Aarogya Care | 5 min read

Does Health Insurance Cover COVID-19 Vaccination? Things You Need to Know!

Medically reviewed by

Table of Content

Key Takeaways

- There are many challenges in vaccinating the whole population

- IRDAI has mandated health insurers to cover COVID-19 expenses

- The standard health insurance plans do not cover the COVID-19 vaccine

With coronavirus claiming many lives across the globe, the launch of COVID-19 vaccines has been a ray of hope. Several healthcare manufacturers have introduced vaccines to lower the impact of this infection and hopefully prevent its spread. Countries are taking measures to vaccinate their population but there are some challenges. Those that choose not to get vaccinated have a higher risk of complications. This results in expensive treatments and medical expenses.

Fortunately, the IRDAI has advised insurance companies to cover COVD-19 treatment costs under their existing health insurance policies [1]. So you can buy a health insurance policy to protect yourself against unforeseen medical costs. But the question is whether these health policies cover the cost of COVID-19 vaccination. Read on to find out.

Additional Read: Child Vaccination in India

Is COVID-19 Vaccination Covered Under Health Insurance Plans?

The roll-out of the COVID-19 vaccination has given a ray of hope to fight against the novel coronavirus. Several vaccines are being manufactured by the pharmaceutical industry. The government has advised precautionary measures such as wearing a mask and maintaining social distancing to protect against the virus. The spike in the COVID-19 cases is being battled by imposing lockdowns across the country.

With an increase in the COVID-19 cases in India, the IRDAI has made it mandatory for all health insurers to cover COVID-19 treatment expenses in their existing health plans. Pre- and post-hospitalization costs are also included, if applicable.

The standard health insurance plans do not cover COVID-19 vaccines as vaccination is preventive in nature [2]. But, if your health plan offers OPD coverage, the cost of COVID-19 vaccines will be covered if specified in the policy. The IRDAI is contemplating including vaccination costs in the COVID-19 insurance policies with an aim to vaccinate all.What Are the Benefits of Health Insurance with Opd Coverage?

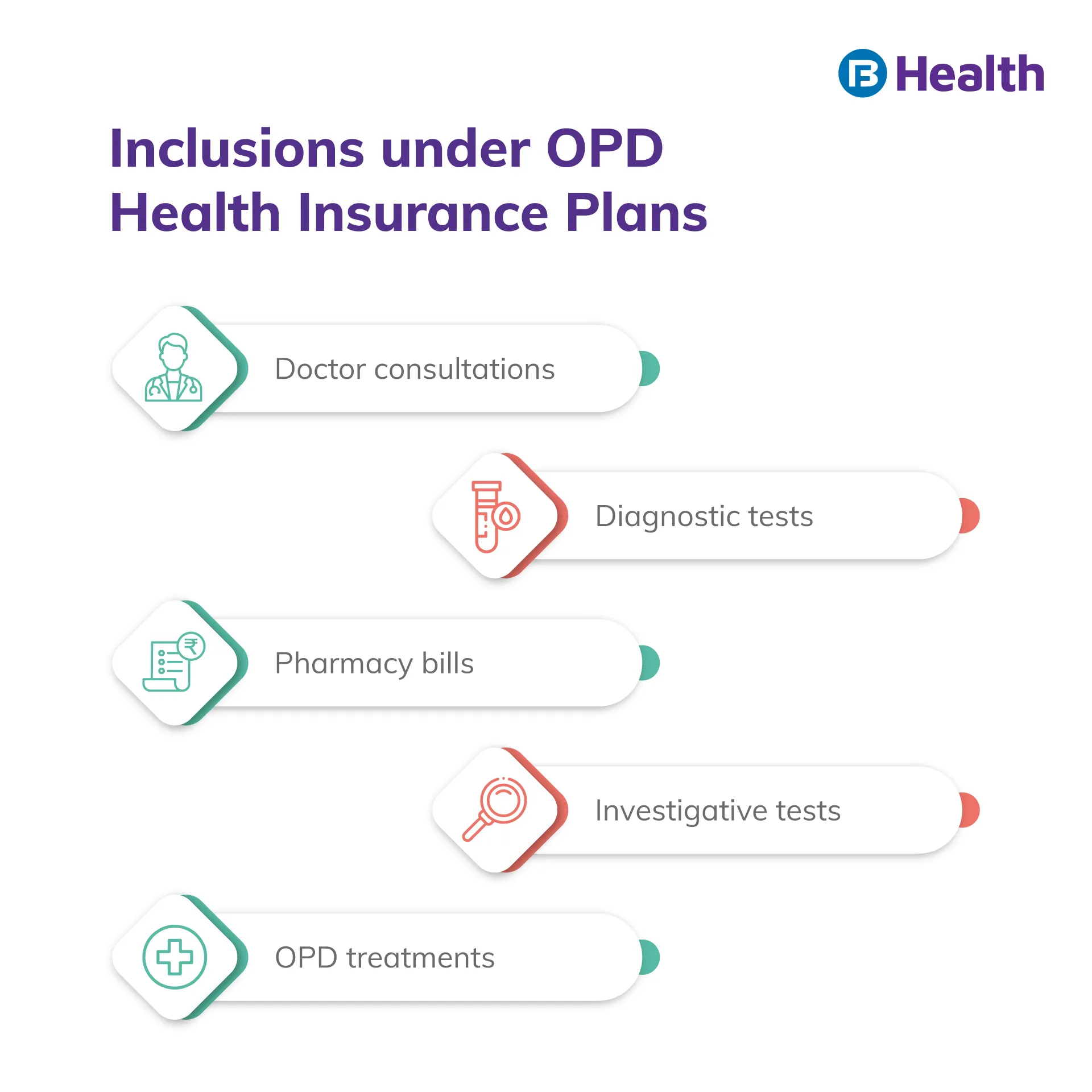

A health insurance plan with OPD coverage covers the cost of outpatient treatment. It covers the medical expenses incurred without hospitalization. These include doctor’s fees, medicines, diagnostic tests, dental treatment, health check-ups, and more. Health insurers generally do not provide OPD coverage and thus it is available as an add-on cover. However, some health insurance companies may include OPD coverage in their basic plan.

Health insurance plans with OPD coverage cover all vaccines including the COVID-19 vaccination. The health insurance plans with OPD cover are generally expensive. The high claim probability and chances of fraud make the premium on such policies costly. Moreover, you may not get covered for the full cost of the vaccine due to sub-limits. You should note that OPD consultations are only covered at network clinics and hospitals.

Here are some benefits and reasons why you should have a health insurance plan with OPD coverage:

- You can claim for medical expenses without getting hospitalized

- You can claim reimbursement on expenses multiple times during the policy period

- Health plans with OPD cover provide tax benefits as it helps save on income tax deductions

- You get covered for expenses including consultation fees, pharmacy bills, and diagnostic costs

- It helps people with pre-existing medical conditions requiring frequent OPD visits

- It may be helpful for people who are immunocompromised

- People with asthma, diabetes, thyroid, and other chronic medical conditions requiring regular doctor consultations may benefit from OPD cover

- Health insurance with OPD cover is beneficial for patients who need regular hospital visits for OPD consultations

Why Should You Opt for Health Insurance with Vaccine Cover?

Here is why you should opt for health insurance with OPD cover that includes COVID-19 vaccination:

- It provides safety to your family. COVID-19 is a contagious disease that spreads through direct contact with an infected person. A health insurance policy that covers vaccination will help in preventing the disease. For better health and wellbeing, consider buying a health policy with vaccination cover.

- If you are already vaccinated, the health plan with vaccination cover may include any costs for booster shots if needed in the future. Apart from this, such covers can be used for any type of vaccination.

- Some insurers provide a separate limit for the vaccination cover that does not cut into your base sum insured. It also does not affect your cumulative bonus.

- Certain health insurers offer vaccination cover as a feature of their base policy rather than an add-on. As such, you do not have to pay anything extra towards the premiums for the coverage.

- Vaccination costs along with other treatment costs can be quite expensive. The rising medical costs can deplete your savings [3]. Opting for health plans that cover vaccination costs will keep you financially secure when you face the burden of medical expenses.

- As the vaccination for COVID-19 is new and research is ongoing on its effectiveness and side effects, nothing can be predicted. In case any adverse reactions require hospitalization, a health plan with vaccination cover may prove beneficial.

- As with any other health insurance plan, a vaccination cover gives you the benefit of cashless claim settlement when the services are availed at network hospitals. Do remember to check the process and claim settlement percentage of the insurer before buying the plan with vaccination cover.

Having the right health insurance policy protects you against the medical costs arising out of various treatments. So, you need to be careful about choosing a policy that offers comprehensive cover and provides protection to you and your family. Buy Complete Health Solution plans offered by Bajaj Finserv Health. These plans offer a medical cover of up to Rs. 10 lakh as well as other benefits. These include network discounts, reimbursements on doctor consultation, lab test benefits, and preventive health checkups. Sign up now and make your health a priority to safeguard against COVID-19 and other illnesses.

References

- https://www.irdai.gov.in/

- https://www.adityabirlacapital.com/abc-of-money/will-covid-19-vaccine-be-covered-under-health-insurance-plans

- https://www.livemint.com/market/mark-to-market/indias-already-stiff-healthcare-costs-get-a-pandemic-boost-11621582098264.html

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.