get you additional discounts. Some companies provide up to 10% discount on adding two members to a health plan. So, check the terms and be smart when choosing a policy!

Discounts on Cumulative Premium Payments

When you invest in health insurance, you have the option to pay your premiums monthly, quarterly or annually. In case you pay premiums annually, your insurance provider may offer you interesting discounts. Getting premiums in a lump sum is beneficial for insurers, which is why they offer up to 10% discounts when you pay annually. So, check this before you decide on the frequency of your premium payments.

Additional Read: 6 Important Tips to Lower Your Health Insurance PremiumNo-Claim Bonus

During your policy tenure, it is not mandatory for you to raise a claim. In case you do not make claims, you are eligible for a bonus each financial year. Your insurer may offer no-claim bonuses in the form of discounts on your premiums. Your insurer may also give you an increment of a minimum of 5% in your sum assured. You can accumulate this over a period of time. Keep in mind that this bonus is added up until you make a claim or reach a specified limit. The good news is that when you transfer your plan from one provider to another, your no-claim bonus is still valid.

Service Discounts

Network Discounts

You can avail huge network discounts when you undergo treatment at any of the hospitals listed with the insurer. These discounts are also available when you take tests at any of the partner labs or purchase medicines from specific pharmacies. Getting such discounts is highly beneficial as you can manage your medical expenses with ease [2].

Additional Read: Are Lab Tests Covered in a Health Insurance Policy? What are the Benefits?Discounts for Maintaining a Healthy Lifestyle

Health is wealth is not a proverb unknown. Taking it seriously and maintaining a healthy lifestyle is what actually matters. Be it following a well-balanced diet or staying active, you can improve your quality of life with a healthy approach. Keeping this in mind, health insurance providers offer exciting rewards to policyholders for leading an active and healthy lifestyle. These wellness rewards also help in motivating you to continue living a healthy life! For instance, if your medical reports for two consecutive years show healthy vitals, you may be eligible for discount of up to 25% on your premiums. There are so many health insurances available in the market Ayushman health account is one of them provided by the government.

Discounts That Empower Girls and Women

Health insurance companies reduce premiums exclusively for female members. Female policy proposers can avail discounts in such cases. You can also find several insurers who provide discounts on plans that include more women members. Such discounts range between 5-10% of your total policy premium.

Free Health Check-up

Though it is not a monetary benefit, your insurance provider may offer a free health check-up once you complete a few years with them. Make sure you continue your policy by renewing it on time to get this benefit. In most cases, your insurer offers you free medical check-ups once you complete 2 or 4 years with them. Some insurers may also provide a free health check-up for every year you do not raise a claim. Lastly, you can get free preventive checkups when you sign up with certain insurers every year.

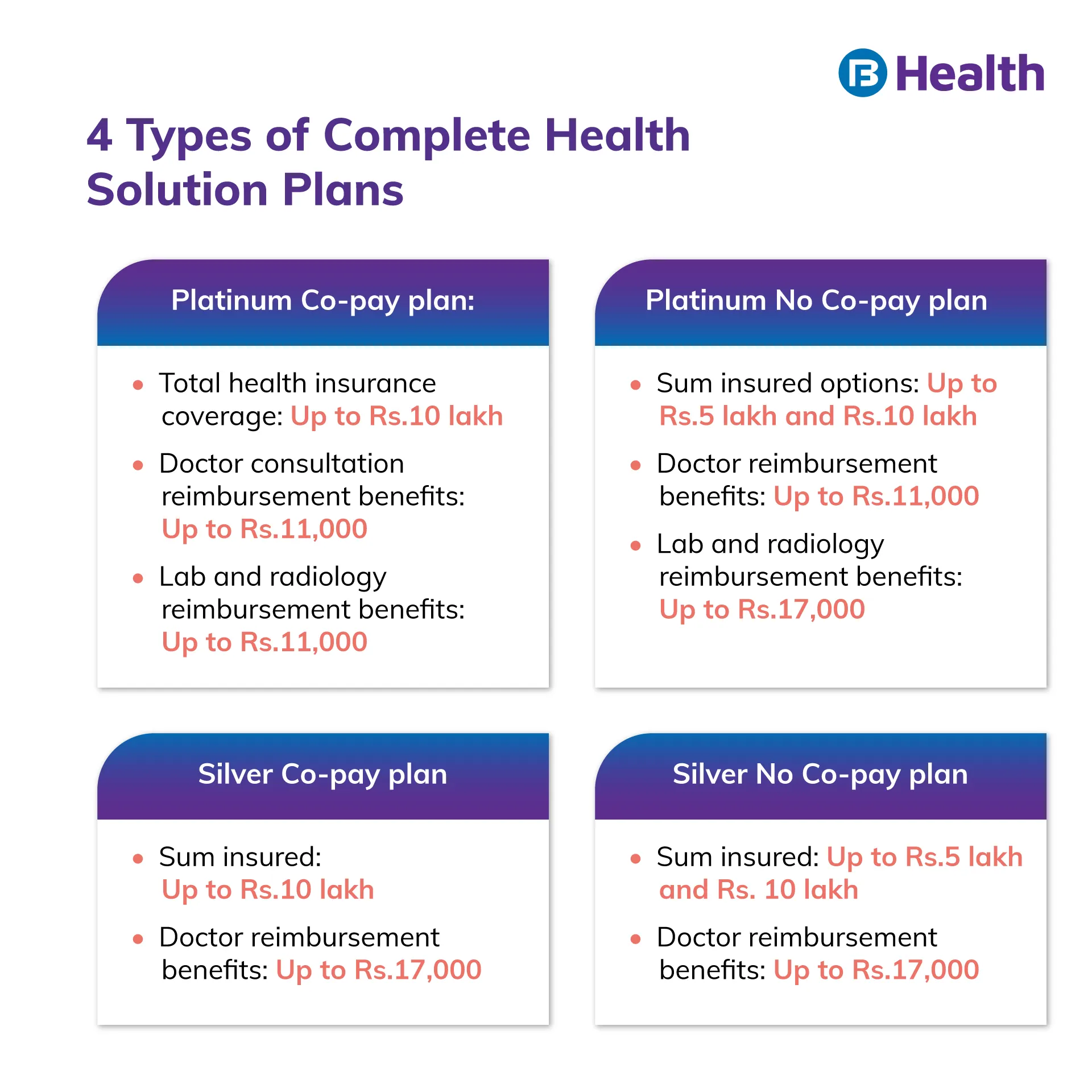

While you know that health insurance policies give you long-term protection, choose a plan with comprehensive coverage. Then getting such discounts is simply icing on the cake! This way, you get the most out of your health policy and save money too. To enjoy amazing discounts and beneficial features, check out the Complete Health Solution plans on Bajaj Finserv Health. These plans provide huge network discounts of 10% to fulfill your medical requirements. You can also get 5% off on room rent during hospitalization at network hospitals. The best part is that you can can avail these plans at nominal premiums and enjoy coverage for preventive healthcare with 45+ tests free of cost annually. Sign up today!

References

- https://www.financialexpress.com/money/insurance/at-least-40-cr-individuals-dont-have-any-financial-protection-for-health-niti-aayog/2359706/

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6482741/

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.