Aarogya Care | 5 min read

Hospital Daily Cash Insurance: 3 Important Facts to Know

Medically reviewed by

Table of Content

Synopsis

Hospital daily cash insurance offers a fixed sum during hospitalization. Get a hospital daily cash insurance policy or an add-on with this benefit. Know more about hospital daily cash insurance plan.

Key Takeaways

- Hospital daily cash insurance offers a lump sum for each day of hospitalization

- A hospital daily cash insurance plan also has a waiting period and exclusions

- Use the hospital daily cash insurance benefit to meet various expenses

With hospital daily cash insurance, you get a specific sum on each day that you are hospitalized. This usually goes from Rs.250 to Rs.15,000 per day. You can use it to pay for additional costs that your normal health insurance policy doesn't cover or view it as compensation for any income you may have lost during the time you have been unable to work.

Usually, you need to be hospitalized for more than 24 hours for a hospital daily cash insurance policy to be valid [1]. Also, remember that the benefits usually double if the insured is admitted to an ICU. Keep in mind that a hospital daily cash insurance plan can be a separate health policy, or your insurer may provide it as an optional rider. Read on to find out more about hospital daily cash insurance.

Coverage you can get under a hospital daily cash insurance policy

With a hospital daily cash insurance plan, you can avail the daily benefit of the following:

- Accidents

- Ailments

- Extension of hospital stay

- ICU admission

Waiting period

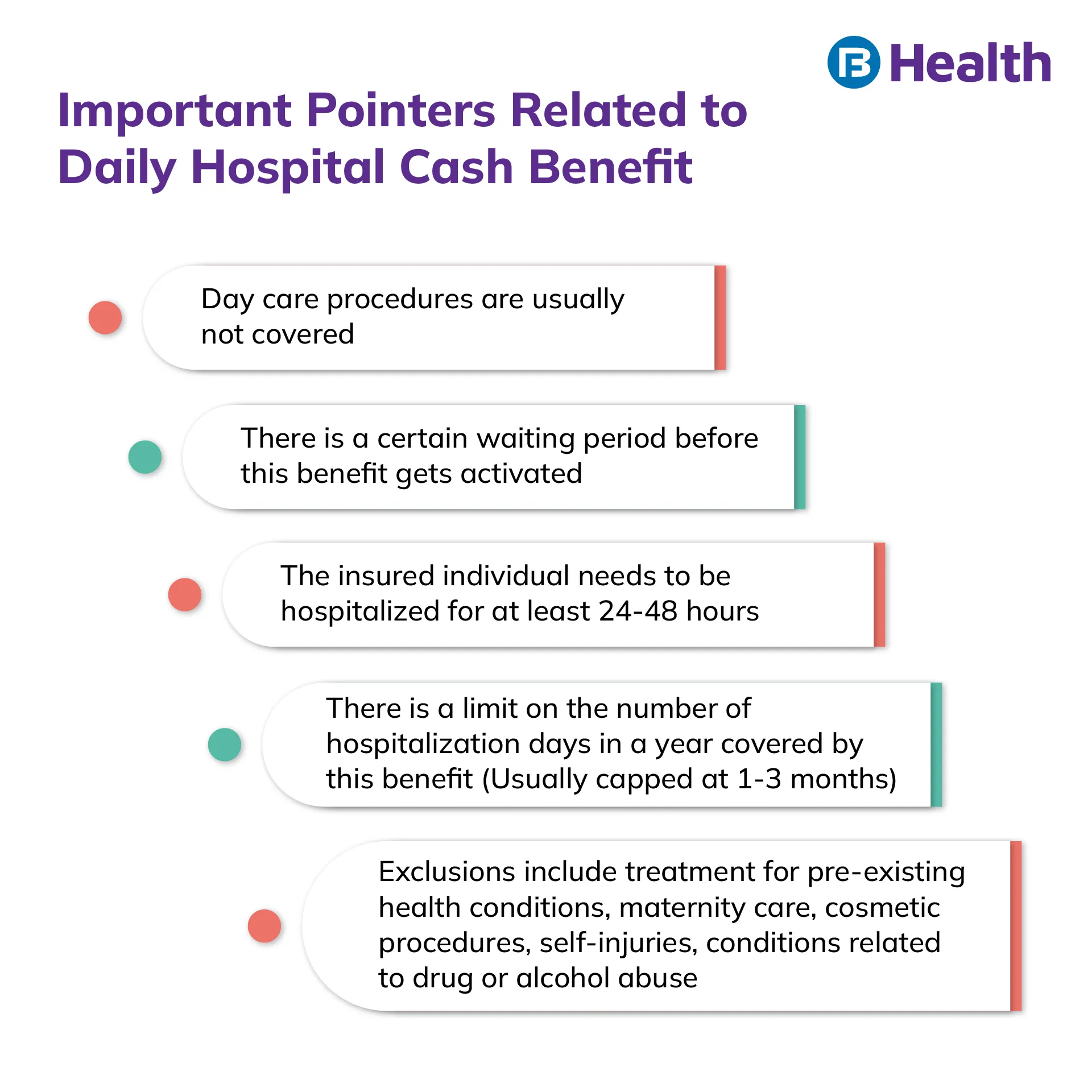

Just like a comprehensive health policy, there is a certain waiting period before a hospital's daily cash insurance policy gets activated. Here are some crucial facts you should know.

- Pre-existing diseases: The policy may not offer the daily hospital cash benefit for the treatment of pre-existing diseases up to 48 months or more, depending on the hospital daily cash insurance plan you choose.

- Mandatory waiting period: You may need to wait for 30 days to avail the claim benefits from this policy unless the claim is made due to an accident. This also differs from insurer to insurer.

- Waiting period for the treatment of certain diseases or procedures: Any claims against the following made within 24 months post the commencement of the hospital daily cash insurance plan may not be considered.

- All types of cysts, benign tumors (external and internal), polyps, and more

- Hysterectomy

- Cataracts and other eye diseases related to old age

- Non-cancerous ENT conditions

- Hydrocele

- Duodenal and gastric ulcer

- Fistula, fissures and piles

- Different types of hernia

- Tympanoplasty

- Mastoidectomy

- Tonsillectomy

- Gout and rheumatism

- Varicose veins and ulcers

Apart from these, certain ailments or treatment procedures may need a waiting period of 48 months before you can enjoy the hospital's daily cash insurance cover. These include osteoporosis, osteoarthritis, and replacement of joints, among a few.

Major exclusions

Some of the common events when a hospital's daily cash insurance plan does not offer you any benefits include the following.

- Hospitalization for dental treatment or examination of teeth

- Any treatment or procedure related to infertility or sterility, such as:

- Going for any type of contraception

- Reversal of sterilization, a type of contraception

- Artificial insemination and related advanced procedures like GIFT, ZIFT, ICSI, IVF

- Gestational surrogacy

- STIs (except AIDS in some cases)

- Treatment to alter gender

- Treatment of external congenital birth defects

- Circumcisions, unless prescribed by the doctor as part of a treatment

- Treatment of drug and substance addiction and alcoholism

- Maternity cover

- Birth of a child

- Miscarriage

- Injury inflicted by self

- Conditions arising from participation in adventure sports

- Suicide or attempted suicide

- Hospitalization due to conditions resulting from criminal acts where the insured is responsible

- War or war-like situations, such as

- Invasion by foreign armies

- Revolution

- Mutiny

- Civil war

- Biological, chemical, or nuclear warfare

- Treatment of conditions arising out of the navy, air force, law enforcement, or military operations

- Treatment procedures that do not have the required medical documentation to back them up

Now that you know about the inclusions and exclusions of hospital daily cash insurance, you can utilize the benefit of a hospital daily cash insurance policy wisely. While you can buy a separate plan for hospital daily cash insurance, you can also opt for the all-inclusive Aarogya Care plan.

Usually, policyholders buy a hospital daily cash insurance cover when their basic plan doesn't cover expenses related to diagnostic tests, surgeon's fees or instruments, and more. However, the Complete Health Solution plans available on Bajaj Finserv Health offer wide coverage. This includes cover not only for in-patient hospitalization treatment and room rent but also for:

- Orthopedic implants, vascular stents, pacemakers, X-rays, and more

- The costs of surgical appliances, blood transfusions, and more

- Care of organ donors and organ transplant procedure

- Boarding and room rent in the ICU

- The fees of doctors, surgeons, and anesthetists

Apart from this, you can make your health insurance claims with ease, either in the cashless or reimbursement mode. For cashless treatment, make sure you get to visit a network hospital part of the huge partner network of Aarogya Care. Alternatively, you can make reimbursement claims from any hospital or medical facility of your choice.

Looking for a discount on health insurance? Aarogya Care plans offer you up to a 10% network discount on medical services from partners and also give you a No Claim Bonus which can get you discounts on premiums or increase your cover. These plans also offer pre- and post-hospitalization coverage, free preventive health check-ups, and COVID treatment coverage, among many other features. You can also opt for free insta consultations with 8,400+ top doctors across 35+ specializations in 17+ Indian languages with these plans.

You can also find list of best hospitals in India and in your city to book for other health related services and OPD consultation at hospitals.

To secure yourself against all kinds of health hazards, sign up for it today. To further enjoy deals and cashback, you can also sign up for a prepaid health card on the Bajaj Finserv Health app or website. All this makes it easier for you to put your health first and get treated more affordably.

References

- https://www.irdai.gov.in/ADMINCMS/cms/Uploadedfiles/Hospital%20Daily%20Cash%20Insurance%20Policy.pdf

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.