Aarogya Care | 5 min read

Health and Personal Accident Insurance: Here Are The 3 Key Differences

Medically reviewed by

Table of Content

Key Takeaways

- Health insurance offers extensive cover for planned and emergency treatment

- The benefits of health insurance include pre-and post-hospitalization cover

- Personal accident insurance covers injury or disability due to an accident

With different types of insurance available, it is important to know their nuances. This will not only help you select a policy as per your needs but also know more about other important plans. There are certain kinds of insurance that may seem similar but in reality, these have different features. The differences are mainly linked to the coverage benefits.

Health insurance and personal accident insurance are an example of this common misconception. These policies cover different aspects even though there may be some overlap. Health insurance covers healthcare-related expenses including medical emergencies. Personal accident insurance only offers coverage for injuries caused by an accident.

Read on to know more about how health insurance is different from personal accident insurance.

Health Insurance

Meaning

A health insurance policy works as a safety net during a planned or emergency treatment. The insurer may bear the costs of your treatment. This benefit is possible because you are required to pay your premiums. Doing so can help you ensure that you and your family’s health requirements are met. A health insurance policy offers coverage for:

- Treatment costs

- Pre-and post-hospitalization care

- Doctor consultation

- Lab tests

What it Covers

A health insurance policy offers financial coverage for you and your family members based on the sum insured. Major insurance companies offer cover for a vast number of health conditions. This includes critical illnesses as well as pre-existing diseases. You can also get health insurance policies for individuals, family members, and larger groups like employees. Some insurers also offer policies for specific chronic illnesses.

Factors and Benefits

The important factors in a health policy are the sum insured, premium amount, and waiting period. The sum insured is the maximum coverage amount you can avail. The premium is the amount paid at the time of purchase. The waiting period is time after purchase during which you cannot make a claim.

Another key benefit of insurance policies is that you get certain tax benefits. The health insurance premiums you pay are eligible for a deduction. The amount depends on your premium amount and the individual paying the premiums.Personal Accident Insurance

Meaning

Unlike health insurance, these insurance policies provide you with financial coverage for accidental injury or disability. Accidents often require funds immediately. This is why it is important to have this insurance along with your health insurance.

What it Covers

It covers the hospitalization or treatment expenses only due to an accident. It may also cover other charges such as ambulance or transportation costs. Some insurers offer an education fund for children in case of accidental impairment or death of a parent [1]. Thus, it offers financial protection to the family members of the insured.

You can get coverage for accidents or injuries that occurred while:

- Traveling

- Due to collision

- Drowning

Other Factors

The premium for this policy depends on your occupation and the type of policy. Unlike health insurance, there is no waiting period for personal accident insurance policies. You are eligible for cover from day one of purchasing the policy. For a family, the sum insured will apply to each member individually [2].

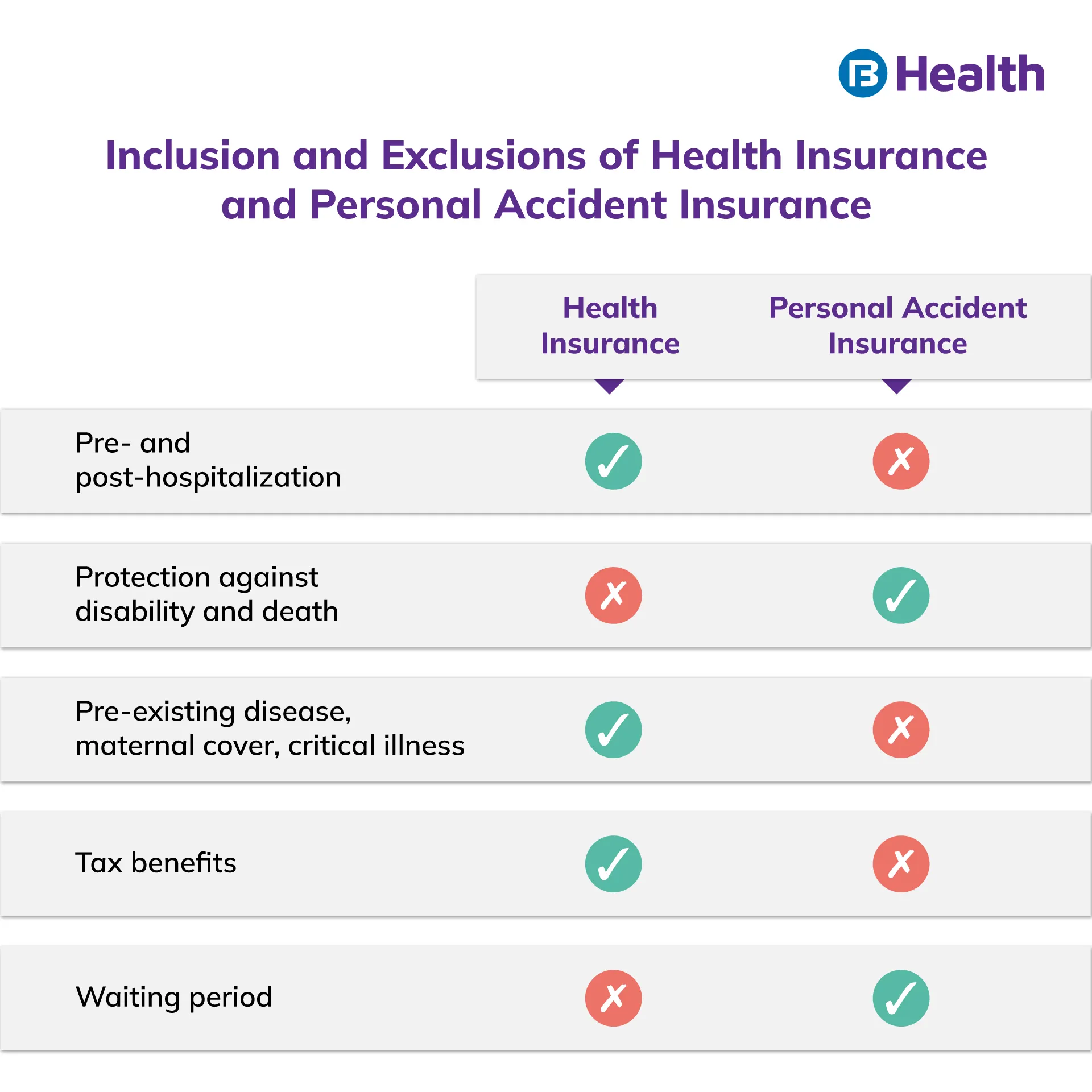

Key Differences Between Health Insurance and Personal Accident Insurance

Cover

Health insurance covers all types of medical conditions and treatments. The inclusions and exclusions depend on the type of policy you buy and the insurer’s terms. Health insurance does not offer cover in case of impairment or death of the insured.

Personal accident insurance covers only the treatment costs that arise from an accident. It also offers compensation for body injuries, impairment or demise of the insured.

Waiting Period

The waiting period for health insurance may differ for each company. It may also be dependent on the type of policy selected. Usually, the waiting period is 30 days but can go up to 48 months.

There is no waiting period for personal accident policies. Your policy comes into effect from day one. A personal accident insurance policy does have a grace period. This is a common benefit and it allows the insured to renew the policy after missing the due date. A grace period is usually offered for a period of 30 days.

Additional Benefits

Pre-and post-hospitalization expenses are covered under health insurance. This isn’t a benefit offered with personal accident insurance policies. Health insurance policy does not offer cover for disability or death of the insured as well as education cost for children of dependents. Personal accident insurance offers this benefit but the coverage amount is based on the sum insured.

Additional Read: Difference Between Life Insurance and Health InsuranceDepending on your lifestyle and profession, you can select one or both of these policies. But remember that health insurance offers greater coverage. Make sure you analyze your needs and compare different policies before you opt either. Read the policy documents to understand the terms and conditions. Doing so ensures that you don’t run into problems when making claims.

In case you do not understand or have doubts, talk to your insurance provider. You can also check out the Complete Health Solution plan available on Bajaj Finserv Health. The four variants under this plan offer individual as well as family health cover. These health plans come with additional benefits like preventive health check-ups and network discounts. Choose this solution and be proactive about healthcare for yourself and your loved ones.

References

- https://www.irdai.gov.in/ADMINCMS/cms/Uploadedfiles/107.

- https://www.irdai.gov.in/ADMINCMS/cms/Uploadedfiles/StandardProducts/Final

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.