Aarogya Care | 5 min read

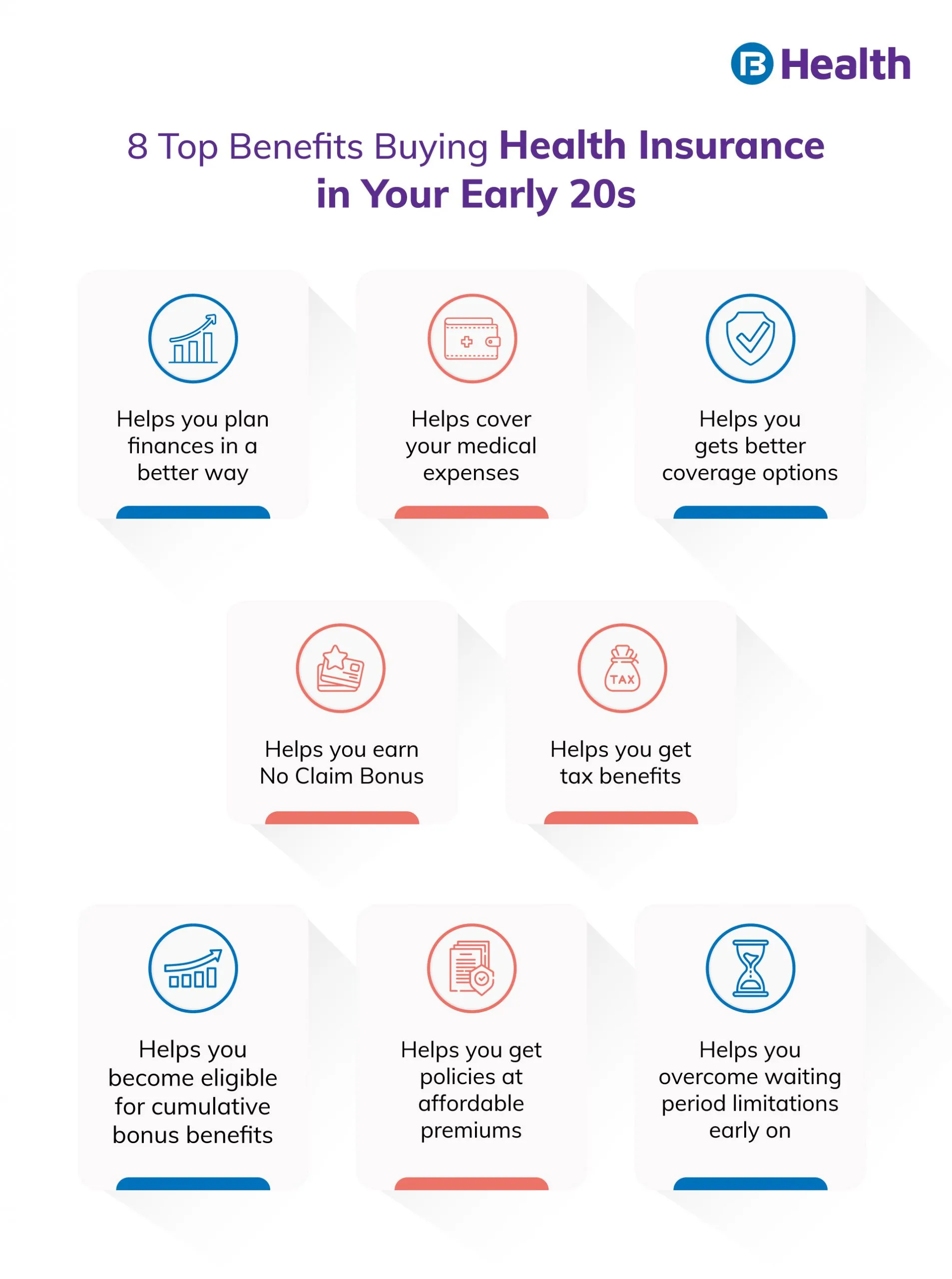

6 Top Benefits of Buying Health Insurance in Your 20s!

Medically reviewed by

Table of Content

Key Takeaways

- Buying health insurance in 20s gives you umpteen benefits

- You need to pay a lower premium and get a comprehensive cover

- No need of medical checkups when buying health insurance in 20s!

With the threat of illness increasing around the world, buying health insurance has become more vital. Right when we thought the threat of the pandemic is slowly decreasing, the emergence of the omicron variant has increased stress for everyone. According to WHO, there is an increased risk of reinfection with this new variant. In such uncertain times, buying health insurance at an early age is important [1]. This way, you can handle all your medical needs with ease today and in the future. After all, your health is your real wealth.

In modern times of stress and anxiety, the sooner you invest in a policy the better it is. While reaching your 20s is exciting, it comes with major responsibilities. One of your most important duties is towards your health. If you are financially independent, you should not delay in buying health insurance. Keep in mind that individual insurance offers wider coverage than the group health policy you may get from your employer.

Here are the different reasons why purchasing a health insurance policy in your 20s is a great idea.

Additional read: Bajaj Finserv Health’s Post-COVID Care Plans

Pay lower premiums

This is one of the most important advantages you get when you invest at a young age. The premium amount varies from one insurer to the other. Age always plays a crucial role in deciding your premium amount. The lesser your age, lower will be your premium amount in most case. As your age increases, there is an increased risk of health ailments and your premiums increase.

Consider a hypothetical example where you purchase a health insurance plan of Rs.10 lakh at 25 years of age. In this case, your premium amount is Rs.10,000. However, if you purchase the same plan at 35, the premium amount may increase to Rs.12000.

Tide over the limits of the waiting period

Waiting period is the time during which you cannot make any claims for specific treatment. This includes surgery and treatment for preexisting diseases. Based on your health insurance plan, the waiting period duration is two or four years. If you are buying health insurance at a young age, you may not need to file any claim during the waiting period. In case you invest in a policy after 45 years, there is a high risk that your existing medical condition may require you file a claim during this time.Get better coverage

If you invest in your 20s, you get to enjoy comprehensive benefits and coverage. Most of the plans available in the market are primarily targeted at young individuals so that they get to enjoy maximum benefits for a longer period. The best part is you get to enjoy such comprehensive benefits at lower premiums! If you are investing at a young age, you can select the appropriate policy from a wide range of options. There is no possibility of preexisting illness when you get coverage at a young age. After this, any illness diagnosed will be automatically covered in your plan.

Avoid medical health checkups

If you take a policy after 45 years of age, it is mandatory for you to undergo a medical health checkup. This is because you are at a higher risk of health complications at this age. In case your health reports reveal issues, your insurance provider can charge a high premium or even reject your application for a policy. However, if you are buying health insurance when you are young, there is no need to go for premedical screenings.

Face fewer policy rejections

When you try are buying a health policy at a later stage in life, there are high chances of rejection. If you are diagnosed with a serious health complication, your insurance provider can reject your application. This is more likely at an age of 40 and up since health risks increase as your age increases. In addition, insurers may offer policies that require high co-pay amounts. This refers to an option where you have to pay a fixed amount while your insurance provider pays the remaining amount during claim settlement. To avoid all this, you can buy a policy at a younger age and enjoy fast approval.

Enjoy tax benefits

You can avail tax benefits on the premium you pay for the health insurance policy. According to the Section 80D of Income Tax Act, you get these benefits if you are taking policy for yourself, your dependents or even your spouse [2]. Investing in a policy in 20s means that you get to enjoy tax benefits for a longer period. This is one of the best advantages of investing in a policy while you are in your 20s.

Additional read: Section 80D of Income Tax ActNow that you are aware how important it is to invest in a healthcare plan at an early age, make sure that you don’t delay in purchasing one. This allows you to enjoy a wider coverage and benefits for a longer period. Since life is unpredictable, it is better to make the wise decision of investing in health insurance while you are in your early 20s. This also helps you deal with increasing lifestyle illnesses right from the time they start. Looking for the right health insurance plan? Browse through the range of Aarogya Care plans on Bajaj Finserv Health.

The Aarogya care Complete Health Solution is one such cost-effective plan that offers a wide range of comprehensive benefits. These plans cover all your medical expenses right from illness to wellness. You can purchase these plans in three simple steps. Simply choose the plan that suits your requirements, fill in the form effortlessly and enjoy the benefits right away. Why wait? Take a wise decision now and reap the benefits for better health

References

- https://www.who.int/news/item/28-11-2021-update-on-omicron

- https://cleartax.in/s/medical-insurance

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.