Aarogya Care | 5 min read

Simple Ways That Can Help You Save Money on Healthcare Plans

Medically reviewed by

Table of Content

Key Takeaways

- Health plans help you deal with medical inflation and protect your finances

- Proper planning and healthy habits can help you save money on health plans

- Availing the various benefits of healthcare plans can also help you save money

Investing in health insurance plans has become a necessity, particularly in lieu of the rapidly-rising healthcare costs. Health insurance plans are extremely useful in beating medical treatment inflation. With the best healthcare plans, you can

- Avail preventive healthcare facilities

- Get cover for your family members

- Protect your savings during planned or unplanned healthcare expenses

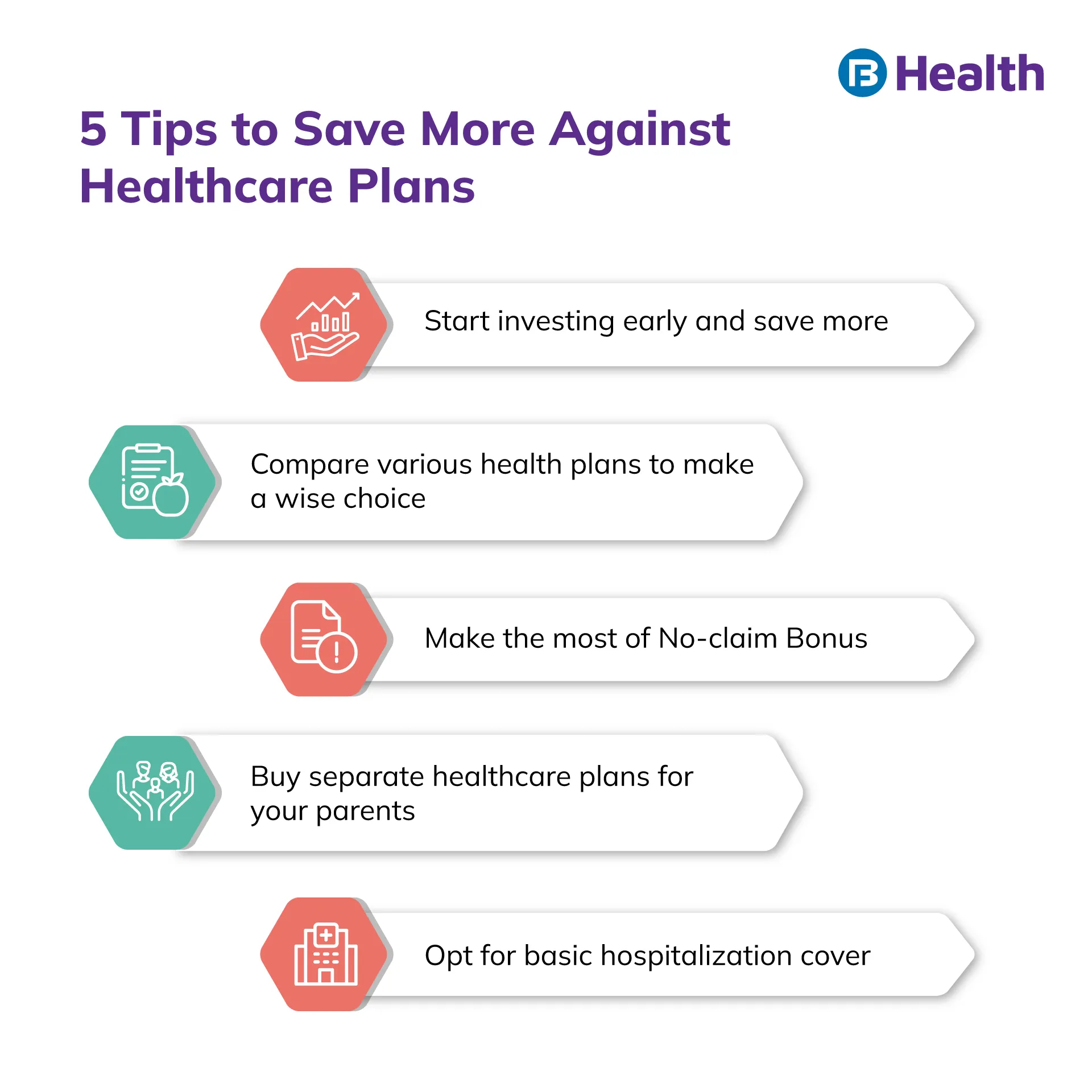

Despite its numerous benefits, around 40 crore Indians, 30% of the population, have no health insurance [1]. Apart from lack of awareness and other reasons, affordability is also a key factor for not buying health plans. But, note that you can save money on healthcare plans with proper planning and resources. Read on to know five simple tips that can help you save on healthcare plans.

Plan ahead for emergency and future needs

When an injury or illness occurs, you need to make some quick decisions. One of these would be to decide on which hospital you should go to. This is important because your health plan provider may also offer cashless benefits and directly settle the bill with the hospital. But this benefit is only available if your treatment takes place at a network hospital of your insurer. So if you know which network hospitals of your insurer are nearby, you can get treatment without worrying about financing it. Usually, your insurance provider gives you a list of network hospitals when you purchase a health plan. In case of further concerns, you can also contact your insurance provider to learn about the network of hospitals in your area.

Moreover, while selecting a healthcare plan, you should take into account your future health needs. Make sure you review your health needs even while renewing your policy. This way, you can get a plan that is best for you and avoid high out-of-pocket expenses that may occur due to medical inflation.

Additional Read: 8 Important Reasons to Review Your Medical Insurance Every Year!Use your health plan benefits.

With every health plan comes a few benefits. Make sure that you use them to your advantage. Some of these additional benefits may include:

Routine health check-up

Get routine health screenings as these tests help identify problems in the primary stages. Early detection can help you prevent or treat the illness with more ease. Often you do not have to pay for vaccines, annual wellness visits, or any health screenings

Prenatal care

You may get this benefit as an add-on or as a part of your healthcare plan. Opt for it during or before pregnancy to safeguard your and your baby’s health

Health advocate

Health plans offer you a health advocate or a case manager. You can contact this person to understand your health plan and its benefits. This will help to make the most of your plan

Extra healthcare services

Know the extra services offered in your health plan and use them in the best way possible

Cut costs on your medicine

Cutting your medicine costs can help you indirectly save on your healthcare plans. Getting reimbursement for buying expensive medicines may, in turn, reduce your cover amount. Insufficient cover at the time of treatment can lead you to buy a top-up plan or do high out-of-pocket expenses. Here are a few methods you can apply to reduce your expenses for buying medicines:

- You can request your healthcare provider to prescribe you generic medicines that have the same active ingredients as branded drugs but cost less.

- You can opt for less expensive options on medicines that treat the same conditions.

- Try to use an app to order your medicine; there are likely to be schemes and offers that can get you a discount.

- Take your medicines as directed; do not buy any extra medications.

Use employer’s insurance

One of the best ways to save on your cost of health insurance is to use the one provided by your employer. Some companies may also offer health insurance that covers the dependents of the employee like spouse, parents, or children. The insurance plans provided by employers are usually group health insurance. Because of this, the premium that you pay here is comparatively less. This way, you can keep your, and your family’s health insured.

Keep in mind that you can port your group health plan to an individual or family floater plan at the time of leaving your current organization [2].

Additional Read: Port Your Group Health Insurance to an Individual Health Plan with Ease! 3 Benefits

Follow healthy habits

The simplest way to reduce your medical costs is to remain healthy. You can take measures to maintain a healthy weight, eat nutritious food and get regular exercise. This can help you avoid costly treatments and tests.

Apart from these, the type of health plan you need is vastly dependent on your health. You are less likely to need a high cover or specific cover if you follow a healthy lifestyle. Moreover, you may also need to pay a high premium if you have unhealthy habits like smoking or drinking too much. Abstaining from these can also help you save on healthcare plans.

Healthcare plans are essential, but it is important to make a wise choice. Follow these tips to save money on healthcare for your future. Check out the Aarogya Care plans available on Bajaj Finserv Health. The Health Protect Plans and Super Savings Plans can help you get comprehensive cover at an affordable price. With these plans, you can enjoy additional benefits such as lab test reimbursement and network discounts that can help you save more. Choose from health plans that are tailor-made for your health needs and secure your and your family’s health with ease.

References

- https://www.niti.gov.in/sites/default/files/2021-10/HealthInsurance-forIndiasMissingMiddle_28-10-2021.pdf

- https://www.irdai.gov.in/ADMINCMS/cms/frmGuidelines_Layout.aspx?page=PageNo3987

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.