Aarogya Care | 5 min read

4 Common Types of Health Insurance Documents You Need To Keep Handy

Medically reviewed by

Table of Content

Key Takeaways

- Health insurance documents are needed to verify your authenticity

- Proof of age, identity, address are a few common health insurance documents

- The insurance card given with your policy is used for verification purposes

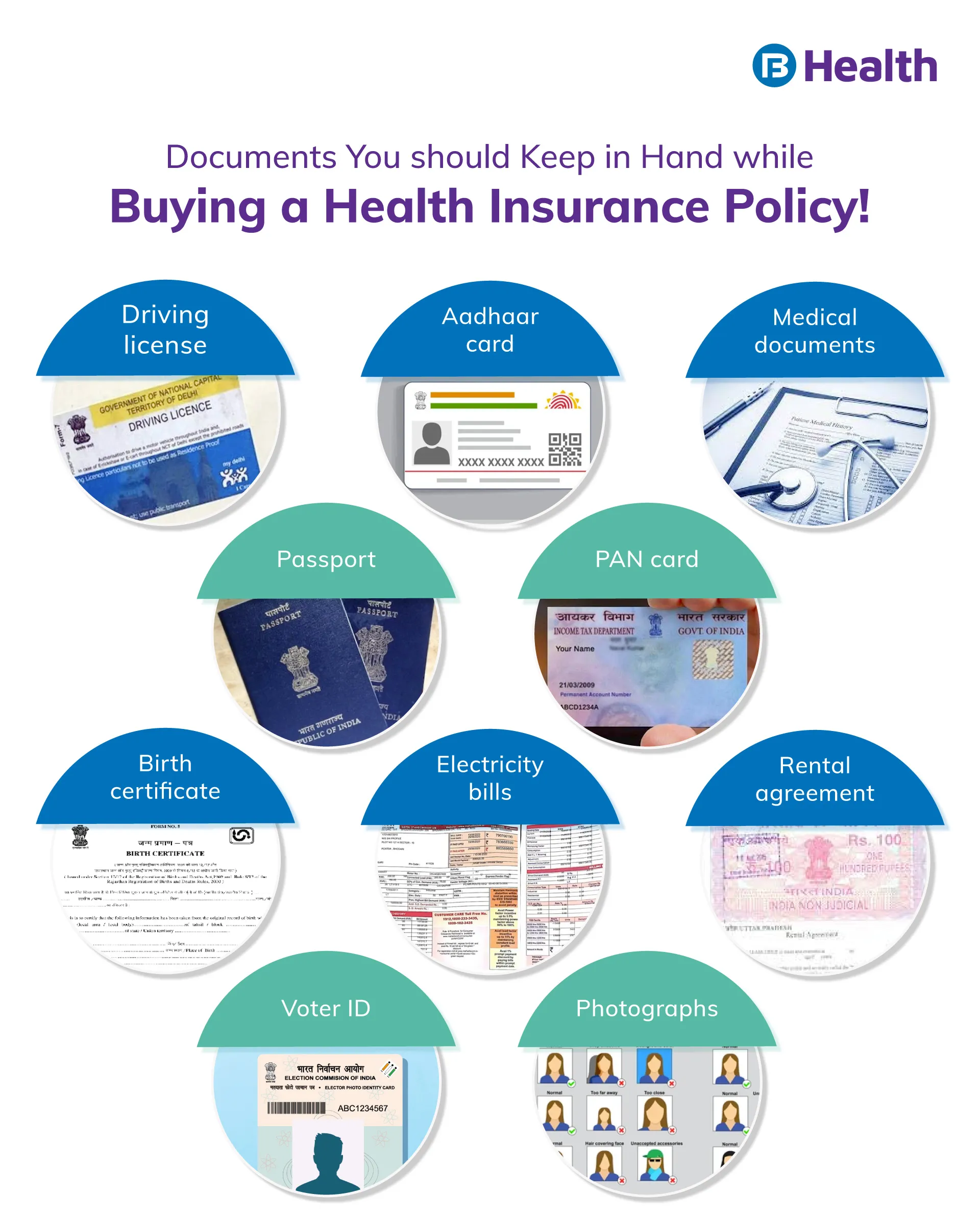

Buying a health insurance policy is important because it helps you be prepared for emergencies [1]. Before availing a policy, you need to submit a set of documents. With the help of these, your insurance provider can customize the plan to suit your needs. More importantly, these documents help the insurer in verifying the authenticity of your application.

The list of required health insurance documents may vary from company to company. However, there are some common documents you may need to keep on hand. Read on to know more about different health insurance documents you may require while availing an insurance policy [2].

Important health insurance documents:-

Identity proof

Identity proof is required for the purpose of keeping a record. It also helps your insurer confirm your identity. This document is also helpful when you are looking to settle your claim. Based on your identity proof documents, the insurer is not just able to verify you as the policyholder, but also provide you with the proper cover. Most often, insurance providers ask for your identity proof at the time of buying a new policy. Here is a list of documents that are generally accepted as identity proof:

- Driving license

- Aadhaar Card

- Voter ID

- Passport

Age proof

This is one of the essential documents you need to keep in mind when you are buying a policy. Many insurance companies have a fixed age bar for issuing a policy. The premium you pay is also based on your age. The more your age, the more your premium will be. Insurers are very particular about verifying your age proof. So, ensure that your documents have the same age listed. The following documents are accepted as a proof of age:

- PAN card

- Driving license

- Voter ID

- Birth certificate

- Passport

- Aadhaar card

Address proof

One the main reasons why insurance companies asks for an address proof is for proper communication. Your provider may send you a hard copy or other any communication on the address mentioned in your document. So, ensure that your address proof has your name and your permanent address on it. Given below are the documents that are usually accepted as address proof:

- PAN card

- Driving license

- Passport

- Aadhaar card

- Ration card

- Utility bills like electricity or gas

In case you have a home on lease or rent, you can also submit the rental agreement as address proof. Talk to your insurance provider to understand if there are any other requirements in this case.

Medical reports

Depending on your insurer, you may need to submit some medical reports before you sign up. You may be asked for these documents if you have crossed a certain age or if you have a family history of certain health conditions. This may also be called a pre-insurance medical screening. Not all insurance companies will ask for this. The tests you may need to undergo are specific and depend on the type of policy you want to purchase.

Depending on the company terms, your insurance provider may ask for more health insurance documents. These include your previous medical reports, photographs, proposal form and more.

Once the formalities are done and you sign up for a policy successfully, you may be given a health insurance card. This contains information like your name, date of birth, policy name and number, and the sum insured. This will help hospitals in the network as well as the insurer in verifying your identity, policy, and coverage. A health insurance card makes such verification easier so carry it along with you all the time. The card is usually sent along with a hard copy of your policy. In case of digital insurance, you may receive a digital card with your policy.

Based on your requirements, you can choose from a variety of health insurance plans. Some of the common plans are:

Individual health insurance plans

As the name suggests, these plans are for an individual and will only cover one person. This is best suited if you do not need to insure your dependent. Individual plans are ideal for large families. However, if you have a nuclear family with dependants, a family floater plan may be best suited for you.

Family floater plans

A family floater plan will cover your entire family. Under this, all members listed in the policy will be insured under a single cover. For instance, in an individual policy, an insurance policy of Rs.5 lakh will only cover one person. In a family floater plan, all the members collectively will have an insurance of Rs.5 lakh.

Additional read: Choose Right Health Insurance Plans for FamilyDisease specific health plans

One of the main benefits of having a disease-specific plan is that it will cover the disease at any stage. From the beginning to a critical stage, your plan will cover all your costs as per the terms. Choose this plan if there is a history of a specific disease in your family.

It is important that you give the correct information in your health insurance documents to avoid a delay or rejection of your application and even your claim. This is why it is a good idea to keep the required documents handy while purchasing a policy. Make sure you pay attention to the terms and conditions of your policy too. For instance, the Aarogya Care's Complete Health Solution plans available on Bajaj Finserv health have a simple 3-step process to make your application hassle free. The 4 variants in it give you the option of choosing a policy that best fits your needs. Choose one to insure your health quickly and easily!

References

- https://www.irdai.gov.in/ADMINCMS/cms/Uploadedfiles/RTI_FAQ/FAQ_RTI_HEALTH_DEPT.pdf

- https://www.irdai.gov.in/ADMINCMS/cms/whatsNew_Layout.aspx?page=PageNo4246&flag=1

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.