General Health | 7 min read

How Health Insurance Works in India: Top Facts to Know

Medically reviewed by

Table of Content

Synopsis

Wondering how does medical insurance work in India? Health insurance offers coverage for medical expenses as per the premium you pay. Read to learn more about how health insurance works in India.

Key Takeaways

- Before you buy a policy, learn how health insurance works in India

- Compare different policies online and choose the best-suited one

- Learn about a policy’s renewal and claim settlement process

Do you know how health insurance works in India? This is a crucial question you should have the answer to. Since medical expenses in India are rising steeply, the best bet is to invest in an ideal health insurance policy. When diagnosed with an illness, you may have to pay out of pocket or need to borrow funds or break investments without a medical policy.

After the pandemic, the medical inflation rate reached 14%, the highest in India as compared to other countries. This makes it even more important for you to have a health plan to rely on so you can visit the best clinics, get the most advanced treatment, and can also avail specialty drugs and medication [1].

Before knowing how medical insurance works in India, it may help you to understand the increasing need for it. For one thing, cancer is becoming more prevalent, with incidence increasing from 26.7 million in 2021 and expected to hit 29.8 million in 2025. In terms of heart ailments, by 2030, 1 out of 4 deaths will be caused due to cardiac diseases, as per experts. Similarly, the number of kidney patients who require a transplant or dialysis is over 100,000 a year, as per studies. The treatment for all these conditions is expensive, and rising costs are a big reason for you to invest in a health policy.

While more people want to know how health insurance works in India after the surge in hospitalizations due to COVID-19, it is in your best interest to learn the basics and invest in a suitable plan. Read on to get the answer to the question, how does medical insurance work in India?

Additional read: Online vs. Offline Health Insurance

How Does Health Insurance Work in India?

To understand how health insurance works in India, you should learn about health insurance.

Investing in a healthcare plan means signing an agreement with a health insurance company. This agreement is regarding a health insurance policy that covers your medical expenses as per the specifications in the policy document. You get coverage for the premiums you pay to the insurer, and these premiums depend on a variety of factors such as your age, health conditions, and the coverage you want.

Health insurance coverage extends to the following:

- Your hospitalization expenses

- Costs of any day-care treatments

- Domiciliary charges for treatment done at home

- Pre-and post-hospitalization expenses

- Annual health checkups

- Ambulance expenses

In some cases, your medical insurance coverage may also cover visits to doctors and your diagnostic tests. It may also offer you discounts on the costs of medical services at partner institutions. All this reduces your health expenses. These parameters vary according to the type of policy you choose. Now that you are starting to understand how health insurance works in India make sure you research various policies online before finalizing a suitable one. Read and understand your policy documents so that you have an idea about the inclusions and exclusions.

Any treatment involving medication and surgeries may cost up to lakhs of rupees. Therefore, the best way to ensure the welfare of the entire family is to get the best health insurance plan with a variety of features and insurance coverage.

Another important aspect of how medical insurance works in India is to know that you can customize policies to a great extent. This helps you get a policy that truly suits your medical needs. For instance, you can opt for add-ons or riders to extend the scope of coverage.

A few examples of add-ons include:

- Accidental rider

- Critical illness rider

- Room rent waiver

- Personal accident cover

- Maternity cover

How to go About Getting Medical Insurance?

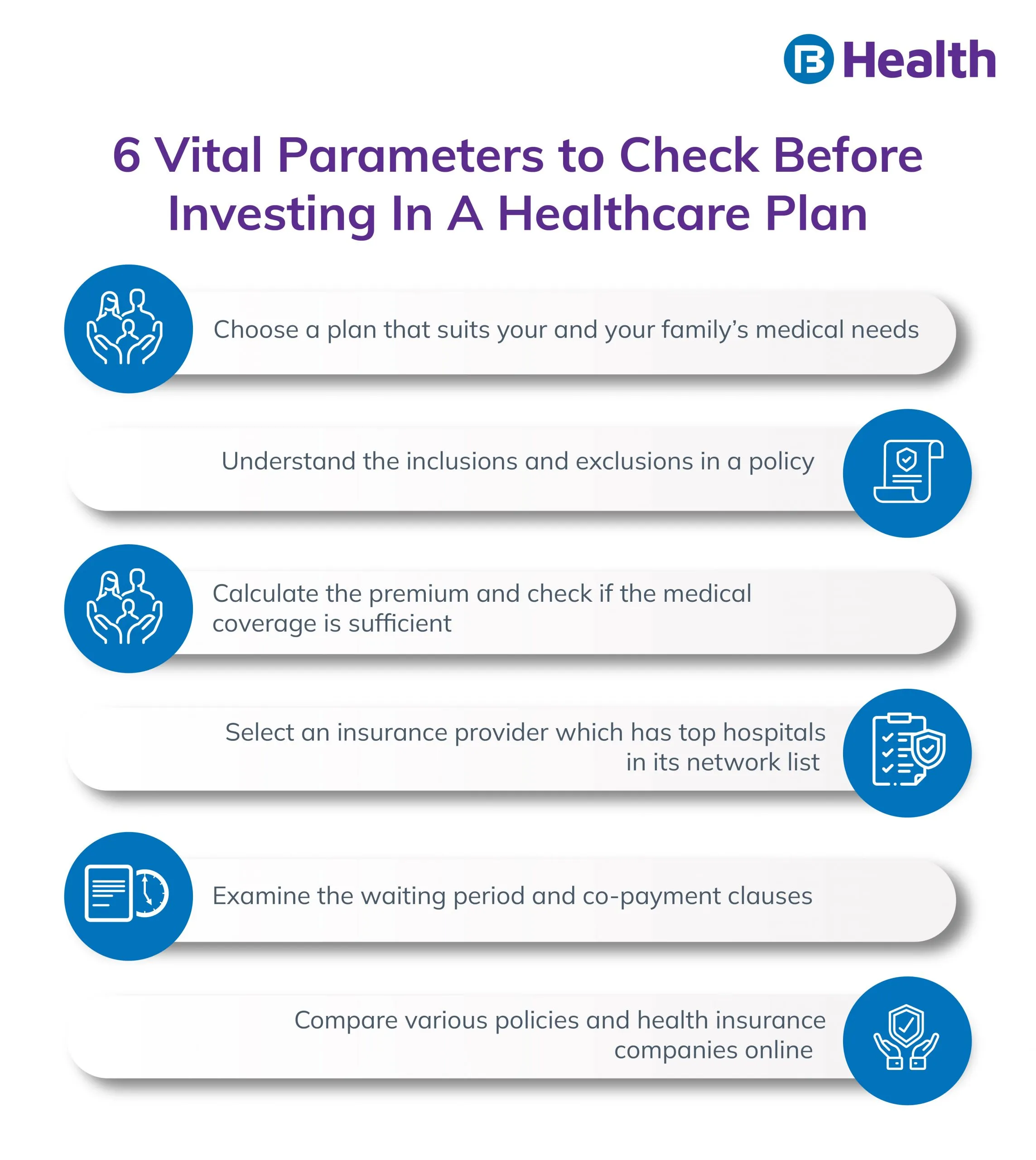

Now that you know how medical insurance works in India, the next step in planning your purchase is keeping certain important facts in mind. Read on to know more.

Select a Suitable Health Insurance Plan

Depending on your or your family’s medical requirements and your finances, you can choose a medical plan. Before finalizing, decide if the plan has to cover only you or your spouse and kids or your dependent parents too. This will help you understand whether to choose an individual plan or a family floater that covers all immediate family members. Keep maternity and family planning factors in mind if you are young and married.

The premium amount varies according to the plan type and the coverage. In addition, if any of your family members has a preexisting illness, the policy terms and conditions may vary for different insurance companies. To learn how health insurance works in India, it is important for you to analyze all these pointers.

Assess Your Premium Amount and Total Coverage

Once you finalize the plan, your premium is fixed based on various parameters such as

- Your and your family’s medical history

- Your preexisting illnesses, if any

- Your age

- Your lifestyle

You’ll be asked by the insurance company to undergo a complete medical checkup. After this, the company decides your premium payable yearly and the total medical coverage. Knowing this computation is key to understanding how health insurance works in India.

Learn the Policy Renewal Process

To activate your policy, you need to pay the premium. There is a specific timeline for you to complete this process. After that, you have to continue paying premiums either monthly, quarterly, or annually. When your plan’s validity is over, you must renew the plan. If not, your policy ceases to exist. Usually, you get 30 days before the expiry date to pay the premium to renew the plan [2]. This is yet another vital criterion for understanding how health insurance works in India. You can renew it online by visiting the insurance company’s website or contacting your insurance provider to renew the policy.

Understand the Process of Claim Settlements

A crucial aspect of how medical insurance works in India is the claim settlement process. To avail financial coverage for your medical requirements, you need to raise a claim requesting the insurance company to pay your medical bills. There are two types of claims, namely reimbursement and cashless claims.

In a cashless claim, your insurance company settles your medical expenses directly with the hospital if it is on its network list. This is a big plus point as it allows you to avail of treatment without paying out of your pocket, as per the coverage terms. When you get treated at a non-network hospital, you can file a reimbursement claim. This means paying your medical bills at the hospital and collecting all your medical documents and bills before you submit them to your insurance provider after getting discharged. After verifying your details and checking the policy coverage, you will get reimbursed for your medical expenses.

To sum up, health insurance involves the simple process of buying a policy by paying premiums and making claims when needed. This is all you need to understand about how health insurance works in India. Knowing how medical insurance works in India makes it easier and faster for you to compare different policies online and invest in a policy.

For cost-effective medical insurance that offers a range of benefits, check out our My Healthcare plan by Bajaj Allianz General Insurance. These policies cover your comprehensive wellness and illness requirements along with an easy digital process from signing up to making claims. From offering huge network discounts and covering hospitalization for COVID-19 to reimbursing you for doctor consultations and lab tests, investing in this healthcare policy can provide you with all the resources you need to address your health requirements affordably.

You can also book 180 free teleconsultations on the Bajaj Finserv Health app or website with this plan to get medical advice without leaving the safety and comfort of home. With a claim settlement ratio of 92.21%, you can truly rely on this plan to secure your and your family’s health. Apart from Aarogya care Bajaj Finserv Health Offers a Health card that converts your medical bill into easy EMI.

References

- https://www.nhp.gov.in/sites/default/files/pdf/health_insurance_handbook.pdf

- https://www.policyholder.gov.in/you_and_your_health_insurance_policy_faqs.aspx#:~:text=A%20policyholder%20can%20pay%20premium,is%20allowed%20as%20Grace%20Period

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.