Aarogya Care | 5 min read

Network Discount in Aarogya Care: What You Need to Know

Medically reviewed by

Table of Content

Synopsis

With network discount, you can get certain percentage off in the cost of healthcare services availed. Read on to know about discount on hospitalization room rent, regular healthcare expenses, & more.

Key Takeaways

- Network discount is a provisional discount offered by your insurer

- Aarogya Care plans offer you a network discount in 4,100+ healthcare facilities

- As part of network discount, you can get up to 10% off on regular healthcare costs

A network discount is a provisional discount offered by your Insurer when you avail healthcare services from any of the healthcare providers associated with them. As part of the network discount, you may get a certain percentage of the costs of different types of healthcare services availed. There can be a discount on hospitalization room rent, regular healthcare expenses, and more. You may also get a network discount by doing your lab tests from your Insurer’s network partners. All these features help you to keep your healthcare expenses low.

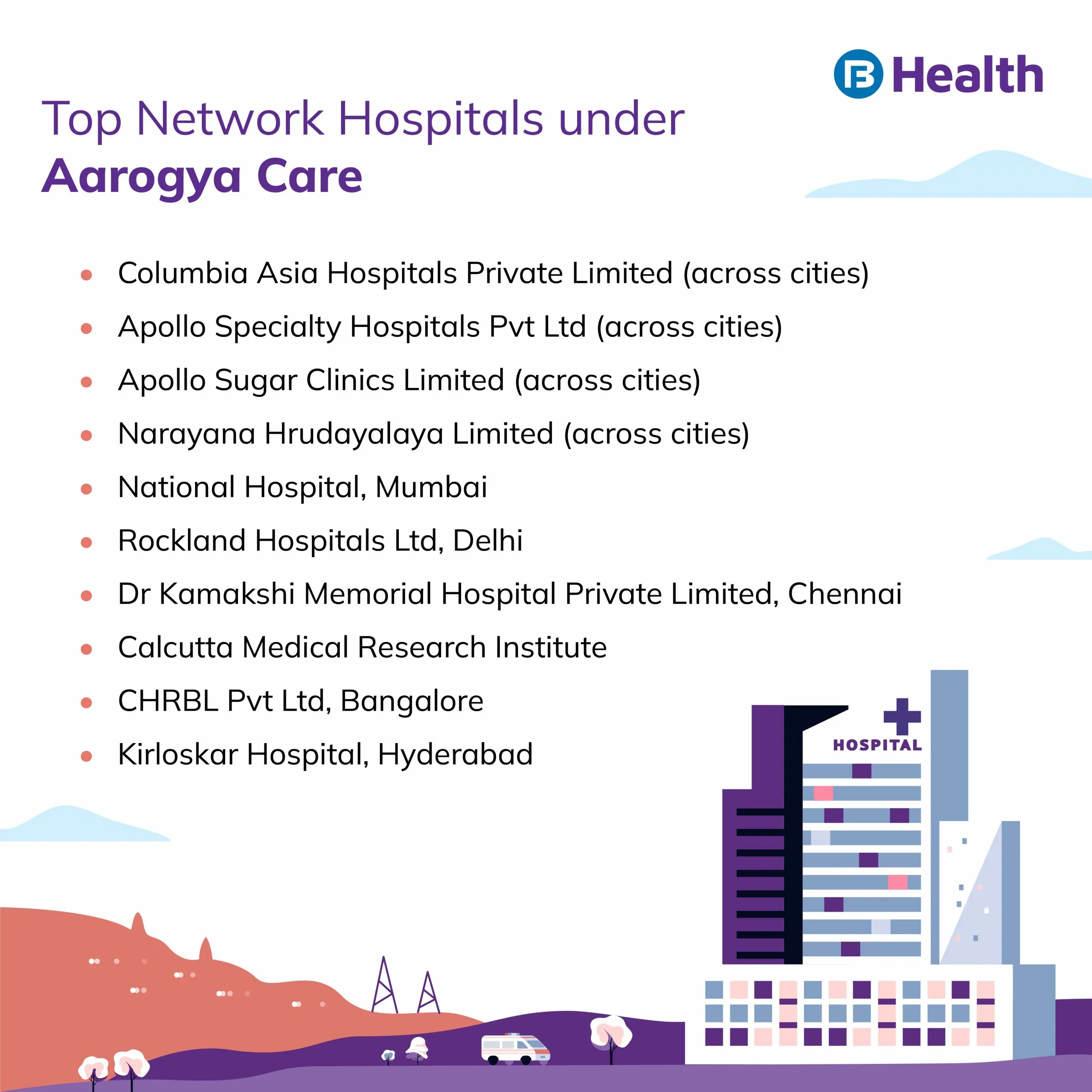

When it comes to Aarogya Care Health Insurance under Bajaj Finserv Health, you can enjoy a network discount by subscribing to its Health Protect Plans. With a Complete Health Solution plan, you will be eligible for network discounts in 700+ hospitals and 3,400+ diagnostic centers across the country. Read on the find out more about network discounts under Aarogya Care and other types of discounts you can get with health insurance.

Discount on Regular Healthcare Expenses

Your regular healthcare expenses include the costs of medicines and medical equipment purchased from specific pharmacies, nursing care, the services provided by other healthcare staff, and more. With the Aarogya Care Complete Health Solution plan, you can get a network discount of 10% against these costs by availing of treatment from a network hospital.

Additional Read: Want A Medical Bill Discount

Discount on hospitalization room rent

When it comes to your stay in a hospital, you need to pay room rent based on the number of days required for your treatment. By subscribing to the Aarogya Care Complete Health Solution plan, you can get a 5% off as a network discount. Just make sure to avail yourself of the treatment from a network hospital.Discount on lab tests

Aarogya Care has partnered with a large number of diagnostic centers across India. By undergoing one or more lab tests from them, you can get a network discount of 5%, provided you have got yourself covered by an Aarogya Care plan.

Additional Read: Save Money on Healthcare Plans

Other types of discounts in health insurance that you can avail

Policy discounts

- No-Claim Bonus

If you do not make a claim during your policy period, it will make you eligible for a bonus. You can claim the No-Claim Bonus each financial year you spend without making a claim. You may get it as discounts on your premiums. Depending on your Insurer, you may also get a revised sum assured with a minimum addition of 5%. The bonus gets accumulated every year until you go for a claim or it reaches a certain limit. Note that if you switch your insurance provider, it doesn’t affect the validity of your No-Claim Bonus.

- Discounts for adding beneficiaries

Adding family members such as a spouse, children and parents makes you eligible for certain discounts. With top insurers, you may enjoy a discount of 10% by adding two family members to your existing policy.

- Discounts for cumulative premium payment

Instead of paying your premiums monthly or quarterly, paying them all at once may qualify you for a discount of up to 10%.

Service discounts

- Discounts for healthy living

With healthy living, you can ensure that your vitals are functioning normally, and there is no need to make a claim. If your medical reports of two consecutive years reflect that your health parameters are fine, insurers may give you a maximum discount of 25% on your insurance premiums.

- Exclusive discounts for female members

Certain insurers have exclusive policy discounts for female policy proposers. Family floater plans with more women beneficiaries may also become eligible for such discounts.

Other interesting facts about Aarogya Care

By subscribing to the Aarogya Care Health Protect Plans under Bajaj Finserv Health, you can get your healthcare expenses insured under Bajaj Allianz, a top national health insurer. Note that it is ISO 9001:2015 certified, and you will join a network of over 11 crores of trusted customers. The insurance provider has also won the following awards:

- Best Insurer in the Asia Pacific region by IDC Financial Insights Asia Pacific

- Best Customer Experience 2020 by CX Asia Excellence Awards

- Best Insurer in India 2020 by IDC Financial Insights Innovation Awards

With Aarogya Care Health Protect Plans, you may not get a separate discount on consultation, but you can consult doctors across specialties multiple times, with a limit of up to Rs.12,000. Apart from that, you will also get unlimited insta-consultation benefits with 8,400+ expert doctors via email, video call, or teleconference ranging across 35+ specialties and 17+ languages. You can consult them in your preferred language any time of the day as per your flexibility. Apart from that, you will also be eligible for the following benefits:

- A health insurance coverage of up to Rs.10 lakh, where you can include your spouse, and four children (provided they are under the age of 21)

- Coverage for pre-hospitalization (60 days) and post-hospitalization (90 days) expenses

- Cover for the fees of doctors across specialties who visit you during hospitalization

- Reimbursement benefits of up to Rs.17,000 if you undergo radiology and pathology tests in network facilities

- Coverage through preventive health check-ups for two adults

- Cover for the expenses incurred for COVID-19 treatment and hospitalization

- Coverage for the boarding, room rent, and nursing at the ICU

- Cover for the medicines, medical equipment, and other procedures required for surgery

- Coverage for the treatment of chronic or recurring illnesses like cancer, kidney disease, and more

- Cover for implantation or transplantation of organs like a cardiac valve, pacemakers, stents, and more

- Coverage for up to 25% of ayurvedic and homeopathic treatment expenses incurred during the hospital stay

- Cover for road ambulance services with a limit of up to Rs.3,000

- Coverage for small surgeries and procedures that can be completed within a day

- Cover for any organ transplant and the care of the organ donor

With all these additional benefits, obtaining for network discount with Aarogya Care Complete Health Solution Plans becomes a prudent choice. Having an Aarogya Care Health Card can supplement your life insurance policy so that you can live stress-free. Considering health as the top priority, get yourself covered right away!

References

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.