Aarogya Care | 5 min read

Individual vs. Family Floater Insurance Plan: Which One is a Better Option?

Medically reviewed by

Table of Content

Key Takeaways

- Individual plans provide coverage for a single person

- Family floaters offer coverage for your family in one plan

- You can avail tax benefits on premiums paid in both plans

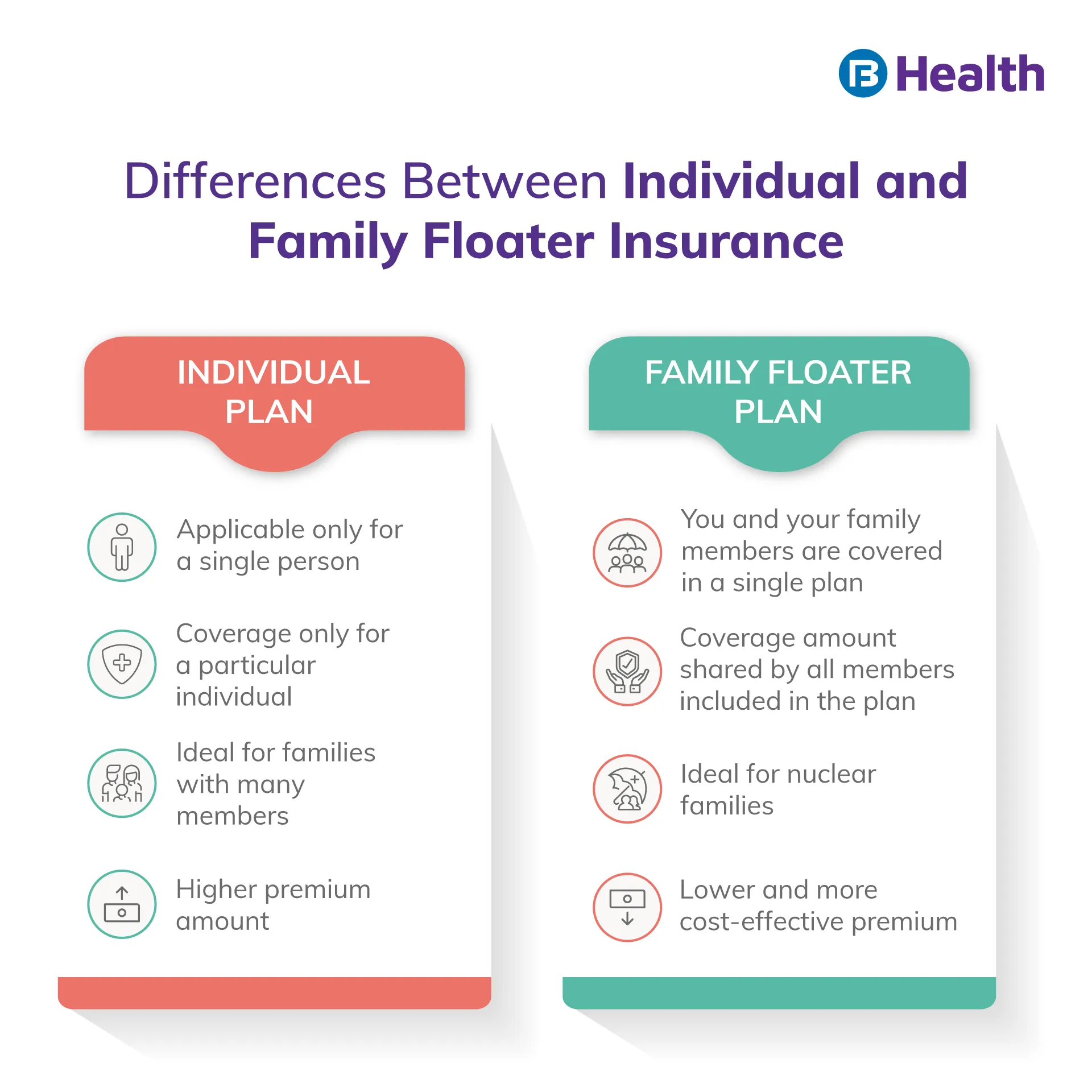

While investing in health insurance for your family is important, it is equally important to choose the right plan [1]. While there are different types of policies, individual and family floater plans are broad categories. In a family floater plan, you can cover all your family members under a single plan. When you opt for an individual plan, the total coverage is be applicable for a single member only. In such cases, you may opt for individual plans for each family member.

A family floater plan is an extended version of an individual health insurance policy. Both types of plans are indemnity plans. Your insurance company will reimburse your hospitalization expenses if it falls under the total sum insured. The sum insured is the maximum amount you can claim from the insurer as per the policy terms.

For instance, if you avail a plan of Rs.3 lakh and your hospital bill comes to Rs.1 lakh, you can claim this amount from your insurance provider. You can claim the remaining unutilized amount for any other hospitalization expenses during the policy year. Usually, this is one year.

Read on to know more about individual and family floater plans to decide which plan is right for you.

Additional read: Health Insurance Policy Benefits

What is an individual health insurance plan?

This is a policy that provides coverage for a single individual. This means that your family members and you won’t be sharing benefits under a single cover. Instead, you may opt for separate plans for each member with a different or the same sum insured. Doing this is ideal for you if you have aged parents and young children in your family. In such cases, the sum insured for parents may be higher as they may have more medical needs. When one member raises a claim, it does not affect the sum insured of other family members.

An individual plan provides the following coverage benefits:

- Pre-and post-hospitalization expenses

- Maternity expenses

- Hospitalization due to accident

- Annual health checkups

- Critical illness cover

What are the features and benefits of an individual plan?

Here are the advantages of availing an individual plan:

- Ideal for people with major health ailments

- Gives you tax benefits on the premiums based on Section 80D of the Income Tax Act

- Allows you lifetime renewability options

- Provides reimbursements for laboratory tests and doctor consultations

- Covers your medical expenses based on the premiums paid and terms of the policy

- Gives you a copay feature where you pay a fixed amount to your insurer for certain services

- Allows you to enjoy all policy benefits separately

- Gives you the option to renew without restrictions on the maximum age of the policyholder

- Allows you to make multiple claims without any worry as the total coverage is specific to you

What is a family floater plan?

This is a health insurance plan that provides coverage for you and your family under a single plan. All members included in the plan share the total sum insured and are covered by an annual premium. Investing in a family floater plan is a cost-effective option for both your overall health and financial requirements [2].

Say you have taken a policy with a coverage of Rs.5 lakh and included a total of 4 members in the plan. In case of a medical emergency, any of these four members can use whatever amount they want depending on the requirement. As long the expenses do not exceed total sum insured, each member can avail its benefits.

One important aspect about a floater plan is that if any one member utilizes the total sum insured, the other members will not have a cover. So, it is best suited for nuclear families and couples.

What are the benefits you get when you buy family floater plans?

Here are a few advantages you get when you avail family floater plans:

- Allows all members in the plan to utilize the sum insured

- Offers a copay feature to reduce the premium where you pay a percentage of cost incurred and the remaining amount is paid by your insurer

- Boosts your savings as it is more affordable than individual plans for each member

- Gives you tax benefits on the premium you pay

Family floater vs. Individual plan: How to decide which is better for you?

If you are a nuclear family, it is ideal to choose the family floater as your premiums are comparatively lower. However, if you want medical coverage for your parents, it is a wise decision to choose individual health plans for them. Including your parents in a family floater can significantly increase the premium. Thus, an individual plan works better. Check the total coverage and how much premium you have to pay. You may also use copay feature to lower your premium.

Additional read: Factors to Consider Before Buying Health Insurance Policy For FamilyNow that you are aware of the features of both types of health plans, choose an affordable policy with comprehensive coverage. Do proper research so that all your family members get maximum benefits from these health plans. Consider the different types of Complete Health Solution plans on Bajaj Finserv Health. They allow you to add up to 2 adults and 4 children and offer a range of features. These policies come under Aarogya Care health plans that provide both wellness and illness benefits. With features like doctor consultation reimbursements, network discounts and lab test benefits, these policies are tailor-made to suit your family requirements.

References

- https://www.policyholder.gov.in/you_and_your_health_insurance_policy_faqs.aspx

- https://www.irdai.gov.in/admincms/cms/Uploadedfiles/ROYAL15/FAMILY%20HEALTH%20FLOATER%20POLICY.pdf

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.