Aarogya Care | 5 min read

Waiting Period: Why is it so Important for You to Know About This?

Medically reviewed by

Table of Content

Key Takeaways

- During the waiting period, you cannot file a claim unless it is an emergency

- The terms for the waiting period depend on the insurer

- You may reduce the waiting period by paying an additional premium amount

Investing in a health insurance policy is an important aspect of one’s life. It helps you prioritize your health and secure your finances. With this investment, you can reduce your financial burden when getting treatment. The different types of health insurance policies will have varying important terms, among which is the waiting period.

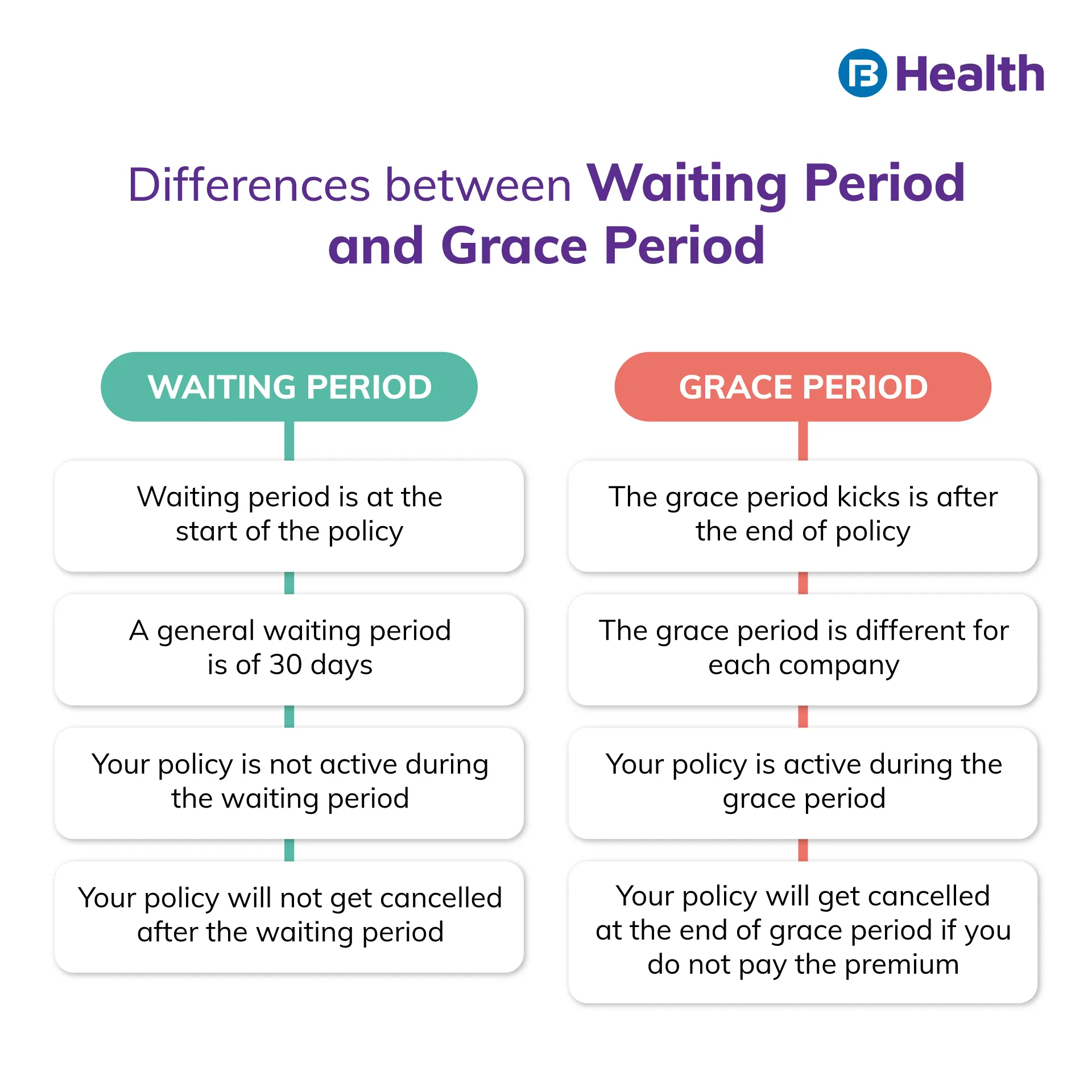

The waiting period is also known as the cooling period. It is the specific time before your policy comes into effect. Depending on the type of policy and cover, your cooling period may differ. This period must pass before you can avail the benefits of a policy. During the waiting period, you are neither covered by the policy nor can you file a claim. So, make sure to opt for a policy that has a shorter cooling period.

Read on to know more about the different kinds of cooling period in health insurance.

Initial or General Waiting Period

The initial cooling period or cooling period refers to the time period after which you can make a claim. During the initial waiting period, your policy is inactive. Unless there is a medical emergency, you cannot file for a claim in the initial cooling period.

Generally, the initial cooling period for health insurance is 30 days [1]. This period may vary depending on the type of policy and your insurer. This is not applicable if you have a continuous insurance cover for more than 2 years.

Pre-Existing Disease Waiting Period

Pre-existing diseases are ailments, injuries, and conditions diagnosed or treated 4 years before the purchase of the maternity insurance policy [2]. These are covered after you complete the cooling period as mentioned in your policy. This cooling period differs from one insurer to the other. The following ailments may fall under the category of PED:

- Hypertension

- Thyroid

- Diabetes

- Asthma

- Cholesterol

Your insurance provider may ask you if you have any PEDs. You may also have to undergo certain health checkups. The results of these tests determine whether you have a pre-existing disease. To avail continuous benefits of health insurance, it is important to disclose if you have PED to the insurer.

Additional read: Pre-existing Diseases Health InsuranceWaiting Period Related to Specific Conditions

As the name suggests, this cooling period is for specific ailments. The medical expenses for these conditions are not covered until this cooling period is completed. The waiting period for these specific diseases can go up to 4 years. A few ailments that fall under this category are:

- Cataract, retina disorder, or glaucoma

- Osteoporosis, osteoarthritis, non-infective arthritis

- Hernia

- Psychiatric disorder or illnesses

- Varicose veins

- Neurodegenerative disorders

- Benign cyst, polyps, or tumors

The inclusion of specific diseases is at the discretion of the insurance provider. The terms and conditions for this are usually mentioned in the policy document.

Critical Illness Waiting Period

The cooling period for a critical illness is dependent on the insurance provider. This cooling period can be for a period of 90 days. During this time, your insurer will not cover any expenses caused because of any critical condition. Some critical illnesses covered under this are cancer, heart attack, or kidney failure.

Waiting Period for Bariatric Surgery

Bariatric surgery is usually recommended for people with a BMI higher than 40. It is also recommended if they suffer from certain health issues. These issues may include sleep apnea, high blood pressure or diabetes. Most insurance companies have a waiting period of up to 4 years for bariatric surgery.

Additional read: Important Riders You Can Add to Your Health Insurance PlansWaiting Period for Maternity and Infant Cover

You may get a separate insurance policy for maternity and infant cover or include it as an add on to your existing policy. In either case, there can be a cooling period before your policy will cover medical expenses for the same. Generally, the cooling period for this may be between 2 and 4 years. It is important to buy maternity cover before you plan or start a family. Expenses included in maternity cover may include delivery, infant care, and vaccination.

If your employer provides health insurance, there may be no waiting period. In instances where a waiting period exists, it is shorter than usual. Alternatively, you can also change your employer’s group health insurance to individual health insurance. In such cases, you may not have a waiting period because it has already been completed in the group policy.

With some insurers, you can reduce the waiting period by paying an additional premium. This is also known as a waiting period waiver. For senior citizen policies, major insurers offer either short or no waiting period. But this may come with a clause of co-payment, where you pay for a certain percentage of your expenses and your insurer covers the rest.

Make sure that you are aware of the terms and clauses of your policy before purchasing it. If you are looking for health insurance policies, check out Complete Health Solution plans offered on Bajaj Finserv Health. These plans have policies for individual health insurance as well as family health insurance. They also offer coverage of up to Rs.10 lakh. Browse the plans and choose the most suitable policy to safeguard your family’s health.

References

- https://www.policyholder.gov.in/Faqlist.aspx?CategoryId=73#:~:text=When%20you%20get%20a%20new,payable%20by%20the%20insurance%20companies.

- https://www.irdai.gov.in/ADMINCMS/cms/Uploadedfiles/RTI_FAQ/FAQ_RTI_HEALTH_DEPT.pdf

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.