Aarogya Care | 5 min read

Why is Investing in a Coronavirus Health Insurance Policy Important for You?

Medically reviewed by

Table of Content

Key Takeaways

- There are different types of coronavirus health plans you can choose from

- A COVID-19 insurance policy covers treatment expenses related to coronavirus

- Hospitalization expenses and costs of PPE kits and masks are all covered

There has been a steady increase in the number of COVID-19 cases across India in the past few months. With the emergence of the new omicron variant, the third wave affected people nationwide. Reports reveal more than 11 lakh of active cases in India, with a glimmer of hope as the number of new COVID cases per day has dipped [1]. To take the COVID graph down to zero, it’s important to keep following the preventive guidelines. You should also not delay getting yourself treated if you are diagnosed with the disease.

To help you meet your pre- and post-COVID treatment expenses, many insurance providers offer coronavirus health insurance policies. With the help of this policy, you can cover all your medical expenses pertaining to COVID-19 treatment. To understand more about COVID-19 health insurance, read on.

Additional Read: COVID-19 Facts: Myths and FactsWhat is a COVID-19 Health Insurance Policy?

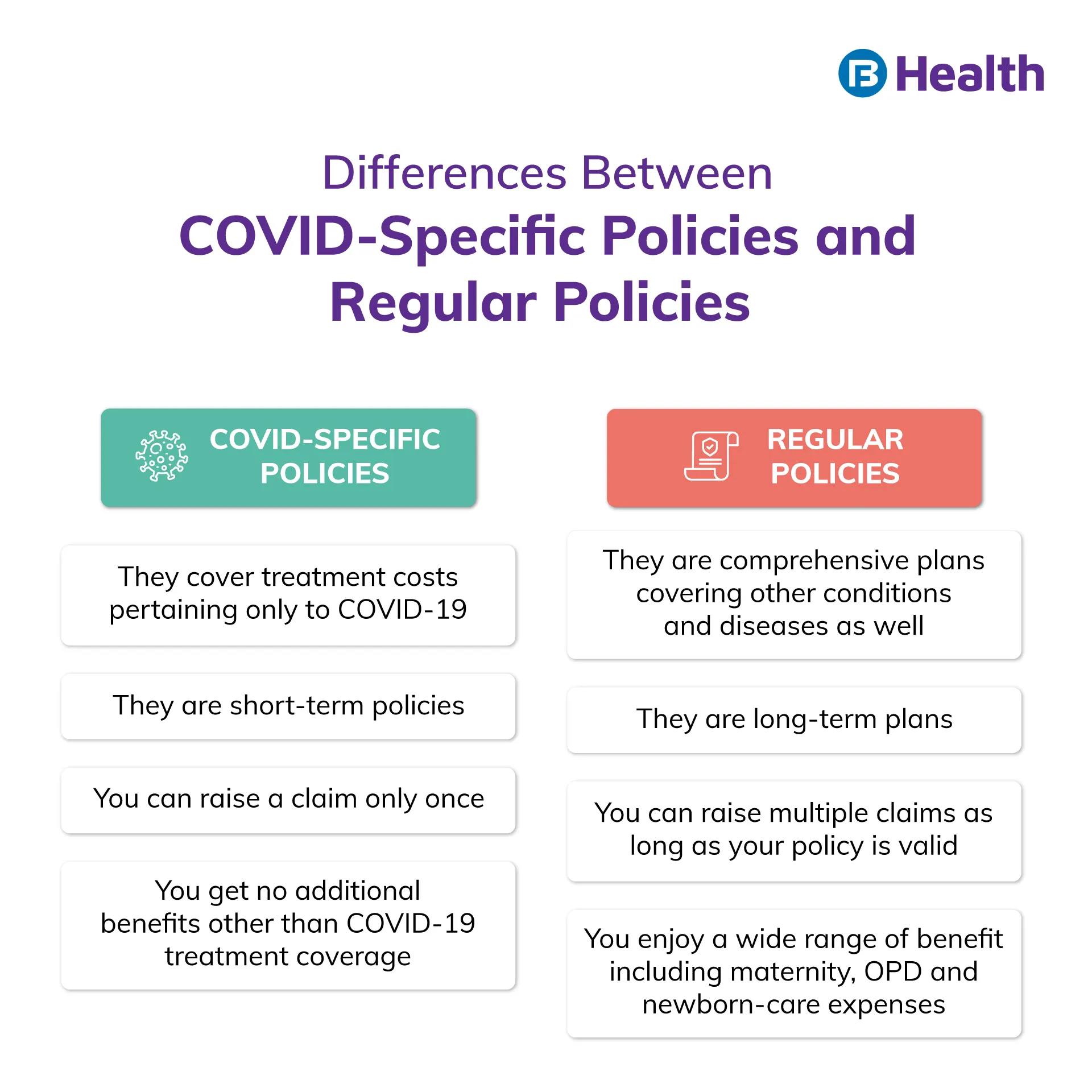

It is a customized policy that covers treatment and hospitalization costs of COVID-19 infection. While a regular health insurance plan covers different illnesses, this policy covers hospitalization expenses specific to COVID-19. A coronavirus policy helps protect yourself and your loved ones more affordably. Buying this policy ensures that you can manage medical expenses due to COVID-19 without much hassle. Since COVID-19 is a new disease, you can get the coverage from the day the condition is diagnosed.

Does a Regular Health Policy Cover COVID-19 Treatment Costs?

Considering the prevailing pandemic, many insurance companies have included COVID-19 treatment as a part of their regular insurance plans. In such a scenario, if you are hospitalized due to COVID, your insurer will cover hospitalization costs [2].

You can settle all your COVID-19 treatment expenses either by reimbursement or cashless mode. Some insurance providers also cover post-hospitalization expenses. After you recover from the infection, there are chances that you may acquire other health-related issues. Any complications that occur due to COVID-19 will be covered by your insurance provider.

Additional Read: Bajaj Finserv Health’s Post-COVID Care PlansWhat Are the Key Benefits of a Covid-Specific Policy?

These are a few beneficial features of coronavirus policy, which are as follows:

- Coverage of COVID-19 treatment with zero additional costs

- Cashless treatment and add-on options available

- Cost of masks and gloves included

How Many Different Types of Coronavirus Health Insurance Policies Are There?

If you want a specific health cover for coronavirus, you can consider different types of COVID-19 health insurance plans.

Corona Kavach Policy

It is a standard insurance policy that includes the following COVID-19 treatment expenses:

- Ambulance charges

- PPE kit costs

- Doctor consultation fees

- Medicines

- Masks

- Gloves

- Home treatment costs

- ICU charges

While the sum insured starts from a minimum amount of Rs.50,000, you can avail a maximum coverage of up to Rs.5 lakh.

Corona Rakshak Policy

It is an insurance policy that covers you if you are hospitalized for a minimum of 72 hours or more due to COVID-19. It covers the expenses for the following:

- AYUSH treatment

- PPE kit costs

- Masks

- Oxygen cylinders

- Oximeters

- Gloves

- Nebulizers

You can choose a sum insured for a minimum amount of Rs.2.5 lakh and a maximum of Rs.5 lakh. This policy is applicable for individuals between 18 and 65 years of age.

Coronavirus Group Health Insurance Policy

The IRDAI has allowed insurance companies to offer group policies for COVID-19 medical expenses. So, you can get coverage for this disease via your employer’s group policy as well.

What are the Inclusions of a COVID-19 Health Insurance Policy?

Here are the common inclusions of a COVID-19 health plan:

- Pre-hospitalization expenses

- Day-care procedures

- Alternate treatment

- Home hospitalization

- ICU room rent

- Post-hospitalization expenses

- Daily hospital cash

What Are the Services Excluded in a Coronavirus Health Insurance Plan?

Here are the expenses not included in a coronavirus health insurance policy:

- Medical expenses for pre-existing diseases

- Hospitalization without the consent of the doctor

- Pre-natal and post-natal expenses

How to File a Claim for COVID-19 Health Insurance?

You can make claims via cashless or reimbursement options. In cashless claims, you need not pay money out of pocket as your insurer will settle the bills directly with the hospital. However, the hospital where you take treatment should be in the list of insurer’s network hospitals. Remember to check if there is an option for cashless facility for COVID-19 treatment in your policy.

In case you get treated at any non-network hospital, you can get reimbursed. Fill the claim form and submit all important documents like medical records, investigation reports, bill receipts and doctor’s prescriptions for verification. After scrutinizing your documents, the insurer will credit the amount to your bank account.

Since COVID-19 has claimed many lives across the globe, it is important that you avail a coronavirus health insurance policy. This way you can manage your treatment expenses without any problem. In case you are looking for a comprehensive coverage, you can get benefits even beyond COVID-19 treatment.

Remember, health is your wealth and taking proper care is essential. Browse through a range of Complete Health Solution plans on Bajaj Finserv Health. With their four different subtypes, you can choose the one that is suitable for you. A few benefits include medical coverage up to Rs.10 lakh, amazing network discounts and doctor consultation benefits up to Rs.17000. Be proactive and choose an appropriate health insurance plan so you can sail through tough times.

References

- https://www.mohfw.gov.in/

- https://ijrssis.in/upload_papers/0208202003143724%20Hasan%20Yusuf%20Hussain.pdf

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.