General Health | 6 min read

Terminal Illness vs Critical Illness Insurance: A Guide

Medically reviewed by

Table of Content

Synopsis

Terminal illness vs critical illness insurance provides long-term advantages at various phases of life. Consequently, you should choose the best plan for your financial situation. Having a financial backup amid medical issues may be life-saving and financially secure.

Key Takeaways

- A terminal sickness or condition occurs when the sickness is incurable and will almost certainly result in death

- Critical illness is any life-threatening condition that necessitates pharmacological or mechanical support

- Critical disease is a dangerous sickness that any intense medical care can heal

We've assembled a list of the top differences between terminal illness vs. critical illness to assist you in making your medical insurance policy more fruitful. These plans distribute the guaranteed insurance amount in accordance with the kind of disease, such as critical illness and terminal illness, as well as the policy's terms and conditions. Therefore, the most crucial thing to know before choosing your coverage is the distinction between a critical sickness and a terminal disease. It is simple for you to select the ideal form of insurance coverage after you are aware of the key distinctions between these two illnesses.

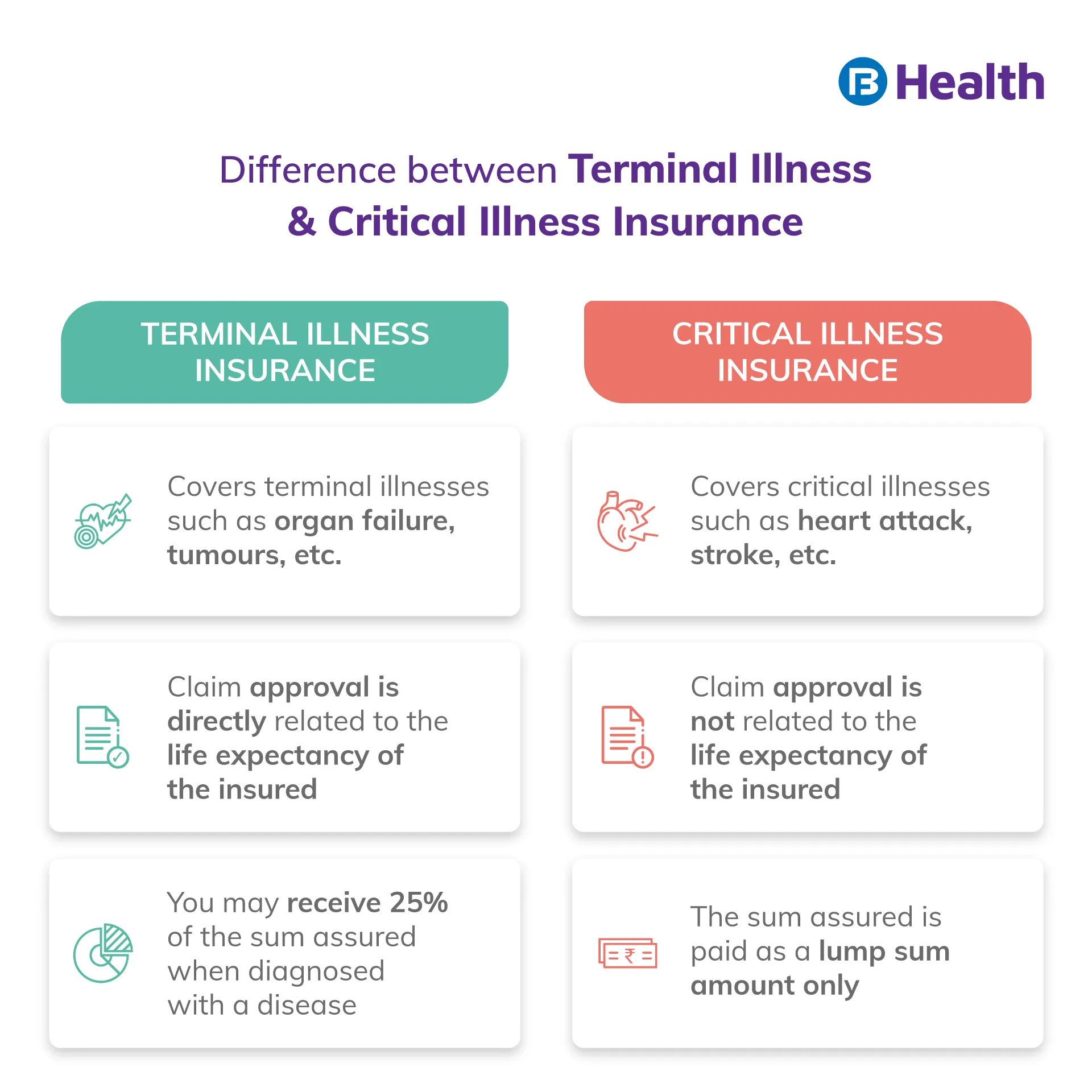

Difference Between Critical Illness and Terminal Illness Insurance

You may want to think about a term plan if you're planning to get health insurance. A term plan is a long-term insurance plan that pays the sum insured to the insurance policyholder's nominee in the case of the policyholder's death. But depending on the insurance coverage the policyholder has chosen, they must pay the premium or make a one-time payment. In addition, for severe illnesses like cancer, heart attacks, organ failure, etc., the policyholders may also get cash payouts under various term insurance policies. Both terminal and critical illness insurance policies cover major illnesses and conditions, which might be confusing. However, the coverage features of terminal illness and critical illness insurance plan varies. Additional Read: Top 6 Health Insurance Tips

| Terminal Illness | Critical Illness |

| It is a serious medical condition | It is a serious medical condition |

| Examples are organ failure, paralysis, Alzheimer's disease, etc. | Examples are heart stroke, heart failure, cancer, kidney failure, etc. |

| This can be treated | Cannot be treated till the cure |

Critical Illness

Every year, the number of severe sickness cases in India rises. These illnesses, in addition to producing health problems, impose a significant financial impact. Fortunately, Critical Illness Insurance, also known as Critical Illness Policy, provides financial assistance in such instances and may be a lifesaver in the face of hefty treatment expenses. Critical diseases are those that are extremely severe yet treatable with intense medical care. Some examples are heart attack, cancer, stroke, handicap, paralysis, blindness, organ transplant, and other frequent critical diseases. In general, policyholders in medical insurance receive benefits up to a specific amount if they suffer from any disease, regardless of the genre of illness. However, in the case of medical insurance, policyholders receive cash benefits only when they are hospitalized, as long as the claim is genuine and the covered person does not exceed the total insured limit. However, this is not the case with critical sickness insurance.Terminal Illness

A terminal sickness is a disease that cannot be treated. Unfortunately, people are becoming more susceptible to such ailments due to their current lifestyles. These diseases are life-threatening, and there is little hope of survival. Alzheimer's disease, paralysis, organ failure, and other terminal illnesses exist. In layman's words, terminal illnesses are diseases and illnesses that are incurable. Unfortunately, these disorders have been rapidly rising, particularly in metropolitan areas, resulting in a decreased life expectancy for many individuals suffering from them. During such times, a terminal insurance policy, in which the nominee receives the sum insured and a bonus following the policyholder's death, is quite advantageous. In addition, in rare situations, insurance companies will pay up to 25% of the sum insured to policyholders if their life expectancy is assessed to be fewer than 12 months. In these cases, however, the death benefit is often reduced to a sum equal to the amount already paid on the policyholder's treatment.

Critical Illness vs. Terminal Illness Insurance

The majority of people often confuse the terms terminal illness vs. critical illness insurance. The terminal illness vs. critical illness insurance can be explained below:| Details | Critical Illness Insurance | Terminal Illness Insurance |

| Coverage | Cancer, heart attack, stroke, organ transplant, renal failure, and other serious conditions are covered. | Brain tumors, organ failure, paralysis, Alzheimer's disease, and other grave ailments are covered. |

| Availability of Claim | Can claim if diagnosed with a serious disease, regardless of life expectancy. The insured can receive the benefit without having to be hospitalized. | If diagnosed with a terminal disease, you may file a claim. If the insured's life expectancy is shorter than 12 months, the benefit can be claimed. |

| Assured amount | The policyholder receives the money promised as a one-time lump sum payment. | For medical care, the insured may get up to 25% of the total promised in specified instances. After the insured's death, the remaining money is given to the nominee as a one-time lump sum payout. |

| Advantage | You will have financial security when you need it most. You may use the claim amount as you see fit. | Following the death of the policyholder, family members will enjoy financial security. If the life expectancy is less than 12 months, the insured may also receive up to 25% of the sum assured for medical care. |

| Tax Advantages | The lump sum payment is tax-free. | The amount of the claim benefit is tax-free. |

| Financial Advantages | A critical illness insurance policy provides cash benefits to policyholders only when they are diagnosed with a critical illness. | A terminal illness insurance policy pays out money to policyholders only if they have a terminal disease and their life expectancy is less than 12 months. |

Who should buy Critical Illness Cover?

Individuals with a history of severe illness may consider purchasing Critical Illness Insurance. Illnesses and diseases such as heart attack, renal failure, organ transplant, stroke, and others are on the rise. Purchasing Critical Illness medical insurance is thus a prudent idea. Critical illnesses are unpredictable, and if you are diagnosed with one, your financial stability will suffer as a result of the high expense of medical treatment. As a result, everyone should consider purchasing Critical Illness coverage in addition to their usual health insurance plan.Who should buy Terminal Illness Cover?

If you are concerned about your family's financial security after your death, you may consider purchasing Terminal Illness insurance. Terminal diseases, such as brain tumors, paralysis, organ failure, and so on, are largely incurable, and the patient's chances of survival decrease during such situations. As a result, it is preferable to guarantee your family's financial security with Terminal Illness medical coverage. Bajaj Finserv Health provides personalized healthcare services for you and your family. With Bajaj Finserv Health, you can choose the best physicians in your area, set up reminders for taking your medications, make appointments, save all of your medical information in one location, and more.References

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.