Aarogya Care | 5 min read

How to Choose Between Super Top-Up and Top-Up Health Insurance Plans?

Medically reviewed by

Table of Content

Key Takeaways

- A top-up health insurance policy can be claimed one single time

- A super top-up policy can be used for multiple hospitalizations

- A top-up mediclaim policy works just like a regular top-up plan

With rising medical costs and the uncertainty brought on by the pandemic, investing in the right health insurance policy has become a necessity. While health plans can help you tackle medical expenses with ease, availing a policy with additional benefits and features may require you to pay a high premium that can drain your wallet. That’s exactly where top-up health insurance and super top-up health insurance plans come into play.

The higher your sum insured is, the higher will be its premium. Therefore, choosing a top-up medical insurance helps in providing better coverage while keeping the total premium amount low. To understand more about top-up and super top-up health insurance plans, read on.

Additional read: Importance of Health Insurance in Present Times: 5 Key Reasons![]() What are top-up health insurance plans?

What are top-up health insurance plans?

A top-up plan offers extra coverage exceeding the basic limit of the health insurance policy. What’s interesting is that you can avail this benefit by paying low premiums. In health insurance, top-up plans are considered as safe and flexible ways to help you in case your medical bills exceed your total policy amount.

To understand a top-up plan better, consider a simple hypothetical example of an individual who has availed a health insurance policy of Rs.10 lakhs. Assume that she pays a yearly premium of Rs.20,000. However, during an emergency, her hospital bills shoot up to Rs.15 lakhs. Since she has a policy of only Rs.10 lakhs, she has to bear additional costs of Rs.5 lakhs out of pocket. That’s exactly where a top-up plan comes into play. If she avails a top-up plan of Rs.20 lakh with a deductible amount of Rs.10 lakh, the additional expense can be covered with this top-up policy. Now she is financially protected!

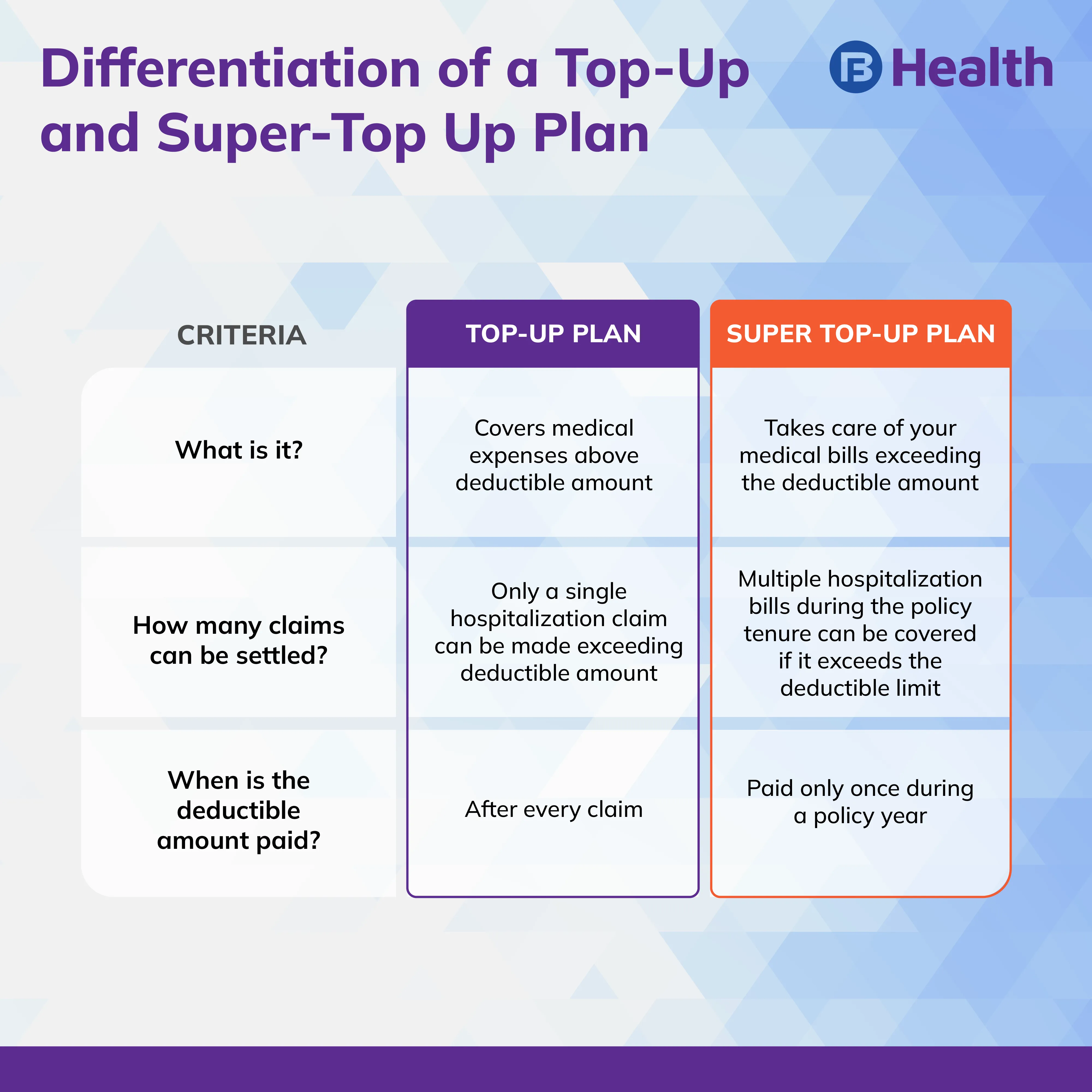

As you can see, once the basic limit of your healthcare policy is crossed, your medical expenses can be met with a top-up plan. However, this plan is capable of covering only a single claim above the deductible amount in a financial year. So, if your hospitalization expenses do not surpass this deductible amount in a single time, no matter how many times you get hospitalized, you may not be eligible for this top-up claim. This is applicable for a top-up mediclaim policy too.

How is a super top-up policy different?

Considering the limitations of a top-up plan as explained above, you can counteract them by opting for a super top-up plan. While a top-up plan pays if you cross the deductible amount for a single hospitalization only, you can utilize a super top-up plan during multiple hospital admissions.

To understand this better, let us consider the same hypothetical example of a person who has a base policy of Rs.10 lakhs and a top-up of Rs.20 lakhs with a deductible of Rs.10 lakhs. Say she was hospitalized twice with medical bills of Rs.8 lakh and Rs.5 lakhs. Now a top up plan cannot be utlised by her for either bill as it doesn’t meet the deductible as a single bill. This is where a super top-up health insurance plan comes in play. It takes into account all bills in a year and pays off the total as per the deductible. In this case, her total bills amount to Rs.13 lakh. Here, her base policy covers her up to Rs.10 lakhs and she can utilize her super top-up for the remainder of Rs.3 lakh.

While there are many super top up health insurance India plans available, always go for the best super top up health insurance plan available in the market once you thoroughly check its features. A super top up health insurance for senior citizens can actually be a boon as premiums increase with age. Investing in this plan is a cost-effective solution as the premium gets reduced considerably. However, remember that you have to shell out the deductible amount either from your pocket or from the base health insurance policy.

Additional read: 6 Important Tips to Choose the Right Senior Citizen Health Insurance Policy

Consider these key facts before opting for a top-up or super top-up plan

Before investing in top-up and super top-up plans, be aware of the importance of deductible amount. Deductible is the base amount beyond which you can utilize a top-up or super top-up plan [1]. Normally, it is not mandatory to have a base plan active before you opt for top-up or super top-up plans. However, if you have a plan in place, you may be able to cover your medical expenses below the deductible amount.

The premium amount of your policy is dependent on your deductible amount. For instance, if your deductible is high, then you pay a low premium and vice versa. You can choose such plans if your existing health coverage does not have enough features or when its sum insured is low [2]. This way you can boost your existing plan without the need for investing in a totally different healthcare policy.

With clarity on how top-up and super top-up health insurance plans work, choose the best top-up health insurance plan available in the market. Check out super top-up health insurance Aarogya Care plans on Bajaj Finserv Health and address your medical expenses affordably. Avail up to Rs.25 lakhs using this super top-up plan and secure the health of your loved ones. All you need to spend is Rs.20 per day! With unlimited doctor consultation on the health app and doctor consultation reimbursement charges up to Rs.6,500, such plans make it easier for you to manage hospitalization and treatment costs. Avail a suitable plan to meet your medical needs hassle-free!

References

- https://garph.co.uk/IJARMSS/Oct2015/7.pdf

- https://www.researchgate.net/profile/Abhishek-Singh-130/publication/340808551_A_Study_of_Health_Insurance_in_India/links/5e9eb46b299bf13079adac51/A-Study-of-Health-Insurance-in-India.pdf

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.