Aarogya Care | 5 min read

10 Tips to Choose the Best Health Insurance Policy in India

Medically reviewed by

Table of Content

Key Takeaways

- There are around 30 health insurers offering health insurance plans in India

- A health policy should offer you maximum coverage at affordable premiums

- The waiting period for pre-existing diseases usually range from 2 to 4 years

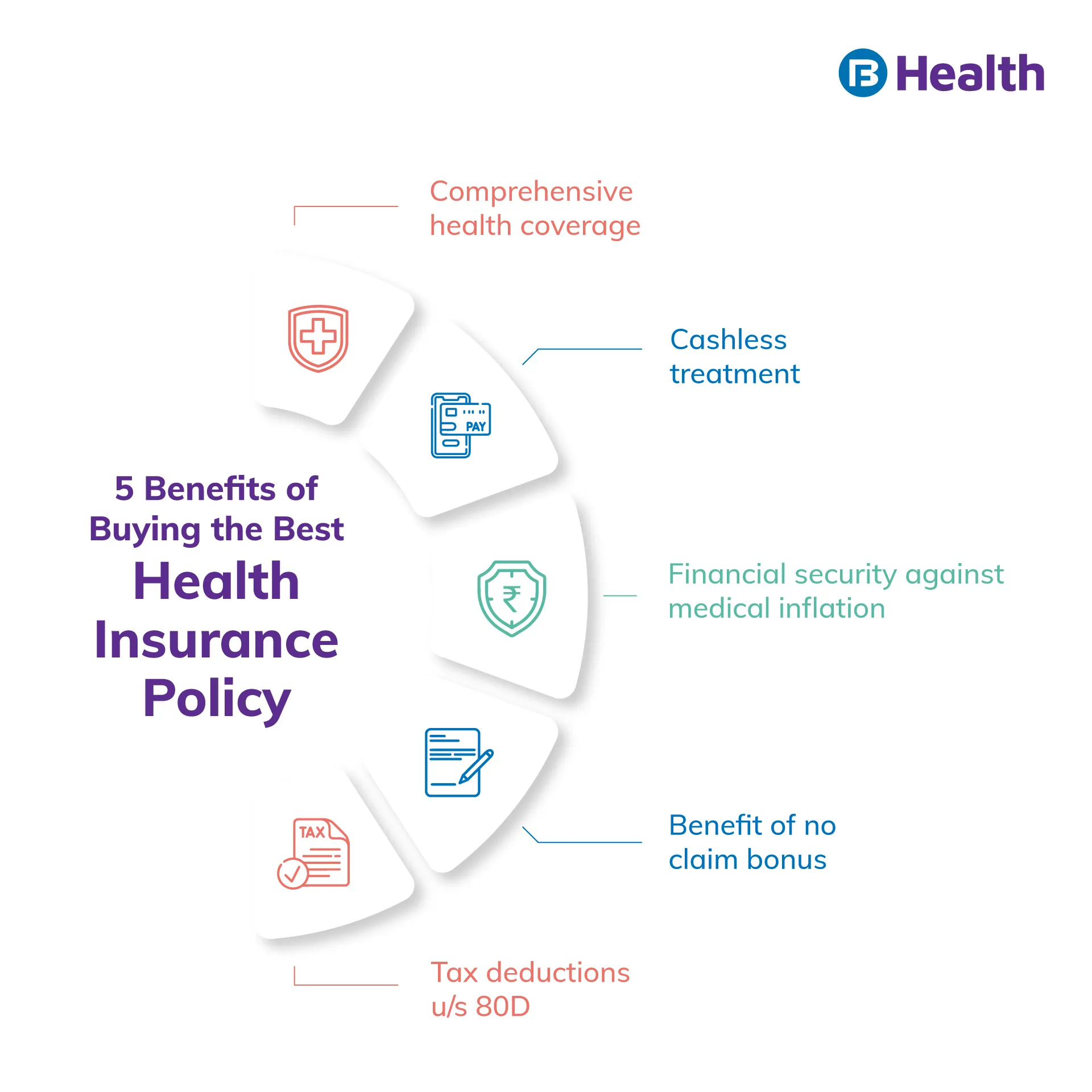

Even the healthiest of us can fall sick. You cannot plan your sickness, but you can surely stay financially prepared for such unforeseen events. With an increase in illnesses and medical expenses, health insurance has certainly become a necessity. Reports reveal that more than 930 million people spend approximately 10% of their total income on health care [1]. But Indians pay for medical needs out of pocket more than anywhere else in the world! To reduce your financial stress, a health insurance policy is key.

There are about 33 health insurance companies offering various health plans in India [2]. With many types of health insurance policies available, selecting the best one that suits your needs may seem challenging. Here are 12 things you need to consider for choosing the right health plan for yourself and your family.

Additional read: Guide to Buying Health Insurance

Buy an Affordable Policy

Planning and budgeting are important for financial stability. When you buy a health insurance policy, choose premiums that are within your budget. However, do not compromise on comprehensive benefits and the sum insured. Plan your health and financial needs properly to choose the best health insurance plan. You can start with a reasonably priced health cover and then gradually increase the cover as you earn more and age.

Prefer Family Floater Health Plans

You may opt for individual health insurance plans if your family already has or doesn’t need cover. But choosing a family floater plan over an individual health plan is best to cover your entire family. You get comprehensive coverage for your spouse, dependent children, and even parents. The premium you pay on family health plans is much cheaper compared to buying an individual health policy for each family member.Select a Plan with Lifetime Renewability

Your health insurance usually comes more in handy during the later years of your life. Thus, when you buy a health insurance plan, choose a policy that offers a longer tenure. It is always better to opt for a health insurance policy that offers lifetime renewability. This way, you will have health insurance to cover your medical expenses at all times.

Choose the Right Coverage and Adequate Sum Insured

Buy a health insurance policy that provides financial protection against a wide range of medical problems and illnesses. It should include pre-and post-hospitalization expenses along with an in-hospitalization cover. Check if the health plan covers daycare treatments, room rent, ambulance charges, pre-existing diseases, or illnesses you are at risk of. Also, opt for a high sum insured based on the treatment costs of diseases you may be prone to.

Consider the Network Hospital List

Health insurers have a tie-up with hospitals. These are known as network hospitals. If you are treated at any of the network hospitals across the country, you can avail of a cashless settlement. Cashless claims do not require you to pay from your pocket as the health insurer directly settles the bill with the network hospital. This can be a huge benefit so choose an insurer with a larger number of such partners.

Opt for a Policy with a High Claim Settlement Ratio

A health insurance policy with multiple features does not necessarily mean that it is worth buying. Chances are, you will not gain claim benefits as it may have a low claim settlement ratio. This is the number of claims that the insurer settles in a financial year. If the insurer has a higher claim settlement percentage, there are higher chances of you benefitting from the cover.

Additional read: Health Insurance ClaimsCheck the Waiting Period for Pre-Existing Diseases

Every health policy has a waiting period before it can cover pre-existing diseases. This generally ranges from 2 to 4 years. It is in your best interest to opt for a health plan that has the least waiting period. This way, you can start enjoying the coverage benefits at the earliest. Also, check if pre-existing diseases you or any of your family members have are covered under the plan.

Compare Policies Online Before Buying

You are not doing justice to your decision if you are not comparing health policies before you buy. Do not simply choose a health plan just because it looks good or is suggested by your agent or friend. There are many companies offering health insurance plans in India. Take the time to figure out your requirements and finalize the best policy. With digitalization, comparing health insurance policies online has become easier and more convenient. This way you can make an informed decision. A few things to check is the claim settlement process of the insurer. Choose an easy process and a company that has good customer support as well.

Purchase a Policy with Minimal Documentation and Easy Process

The process of lengthy documentation and standing in long queues has become a thing of the past. Many top health insurance companies have now upgraded their services. Today, buying a health insurance policy has become a matter of a few minutes. You can purchase a health policy from the comfort of your home by checking all relevant details online.

Read the Terms and Check the Insurer's Credibility

Be careful to read the exclusions of the health insurance policy instead of finding out about them later. Make sure you read the fine print and know the terms and conditions before signing the policy document. Also, check the credibility of the insurer. You can read reviews online and do some research on the company. There are so many health insurances available in the market Ayushman health account is one of them provided by the government.

Ensure you buy the right health insurance that offers high coverage for your whole family and has a high claim settlement ratio. Check the Complete Health Solution plans offered by Bajaj Finserv Health. These plans offer a medical cover of up to Rs.10 lakh for you and your family. You do not require any medical checkup to buy these plans and there are no hidden costs. Buy this plan and enjoy preventive health checkups, pre- and post-hospitalization cover, network discounts, and more.

References

- https://www.who.int/health-topics/universal-health-coverage#tab=tab_1

- https://www.irdai.gov.in/ADMINCMS/cms/NormalData_Layout.aspx?page=PageNo264&mid=3.2.10

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.