Aarogya Care | 5 min read

Long Term vs Short Term Health Insurance: Top Differences

Medically reviewed by

Table of Content

Synopsis

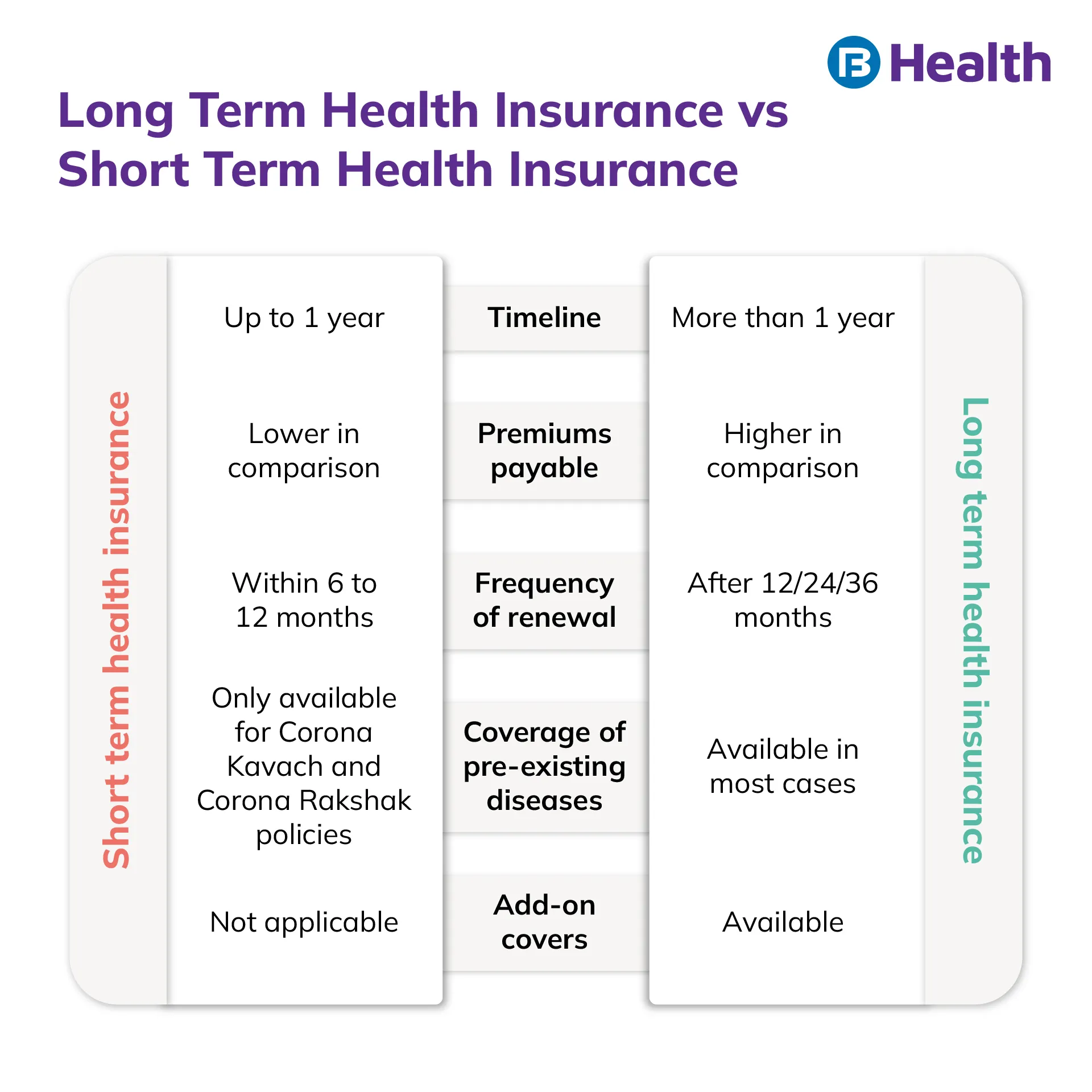

The difference between long-term and short-term health insurance is based on the timeline and the benefits. Read to know when to choose short-term health insurance vs long-term medical policies.

Key Takeaways

- Long term and short term plans in health insurance have their unique benefits

- Short term health plans help you in treating COVID or while porting insurance

- With long term health plans, you can enjoy coverage for pre-existing diseases

With medical expenses rising by leaps and bounds, investing in health insurance has become essential to maintaining financial wellness during planned or emergency treatment. With a health plan, you can enjoy coverage for common healthcare expenses like ambulance services, hospitalization, health tests, surgical procedures, and more. However, it is important to understand the differences between long-term vs. short-term health insurance in order to make wise investments as per your requirement and finances.

While long-term health insurance provides you coverage for more than one year, short-term health insurance offers you coverage for only a few months to one year. Read on to understand the differences between short-term health insurance vs. long-term by comparing long-term and short-term plans, and get the answer to a few frequently asked questions.

What does long-term health insurance mean?

With long-term health insurance, you can enjoy healthcare coverage for one year or more. The major feature of a long-term health plan is that it doesn’t require frequent renewals, so you can conveniently leverage your coverage benefits. It is important to note that the tenure for a long-term health policy can vary from more than one year to three years.

Additional Read: Making a Health Insurance Claim

What are the features of a long-term health plan?

The basic features of a long-term health policy include its long policy term, coverage of pre-existing diseases and illnesses, and the facility to buy add-ons. By going for a longer tenure, you can reduce the premiums significantly. However, premiums also depend on factors like your health and age, pre-existing illnesses, and more.

When it comes to pre-existing illnesses, note that your policy may have a certain waiting period before coverage begins. Add-ons or riders are additional benefits that you can avail yourself of beyond the basic health insurance policy. Accidental cover and critical illness cover are two common examples of add-ons.

Explore Aarogya Care PlansWhat is short-term health insurance?

With short-term health insurance, you can enjoy healthcare coverage for a short period, usually up to one year. If you buy a short-term health plan, you may need to renew it from time to time.

What are the features of a short-term health plan?

As the maximum tenure for such plans is one year at max, the premiums are also lower. Due to its short validity, coverage for pre-existing illness and add-ons are not available in a short-term health policy.

Who should buy a long-term health insurance policy?

Purchasing a long-term health plan is a prudent choice for anyone due to multiple benefits like long tenure and comprehensive coverage. Make sure to buy one to cover yourself and your family members.

Additional Read: Need of Health Insurance: Top Reasons Why Term Insurance Isn’t Enough

Who should buy a short-term health insurance policy?

The popularity of short-term health plans has seen a major spike due to the pandemic, as a huge number of people have opted for the Corona Kavach and Rakshak health plans. Both the health plans offer three tenures: 3.5 months, 6.5 months, and 9.5 months.

Apart from COVID-19, these policies can be helpful in the following cases:

- While you are porting to a new long-term health insurance plan, buying a short-term health policy can provide you coverage during this phase so you can be secured.

- For students or NRIs who don’t plan to stay in India for long, short-term health insurance is a prudent choice.

FAQs

What does short-term health insurance cover?

Short-term health insurance covers different types of health expenses during the treatment of COVID, porting of policies, or for a brief stay in India.

Is it wise to invest in short-term health insurance?

It is absolutely wise to invest in it if you are in the midst of choosing a new long-term policy. A short-term policy can provide you with essential health coverage during this period.

What are the disadvantages of short-term health insurance?

In short-term health insurance, the following will be absent:

- Critical illness cover

- Maternity cover

What does long-term health insurance cover?

A long-term health policy covers all sorts of healthcare requirements, and you can buy add-ons or riders to enjoy more specific coverage.

What are the short-term COVID 19 health insurance plans in India?

There are two short-term COVID 19 health insurance plans in India: Corona Kavach and Corona Rakshak. Both were declared in 2020, and the tenure options are as follows:

- 3.5 months

- 6.5 months

- 9.5 months

By knowing about the difference between long-term and short-term plans, investing in health insurance becomes easier. To get comprehensive health coverage for the long term, you can go with Aarogya Care Health Insurance plans offered on the Bajaj Finserv Health platform. Get high coverage for you and your family up to Rs.10 lakh.

Apart from that, you can also enjoy additional benefits like network discounts, reimbursements on lab tests and radiology, in-patient hospitalization coverage, preventive health check-up at no charge, pre- and post-hospitalization coverage, and unlimited teleconsultations with doctors from different specialties, and more. Along with this medical insurance, you can also sign up for a health card to enjoy discounts from partners. With all these benefits to support your health, make sure to get yourself covered without delay!

References

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.