Aarogya Care | 5 min read

Super Top-up Health Insurance: Its Purpose and 5 Top Benefits!

Medically reviewed by

Table of Content

Key Takeaways

- Super top-ups plans offer a higher sum insured at low premium amounts

- The deductible amount has to be exhausted only once in a policy period

- The premiums of super top-up health insurance are eligible for tax deduction

Super top-up plans work as an extension to your current health insurance plan. Having it is beneficial in case you exhaust your current health insurance. These plans cover your medical expenses after the deductible amount is reached. This amount is decided at the time of purchase. It is the amount that you will have to pay before you can start availing the benefits of your super top-up plan. Your super top-up will cover the expenses exceeding the deductible amount.

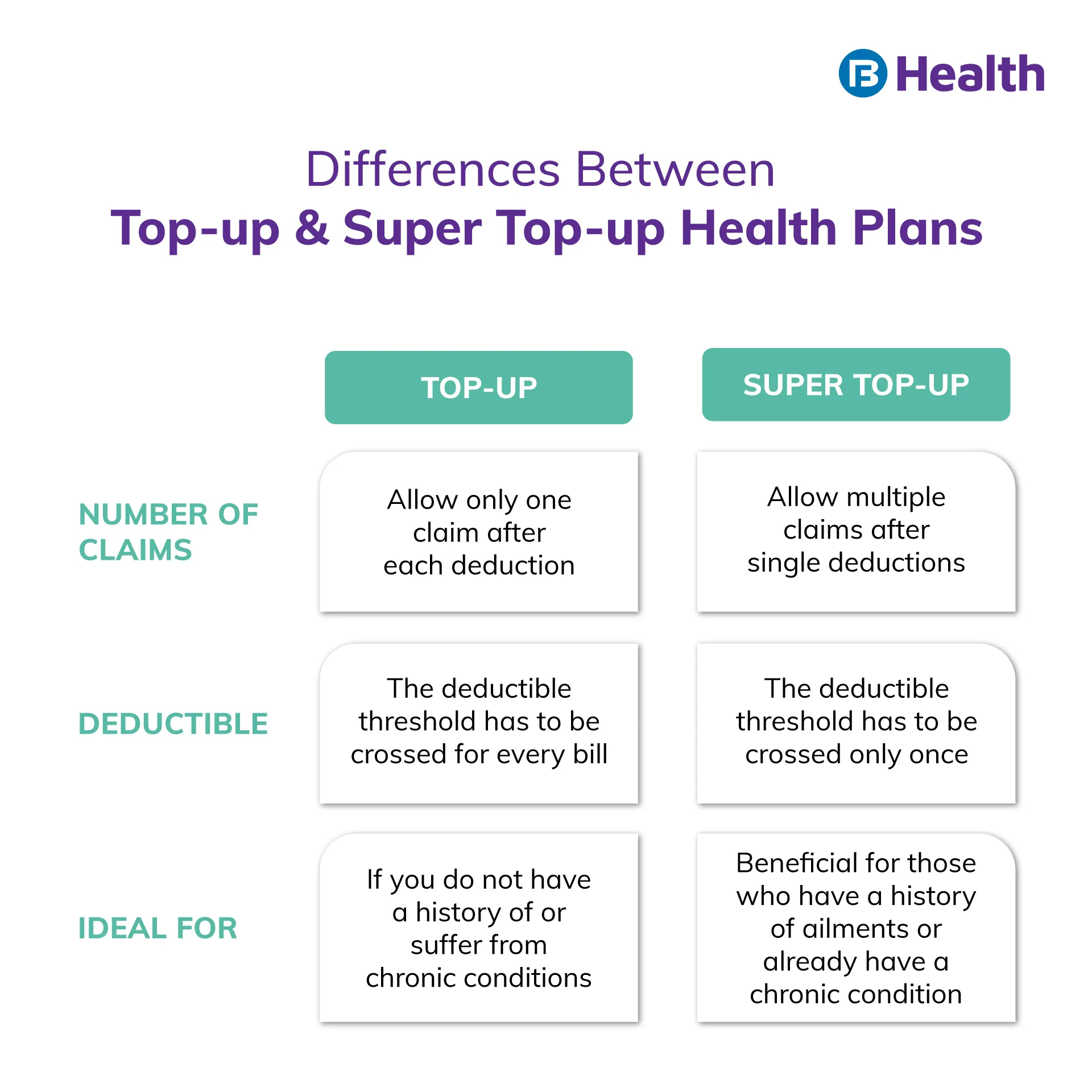

For example, if your super top-plan is for Rs.7 lakh and the deductible is Rs.2 lakh, you can make a claim for over and above Rs.2 lakh. You can pay the deductible amount from your regular health insurance or from your own pocket. Unlike a regular top-up plan, you can make multiple claims during the policy term.

Read on to know who should buy a super top-up plan, along with the benefits and inclusions these plans come with.

Who Should Buy a Super Top-Up?

Senior Citizens

Age and sum insured are two factors that affect your premium amount. As you get older, you may need increase your sum insured as you become more vulnerable to certain diseases. Due to this, your premium is likely to increase. In such situations, you can consider super top-up plans as they have a deductible clause and come into effect only after crossing the limit. This makes it feasible for the insurer to offer a higher sum insured at lower premiums.

Additional Read: Super Top-Up and Top-Up Health Insurance Plans

Corporate Health Insurance Subscribers

Health insurance offered by employers usually take care of your basic health needs. But they may fall short in case of a bigger or more expensive treatment. Buying an individual health insurance over and above such group insurance may cause a financial strain. This is why, super top-up plans may be a better option because of their low premiums and high coverage.

Individuals with Limited Cover in Health Insurance

More often than not, people have a basic health insurance policy. While it takes care of basic needs, it may not be sufficient for major health expenses. Around 62% of the health expenses in India are paid out of pocket [1]. No insurance cover or insufficient cover are two of the major reason for high out-of-pocket expenses [2]. The major benefits of super top-up plans are affordable high coverage and tax benefits. You can upgrade your basic health insurance with it to meet your needs.

Benefits of a Super Top-Up Plan

Can Be Tailor-Made

With the deductible feature of this plan, you can plan and decide the sum insured based on your needs. This can be as per your current health insurance plan, making it easier for you to manage your finances.

Has a One-Time Deductible

Unlike a top-up plan, you can make multiple claims in a policy period with a super top-up. You need to exceed the deductible threshold only once and not every time you file a claim.Upgrades Your Current Health Insurance

The extensive benefits that a super top-up plan offers allow you to upgrade your current policy to meet your requirements. Apart from increased cover, it also offers an extensive cover as compared to a basic health policy.

Offers Tax Benefits

Like health insurance, super top-up plans also offer tax benefits. The premiums of a super top-up plan are eligible for tax benefits as per Section 80D of Income Tax Act. You can avail a deduction of up to Rs.75,000 this way [3]. The deductible amount depends on the age of the policy members and the type of policy.

Better Coverage with Low Premiums

As explained, super top-up plans have a deductible clause that allows your insurer to offer you a higher sum insured at low premiums. This is feasible because you pay a part of sum insured and the insurer has to cover the rest. The deductible has to be exhausted only once. You can pay the deductible amount through your regular health insurance too. Thus, you can save on out-of-pocket health expenditure!

Inclusions of Super Top-Up Plans

Here are the medical expenses that are usually included in a super top-up policy:

- Day-care treatment costs

- ICU expenses, nursing fees, room rent

- Ambulance charges

- Before and after hospitalization expenses

- Pre-existing diseases after waiting period

- Yearly health check-ups

Exclusions of Super Top-Up Plans

Almost all insurance policies have a list of exclusions. Here are the commonly excluded expenses of a super top-up plan.

- Infant care

- Dental treatment unless hospitalized

- Plastic surgeries

- Congenital diseases

- Ailments caused by lifestyle habits

- Treatment required due to rebellion, war, terror, invasion

- Any experimental treatment

With rising medical costs, it may become difficult to ensure sufficient healthcare for everyone. Super top-up plans are a great way to ensure that you have better coverage at low premiums. If you are looking to upgrade your current plan, check out the Super Top-up plan available on Bajaj Finserv Health. With unlimited teleconsultation, you also get doctor consultation reimbursement of up to Rs.6,500. The plan also offers a cover of up to Rs.25 lakh at an affordable premium. This way you can protect your and your loved ones’ health with ease!

References

- https://data.worldbank.org/indicator/SH.XPD.OOPC.CH.ZS?locations=IN

- https://bmchealthservres.biomedcentral.com/articles/10.1186/s12913-020-05692-7

- https://www.incometaxindia.gov.in/_layouts/15/dit/pages/viewer.aspx?

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.