Aarogya Care | 5 min read

Section 80D: Enjoy Combined Benefits of a Tax Rebate and Medical Coverage

Medically reviewed by

Table of Content

Key Takeaways

- Claim tax benefits on premiums you pay for your parents

- Maintain copies of policy documents and premium payment receipts

- Avail tax deductions for premiums paid for critical illness treatment

Investing in medical coverage is the need of the hour considering the increasing medical costs. In instances where you or your loved ones need hospitalization, it is likely that you will have to bear significant costs. This is when health insurance comes into play. With the right instrument, your premiums aren’t an issue and you can focus on getting quality care. To encourage people to invest in health insurance plans, you can avail tax benefits on premiums you pay. You can enjoy these tax benefits u/s 80D of Income Tax Act.

According to Section 80D, you are entitled to avail tax deductions on the total premium amount you pay in a financial year towards your health insurance policy [1]. These tax benefits are available on your regular health plan premiums along with premiums you pay for top-up and critical illness policies. This is also applicable to the premiums you pay towards health plans for your parents, spouse and children. Read on to understand more about the different aspects of saving tax under Section 80D.

Additional Read: Section 80D of Income Tax ActWhat Are the Health Insurance Tax Benefits Under Section 80d?

As per Section 80D, you can claim tax benefits on premiums you pay for your parents. You can make a maximum claim of Rs.25,000 for premiums paid towards self or family during each financial year. If one or both of your parents are senior citizens, the maximum rebate you can claim is Rs.50,000 for one year. However, the premiums paid for your siblings do not qualify for tax benefits.

To make it easier for you to understand, consider the following example. Let us assume 45-year-old Raj has bought a health insurance policy covering himself, his spouse and his children. He pays an annual premium of Rs.30,000. Raj also avails another policy for his parents, both of whom are senior citizens. He pays a premium of Rs.40,000 towards their policy.

In such a scenario, Raj is eligible for tax deductions up to Rs.25,000 for the policy covering himself, his wife and children. Since both his parents are senior citizens, he is eligible for tax deductions up to Rs.50,000. In this case, he can claim tax deductions up to Rs.75,000 as per Section 80D of Income Tax Act.

Similarly, you can avail tax deductions on preventive health check-ups too. According to Section 80D, you are eligible for tax exemption for expenses up to Rs.5,000. For example, if you have paid Rs.22,000 towards your premium and spent Rs.5,000 for your health check-ups, you can claim up to Rs.22,000 for the premium amount and Rs.3,000 against the check-up. Both add up to Rs.25,000, and this is the maximum amount you can claim as per Section 80D.

What Are the Eligibility Criteria for Availing Benefits?

To enjoy these tax benefits, you have to meet the required eligibility criteria. As per Section 80D, you can claim deductions if you have purchased a policy for yourself, your spouse, dependent children and parents. To get tax rebates, you need to submit the following documents:

- Copy of the premium payment receipt

- Copy of the policy document

Can You Avail Tax Benefits for Premiums Paid Towards Critical Illness?

Critical illness is a condition like cancer, multiple sclerosis and other cardiovascular diseases or corrective procedures like graft surgery and organ transplantation [2]. All these conditions and their treatment can cost you a huge sum. If you have not availed a policy, you have to bear these costs out of your own pocket.

If you have a health plan, you can get tax deductions for premiums you pay towards treatment costs of critical illness as mentioned in your policy. If you are below 60 years of age, you can avail a maximum deduction of Rs.40,000 towards treatment of a specified illness. Senior citizens can claim tax deductions up to Rs.1 lakh for all treatment expenses incurred during a financial year. When you are filing tax returns, it is mandatory to attach an endorsement as proof of treatment of your illness.

Additional Read: How Does Leading Sedentary Lifestyle Affect Health

Are There Any Tax Benefits Available on Premium Payment by Cash?

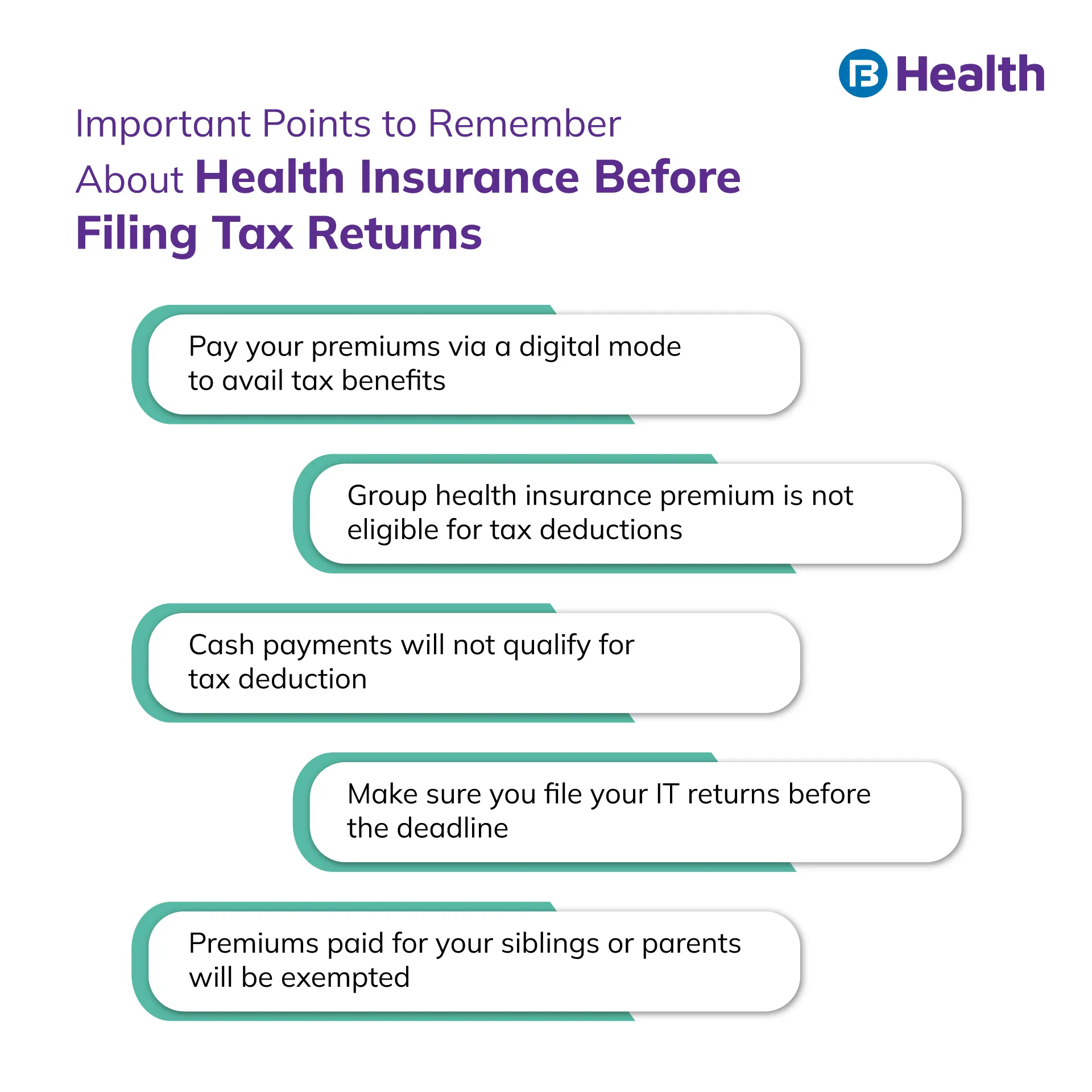

You cannot avail tax benefits if you pay your premiums in cash. To be eligible for tax deductions, you must pay the premium using the following methods:

- Cheque

- Online banking

- Demand draft

- Credit or debit cards

However, there is an exception to this rule. In case you pay cash for health check-ups, it is still eligible for tax deductions as per Section 80D.

Is There Any Tax Deduction Under 80D for Super Senior Citizens?

There is a provision of tax deduction for super senior citizens as well. Super senior refers to individuals who are over 80 years of age. According to Section 80D, if you are paying premiums for your parents, who are super senior citizens, you are still eligible to claim deductions. These will be made against the costs for their treatment and medical check-ups. In this case, you can claim a deduction of up to Rs.50,000 during each financial year.

Health insurance helps ensure that your loved ones get the medical care they need without financial constraints. This serves the dual purpose of not only helping you manage medical expenses but also reducing your tax burden. This emphasizes how important it is to invest in a health insurance policy. Check out the Complete Health Solution range of plans on Bajaj Finserv Health. With medical coverage up to Rs.10 lakh and huge network discounts, investing in these plans can help you save your money while caring better for your health.

References

- https://cleartax.in/s/medical-insurance

- https://www.irdai.gov.in/ADMINCMS/cms/Uploadedfiles/Critical%20Illness%20Insurance%20Policy.pdf

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.