Aarogya Care | 4 min read

Is Your Health Insurance Cover Enough for The Pandemic?

Medically reviewed by

Table of Content

Key Takeaways

- An adequate health cover can help you safeguard your health and finances

- Some health insurance policies may not cover certain situations or illnesses

- For enough health insurance cover you can opt for specific or super top plans

Health insurance policies are a must to secure your and your family’s health, and save your finances. They help cover the medical expenses of an emergency or a planned treatment. However, there are certain situations when your policy may not be enough or effective such as the sudden emergence of an epidemic or pandemic. To counter that, IRDAI has made it mandatory for insurer to offer cover for COVID-19 treatment as per policy terms [1].

Despite this mandate, there is still a possibility that your health insurance cover may be inadequate. In such cases, you can take certain measures to increase your health cover. These can help ensure that your health insurance policy covers the COVID-19 treatment as well. Read on to know the top 4 ways in which you can make sure you have adequate health cover.

Additional Read: Health Insurance During PandemicReassess your health needs and sum insured

Your and your family’s health needs may change for various reasons. This is why at the time of renewal or purchase of a health insurance policy, it is important to take them into consideration. There are different plans that focus on the health needs of different people. If you are looking to cover your family under one plan, you can select a family health cover policy. If your parents have crossed the age of 60 years, you can cover them with a senior citizen policy. Similarly, there are insurance policies that cover specific illnesses.

While selecting the policy, make sure you have sufficient cover amount or sum insured. It will depend on your health conditions as well as your lifestyle, age and number of dependents. It is important to take future needs into consideration because health insurance policies are usually for one year. Making changes in the middle of the term may be tedious and cause added financial burden.Look for pandemic-specific policies

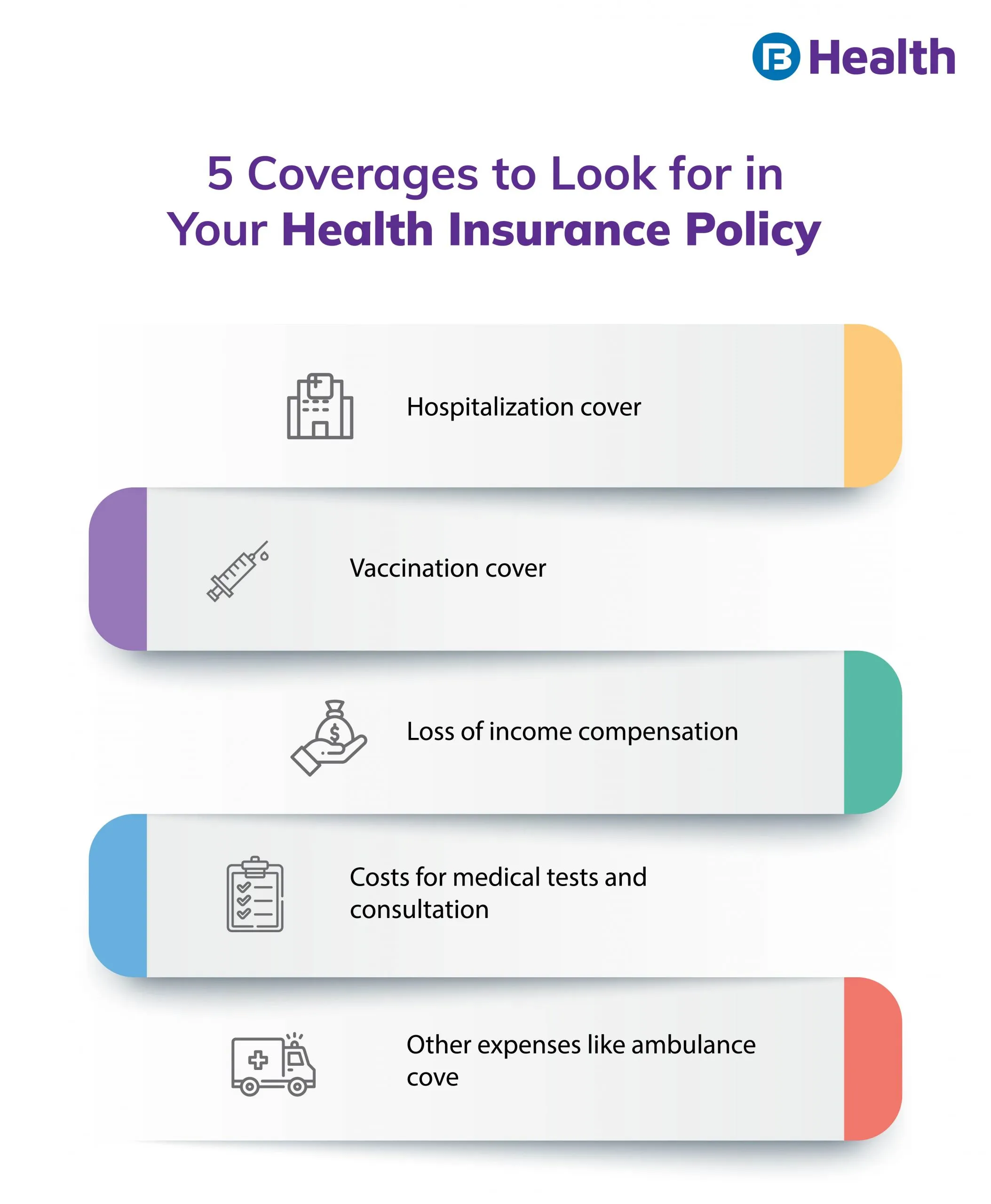

One of the ways to ensure adequate cover for unforeseen circumstances is specific policies. During the COVID-19 pandemic, IRDAI announced ’Corona Kavach Policy’. This health insurance policy aims to cover [2]:

- Hospitalization

- Pre and post hospitalization expenses

- Home care treatment

- Ayushman health accounts

Policies like these can be a quick and pocket-friendly option that you can opt for. These short-term policies can help increase your health cover. This is especially beneficial if you have cash crunch due to loss of income or and salary reduction.

Check the sub limits and other policy terms

A major benefit of knowing your health insurance cover policy terms is that you don’t get blindsided at the time of treatment or reimbursement. A sub limit is a predefined limit set by your insurance provider. It is a cap that your insurer may place on your expenses for certain medical procedures. Generally, this sub limit is a fixed amount but in some cases it may be proportionate. Proportionate sub limit is the percent of a specific amount or total sum insured set by your insurer.

All in all, a sub limit is the maximum amount your insurer will pay under certain circumstances. Along with this, you should know the waiting period, grace period, copay, deductible, or any other cause of your health insurance policy. This will help plan finances accordingly and in advance.

Additional Read: Health insurance for coronavirus pandemicOpt for super top up plans

A super top up health cover policy gives additional cover to your health plan at low prices. This comes handy in situations where you cover may be insufficient. These policies usually cover all the expenses as per your policy terms.

You can get a super top up plan for almost all types of health insurance policies depending on your insurer. Moreover, in case of family floater policy, even if one member exhausts the sum insured, all the members can avail additional cover with a super top up plan.

With adequate cover, you can ensure that you do not have to worry about out-of-pocket expenses. It is important to have a health insurance policy especially during a pandemic. This is because the situation puts everyone at risk and may increase or fluctuate the medical costs. A health insurance cover can help you beat these and get treated without financial stress. Check out the Aarogya Care plans available on Bajaj Finserv Health. The Health Protect Plans and Super Savings Plans can offer you a comprehensive cover of up to Rs.10 lakh. These plans also come with additional benefits of network discounts, lab test reimbursement, and more. This way, you can protect your and your family’s health even during uncertain situations!

References

- https://www.irdai.gov.in/ADMINCMS/cms/whatsNew_Layout.aspx?page=PageNo4621&flag=1

- https://www.irdai.gov.in/ADMINCMS/cms/Uploadedfiles/RTI_FAQ/FAQsCoronaKavachPolicy.pdf

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.