Aarogya Care | 6 min read

Does Life Insurance Cover Disability? Top 4 Pointers for You

Medically reviewed by

Table of Content

Synopsis

Does life insurance cover permanent disability? You may know about death benefits in a term policy, but life insurance covers disability too. Learn about disability cover in insurance here.

Key Takeaways

- Along with death benefits, life insurance covers disability too

- Get an add-on cover along with your life insurance term plan

- Read to understand disability cover insurance a little better

Are you wondering, does life insurance cover disability? You may be aware that investing in a life insurance term policy provides financial protection to your family in case of an unexpected event such as death. Unlike a health insurance policy in which your medical expenses get reimbursed, a life insurance policy provides monetary benefits. In the event of your death, your nominee gets the sum assured as per the policy terms and conditions. Pay your premiums regularly for a fixed term to avail such death benefits.

Statistics reveal that India is ranked #10 in life insurance investments globally [1]. During the last financial year, life insurance penetration was approximately 3% in India. However, approximately 91% of people consider it necessary to invest in a life insurance policy. But only 70% of them actually buy a term policy.

Not only does a term policy provide you monetary death benefits, but it also offers financial security for your future. In the absence of any unfortunate event, you get your fixed sum assured at the end of the term. This is why a life insurance term policy can be an important investment.

While you are familiar with death benefits, you may be thinking about the disability cover in insurance. In a standard life insurance policy, you may not be entitled to any benefits in the event of permanent disability. However, you may avail disability benefits by purchasing an add-on cover.

Before investing in a term life insurance plan, study its features and benefits properly. To know more about the disability cover in insurance and to understand how life insurance covers disability, read on.

Additional read: Health Insurance Rider

What do you mean by the disability cover in insurance?

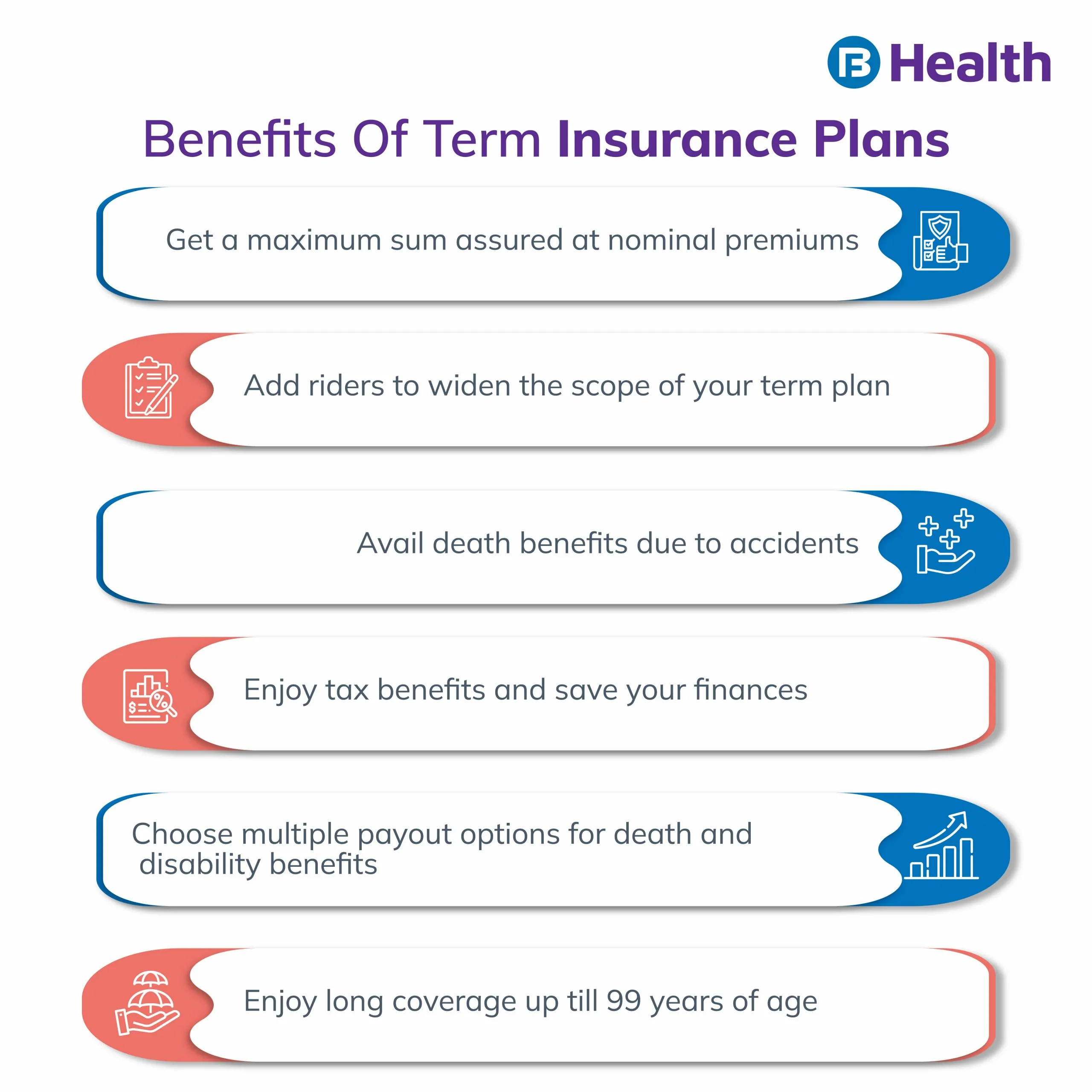

As mentioned above, purchasing an add-on cover can increase the scope of your term insurance plan. These add-ons are called riders, which are available upon paying extra premiums. If your life insurance covers disability, you can avail of benefits not only in case of death but also in the event of permanent disability.

When you suffer disability while at work or due to an accident, you are eligible for insurance benefits if your life insurance covers the disability; in case you are involved in a hazardous occupation, this cover becomes a critical rider for you and your family. This is because, in case of any disability, your family is entitled to get monetary benefits as per the terms and conditions of the life insurance plan. For a permanent disability, this critical rider is a boon as it helps your family manage financial requirements without any hassles.

If your life insurance covers disability, the policyholder can avail of 10% of the total sum assured in conditions of permanent disability. This 10% amount is paid every year for an approximate period of 10 years, depending on your policy’s terms and conditions. This way, you’ll be entitled to an income during this period. If you are the sole breadwinner for your family, getting this add-on along with your standard term policy is ideal.

Explore Aarogya Care PlansUnder what conditions does life insurance cover permanent disability?

When you buy a life insurance plan, the disability terms and conditions will be explained in the policy document. The majority of insurance providers consider you as completely disabled if you are totally incapable of involving yourself in any occupation because of an accident. The conditions you need to satisfy in order to claim permanent disability benefits include:

- You have lost both your hands permanently

- You are unable to use your legs

- You are suffering from permanent blindness

- You have hearing loss

- You are unable to speak

In a life insurance cover disability plan, you can avail of the permanent disability benefits only if you have remained disabled for a continuous period of 6 months. Another clause mentioned in most term insurance plans is that your disability need not occur immediately after you have met with an accident. Most providers offer a cushion of 180 days from your accident date. Within this window, you can claim the add-on benefits of your life insurance cover disability plan.

Additional read: Term Insurance vs. Health Insurance

What are the exclusions in a life insurance cover disability policy?

Now that you are clear about the inclusions of disability cover in insurance, it is important to be aware of some exceptions to this policy. For your life insurance to cover disability benefits, note that the following parameters need to be avoided.

- Your permanent disability should not be because of a self-inflicted injury.

- You should not have become disabled due to any destruction caused by yourself.

- Your disability should not have occurred due to the consumption of alcohol or any other substance.

- War cannot have caused your disability.

- Your disability should not be due to any existing illness.

- You should not have become disabled by engaging yourself in recreational activities like skydiving, paragliding, rock climbing, or any such similar events.

However, if your disability occurs due to any illness mentioned in the policy, your life insurance covers disability under such circumstances. A few such conditions are mentioned below.

- Kidney failure

- Cancer

- Bacterial meningitis

- Heart ailments

It is always better to study policy terms and conditions properly before buying a term insurance policy with disability benefits.

How can you avail of the disability add-on benefits along with death benefits?

To avail of the rider benefits, different options are provided by insurance companies. You may avail benefit as a lump sum amount, or you may get the benefit as regular payouts. By receiving payouts, you get regular income for the chosen period until your spouse is alive or till the end of the policy term. There is also a third way to avail of life insurance to cover disability benefits. You can opt for a combination that includes a lumpsum amount and regular income payouts for a maximum period of 10 years.

Now that your query, does life insurance cover permanent disability? is cleared, it is advisable to get this add-on along with your life insurance term plan. This helps you secure your and your family’s financial future in case of a permanent disability. Since life insurance covers disability, you can avail of it along with regular death benefits. Just like investing in a life insurance policy is important, it is also necessary to get a health insurance plan to manage your unplanned and planned medical expenses. When you compare health insurance vs. medical loans, investing in the former can definitely reduce the financial strain on your pocket and get comprehensive benefits too.

For affordable health insurance, browse through the Aarogya Care range of plans on Bajaj Finserv Health. With a maximum coverage of up to Rs.10 lakh, these comprehensive plans cover both your illness and wellness needs. Right from amazing network discounts to reimbursements on doctor consultations, these health plans perfectly suit your requirements. You can even apply for a health card on this platform. This card allows you to get cashback and discounts on various health services such as lab tests and consultations from specific partners. Together, all these services can help you enjoy a physically and financially healthy future.

References

- https://www.ibef.org/industry/insurance-sector-india#:~:text=The%20life%20insurance%20industry%20is,at%20US%24%2078%20in%20FY21.

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.