Aarogya Care | 5 min read

How Are Health Insurance Wellness Benefits Useful?

Medically reviewed by

Table of Content

Key Takeaways

- Plans with health insurance wellness benefits provide you with a mentor

- This wellness coach provides tips and guidance to lead a healthy lifestyle

- You can get huge network discounts on pharmacy bills and lab tests as well

In today’s world, busy lifestyles and stressful routines may pose multiple health challenges for you. When you prioritize your health above everything else, you can achieve all your life’s goals with ease. For the same reason, follow a proper wellness regime by following a nutritious diet and maintaining an active lifestyle. But what if you get rewarded for following a healthy lifestyle? Sounds exciting, right!

As per IRDA’s health regulations, insurance providers have started including wellness benefits in their plans. With the help of these features, you can give priority to your health. There are a lot of incentives you may get when you take a policy. The best part is you get to utilize these health insurance wellness benefits as value-added features in most cases. In such a scenario, you needn’t pay any additional costs for enrolling yourself in these wellness programs [1].

Read on to know more about health insurance wellness benefits.

Additional read: Top Health Insurance Schemes

What are the kinds of wellness benefits you can get?

Different insurance providers offer various types of wellness programs. In most cases, you get an option of wellness coach. This is a mentor who is assigned to you by the insurance company. This mentor gives you the right instructions on the right kind of diet you should follow. Apart from diet, your mentor provides you with tips on health, nutrition and fitness. They could tell you what type of exercises you need to do and if you are consuming the right proportion of nutrients. A wellness coach helps you in weight management as well. You can get advice from these mentors either through mobile chats or apps.

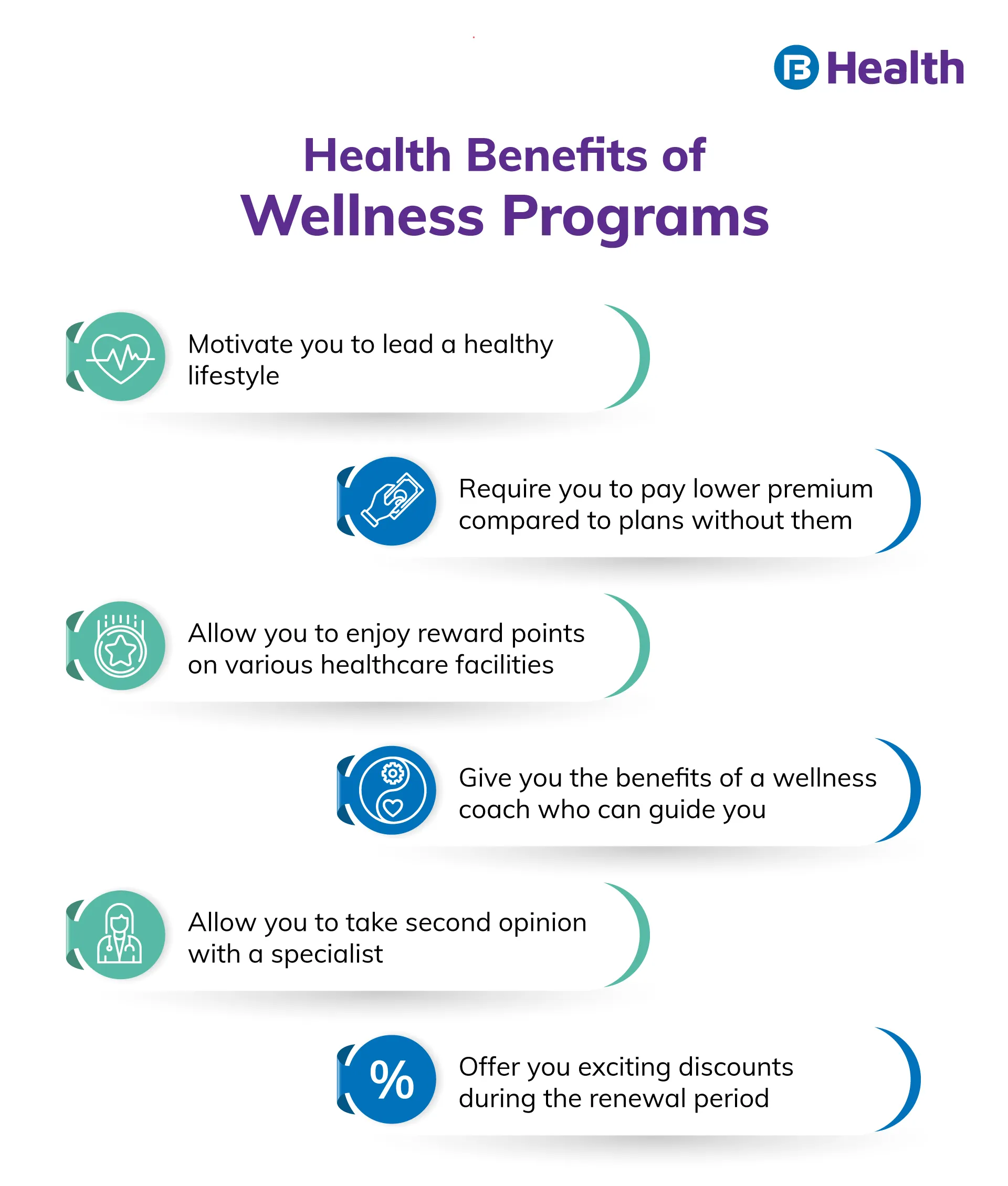

When you achieve a specified target as a part of the wellness program, you also get rewards either. These may be points or benefits. A few of these benefits include:

- Discounts on pharmacy expenses

- Network discounts at any of hospitals listed with insurance provider

- Concessions on OPD bills and at diagnostic centers

- Cyclothon

- Marathon

- Regular walking

- Yoga practice

- Routine workouts

You can enjoy the benefits of these discounts based on the terms and conditions specified in the policy. Using an integrated tracking mechanism, the insurance company is able to monitor all your health-related activities using mobile apps and other digital devices.

Another benefit you may get is expert advice for a specific disease or a surgical procedure. This is like a second opinion. The only thing you need to do here is that inform the insurance provider when you seek a second medical opinion. Fill in the required form along with a copy of investigation report, medical reports and discharge summary, if applicable. This way your insurance provider has a clear understanding of why you require an expert medical opinion.

Additional read: Sedentary Lifestyle AffectWhat are the advantages of using health insurance wellness benefits?

One of the major advantages of availing these benefits is that they are complimentary. So, you do not need to pay any additional premium for availing these benefits. Moreover, health plans with wellness benefits have lower premiums when compared to policies without benefits.

Availing these plans is mutually beneficial for both the insurance provider and policyholder. When you utilize such wellness benefits, the chances of you making claims are fewer. Since you are leading a healthy lifestyle, you may be less prone to illness or disease. This the insurance company. In case you make recurring claims during a policy year, your insurance provider cannot terminate your plan midway. This is beneficial for you as a policyholder. Moreover, enrolling yourself in these wellness programs modifies your existing lifestyle and helps you stay physically fit and active. They also give you the motivation to lead a healthy lifestyle.

Why do health insurance companies offer wellness benefits?

Insurance providers include such wellness benefits in their policies so that their plans stand out from the rest of the competitors. Apart from increasing their competitiveness, these plans understand customer requirements. Thus, they enjoy more popularity. Most preventive health checkups form a part of wellness packages. Previously, insurance companies allowed health checkups only once in four years. However, these checkups are now being provided every year. Many organizations have taken initiatives to organize wellness programs for their employees. These steps actually motivate them to lead a healthy lifestyle [2].

Why to use these wellness benefits?

Wellness benefits lead you towards a healthier lifestyle. There are various tools you can use so that you meet your health goals. Using fitness apps helps you track your daily steps and calories burnt. These apps send you fitness reports on monthly or weekly basis. You can use apps to monitor your food intake as well. With determination, you can modify your routine by incorporating such small changes. That is exactly why insurance companies are including wellness benefits as a part of their policies.

Since different providers offer unique types of wellness benefits, take care to read and understand your policy documents clearly. Instead of getting carried away just by wellness benefits, have a thorough knowledge of what the insurance provider is actually offering. Do proper research before you finalize any health insurance plan. If you are looking for comprehensive plans with both wellness and illness benefits, you may consider the Complete Health Solution plans on Bajaj Finserv Health.

There are four different types under this plan, namely, Silver, Platinum, Silver Pro and Platinum Pro. While the Complete Health Solution Silver offers doctor consultation benefits up to Rs.17000, you get up reimbursed up to Rs.12000 on doctor consultations when you avail the Platinum plan. All these plans provide a maximum sum insurance of Rs.10 lakh and cover all your pre- and post-hospitalization expenses. Avail these budget-friendly plans and prioritize your health.

References

- https://www.irdai.gov.in/ADMINCMS/cms/frmGuidelines_Layout.aspx?page=PageNo4236

- https://psycnet.apa.org/record/2008-00533-006

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.