Aarogya Care | 5 min read

How are Bajaj Finserv Health's Aarogya Care Health Insurance Plans Beneficial?

Medically reviewed by

Table of Content

Key Takeaways

- Aarogya Care plans from Bajaj Finserv Health cover preventive health checks

- Aarogya Care Health Protection Plans provide coverage up to Rs.25 lakh

- Top-up health insurance plans are available with a deductible of Rs.5 lakh

Increasing medical costs have made people realize how important it is to have health insurance. So much so that the insurance industry in India is expected to grow annually by 12-15% over the next few years [1]. But, choosing a health insurance policy isn’t simple or easy. Understand the features and the benefits it offers to buy the right one.

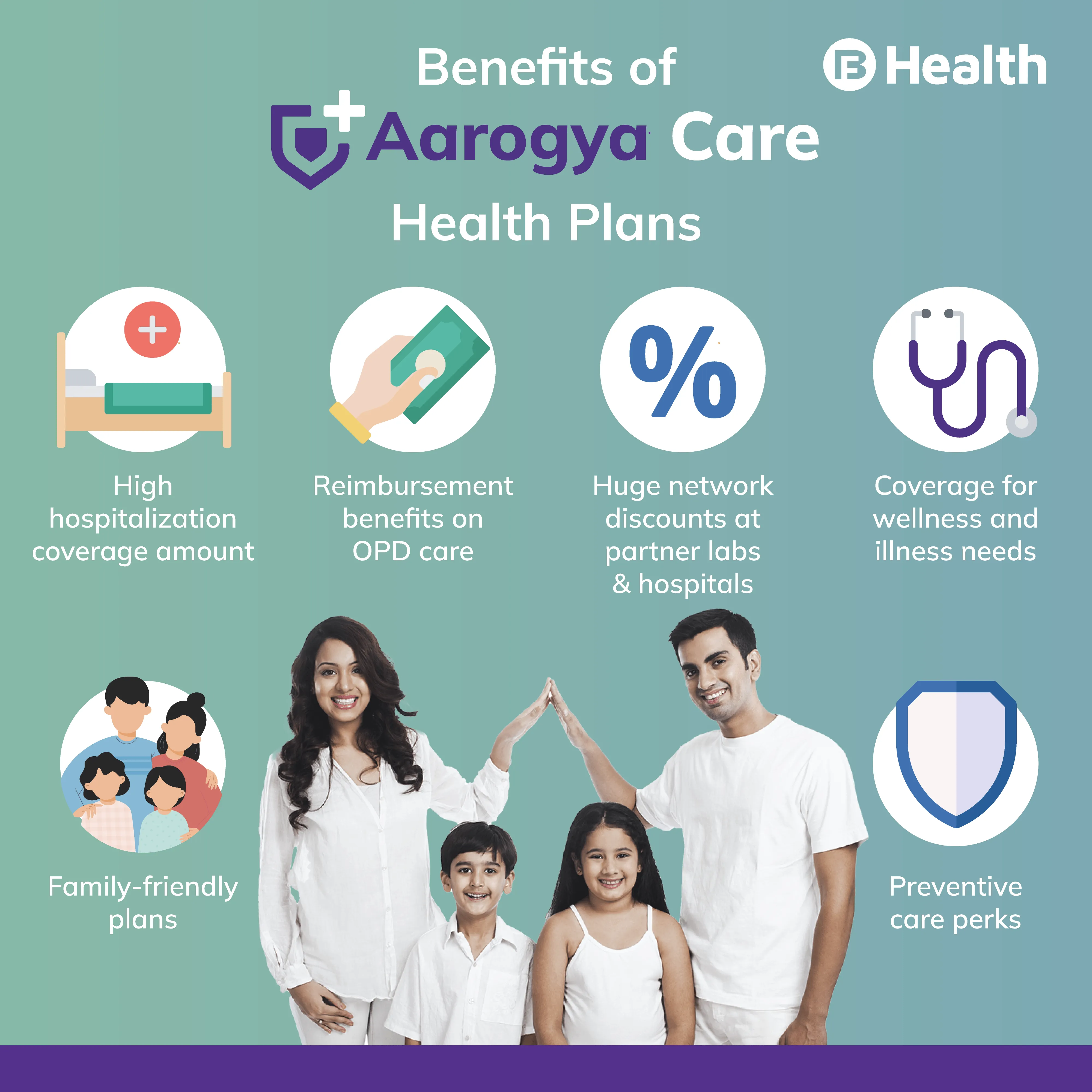

The Aarogya Care Insurance Plans offered by Bajaj Finserv Health are smart options you can consider. They are affordable policies packed with features. The many benefits of purchasing Aarogya Care Plans are:

- Huge network discounts

- Preventive care facilities

- Lab tests discounts

- Comprehensive coverage

- Online and teleconsultations with reputed specialists

These health protection plans are some of the most comprehensive plans in India. They provide financial coverage for a wide variety of healthcare issues. You also enjoy customized benefits to suit your requirements. To know all about different types of Aarogya Care Plans and their features, read on.

Additional read: Different Types of Health Insurance Plans for Family: Are They Important?

Why Should You Choose Aarogya Care Plans?

Aarogya Care Plans include many different types of policies. Some include insurance coverage while others are add-ons or non-insurance in nature. Aarogya Care health insurance plans suit all your family’s healthcare requirements, which is why they are called 360° plans. These plans are personalized to your needs, pre-paid so you can get help 24X7, and preventive so you can use them even when you are not hospitalized. They also cover pre- and post-COVID care and have a large network of partners so you can access medical care across India. You can sign up for these plans online with an easy digital process too. Read on to know the various types of Aarogya Care health plans.

How Are Health Protect Plans Beneficial?

Health Protection Plans offer coverage up to Rs.25 lakh. You can include up to 6 family members in it and this is ideal for most households. It offers complete hospitalization coverage and a range of other benefits. You can choose from 3 different types, which are:- Health First Plan

- Complete Health Solution

- Super Top-Up Plan

- 1 voucher of preventive health checkup

- 5% discount on room rent during hospitalization

- OPD reimbursement charges up to Rs.15,000 for each member

- Coverage for 2 adults and 4 children

- Health insurance coverage up to Rs.5 lakh

With the Complete Health Solution, you get a higher cover of up to Rs.25 lakh with discounts on lab tests, a higher discount on room rent and doctor consultations, and reimbursement benefits on OPD costs. The Super Top-Up Plan is another add-on option you can go for. It helps you upgrade your existing plan for better coverage [2]. These top-up health insurance plans offer Rs.25 lakh coverage with a deductible amount of Rs.5 lakh. Perks of this offering include:

- Lab benefits of Rs.16,000

- Doctor consultation reimbursement charges of Rs.6500

These plans cover critical benefits that may be excluded in other policies. The important riders also ensure comprehensive care, no matter the illness or treatment.

Additional read: A Guide to Important Riders You Can Add to Your Health Insurance PlansWhy Should You Invest in Personal Protect Plans?

These plans are customized to cater to the modern lifestyle and chronic health conditions. They are illness and wellness plans with self-care benefits as well. Four important health plans offered here are:

- Pre-COVID Care

- Easy Consult

- Post COVID Care

- Sedentary Lifestyle Care

By availing the Sedentary Lifestyle Care Plan for instance, you can save up to Rs.4700 on care. You get validity of 1 year alongside:

- Discounts of Rs.3000 on lab tests

- 10% discounts on doctor consultations

As this plan is associated with a sedentary lifestyle, you get an option to consult a physiotherapist of your choice. Here, you can claim reimbursements of Rs.1000 on OPD consultations.

What Are the Distinctive Features of Health Prime Plans?

These plans are very affordable and can be availed by paying just Rs.199. Few types included as a part of this plan are:

- Health Prime Max +

- Health Prime Elite Pro

- Health Prime Ultra Pro

Health Prime Max + can be purchased with a minimal amount of Rs.699 with a validity of 3 months. This quarterly prepaid plan can address your wellness needs up to Rs.5000. Various other benefits you get with this plan include:

- 1 free voucher each for dental and eye checkups

- Free ambulance service during hospitalization

- Teleconsultation sessions with specialists

How Is a Super Savings Plan Different from Other Health Insurance Plans?

The most important benefit is that you get discounts at partner network hospitals. The Suburban Medicard is a part of this plan and is available in 3 types:

- Classic

- Premium

- Platinum

The Classic loyalty card can be purchased by spending only Rs.99. Platinum and Premium cards are available for Rs.1999 and Rs.499, respectively. You can avail the benefits of a complete health package twice on a Platinum card and once with a Premium card.

Considering the importance of health insurance plans, it is vital that you choose the best health insurance policy. These help manage your medical expenses properly and affordably. With Bajaj Finserv Health Aarogya Care Plans, you can buy the right policy from the bevy of options offered. What’s more, you enjoy a cashless claim process too! Lastly, the wide range of perks helps you save money and prioritize healthcare. Apart from this Bajaj Finserv Health Offers a Health EMI card that converts your medical bill into easy EMI.

References

- https://www.ibef.org/industry/insurance-presentation

- https://www.researchgate.net/profile/Abhishek-Singh-130/publication/340808551_A_Study_of_Health_Insurance_in_India/links/5e9eb46b299bf13079adac51/A-Study-of-Health-Insurance-in-India.pdf

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.