Aarogya Care | 5 min read

The Type of Medical Insurance You Need in 4 Different Phases of Life!

Medically reviewed by

Table of Content

Key Takeaways

- Your health insurance policy should be upgraded according to your life

- You should not solely rely on insurance provided by your employer

- When it comes to health insurance, choose wisely and do your research

There are many different types of health insurance policies to choose from. Despite the abundance of options, nearly 30% of the population is uninsured [1]. Be a part of the 70% and buy a medical insurance at the earliest. The perfect policy for you may depend on the current phase of your life. Just like you have different goals for different stages of your life, your health insurance policy should also be different for each phase.

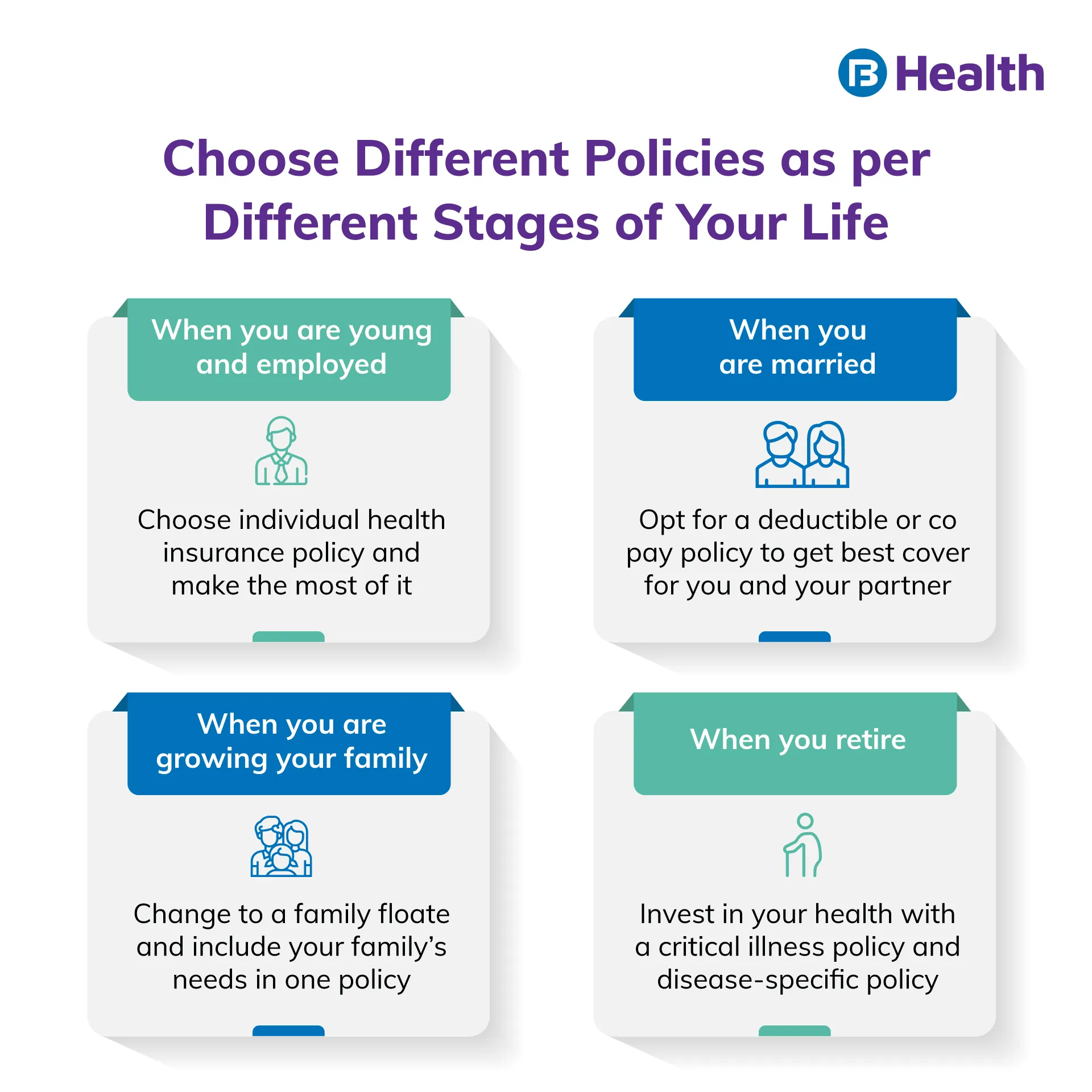

In terms of medical insurance, your life may be divided into 4 phases. They start from when you’re young and have a job and go up to when you decide to retire and kick back! These phases are divided on the basis of your changing priorities. Based on this, you can select the ideal insurance that gives you the support you need.

Read on to know more about how to choose the right health insurance policy based on which phase you are in life.

Additional Read: How to Save Money on Doctor Consultation

Additional Read: How to Save Money on Doctor ConsultationWhen you’re young and employed

Until the age of 25, you may have insurance coverage under your parents health insurance. However, after 25, you may be in need of a new health insurance policy. Your company may provide you with insurance, but it is important to ask yourself if it provides you with enough cover.

Even if the company insurance does provide enough cover, it is always good to have a personal plan as a backup. This will be useful if you are switching jobs or resign from your current one. The questions you need to ask before buying a policy are:

- What are the current and potential benefits?

- Will you need to include your parents in your plan?

- What is your budget?

- How often would you be visiting the doctor?

When you’re newly married

After marriage, your priorities change. You may start thinking about your partner’s health requirements along with yours. At this time you should think about upgrading or changing your policy. You should carefully analyze the requirements that you and your spouse have. Before changing your policy, ask the following questions:

- What benefits will you get after combining the policies?

- What are your preferences with regards to hospitals and doctors?

- Are these preferences included in your company’s network?

- What is the budget and can you go for a deductible plan?

Opting for a deductible at this time can be a good option. This may help you get better cover for you and your partner. You can also go for co-payment options for cost benefits. Whatever you choose, do a proper research and analysis before finalizing a policy.

When you have a family with kids of your own

When you think about growing your family, you should also start thinking about changing your policies. With kids, one of the best insurance plans would be a family floater policy. You should also look for policies that give you maternal coverage. This comes with a waiting period, so it is important that you get these when you start thinking about children.

This is also the time when you may start thinking on a long-term basis. You should consider policies that may give you add-on covers for critical illness. Before deciding on a policy, answer these questions:

- Is your current policy cover enough?

- Do you and your partner have insurance from your employers?

- How many times do you visit the doctor?

- Does your policy have outpatient cover?

- Are your preferences included in the network list?

Once you answer these questions, talk to your partner and choose a policy that is best suited for you.

Additional Read: How to Port your Health Insurance PolicyWhen you have retired and want a good lifestyle

When you retire, chances are that your children may be over 25 and no longer included in your policy. This would be the best time for you to switch back to individual health plans. You may be already aware of the health risk you have. Plan your policies according to these requirements. Answer these questions before choosing a policy:

- Are you covered under your children’s policies?

- Does your insurance cover critical illness?

- Are alternate therapies included in your cover?

- Which plans have the best cost-benefit?

Other than these, you may also need to sign up for specific health insurance plans such as:

- Maternal insurance when you or your partner decide to start a family

- Critical insurance if you or your partner is at risk or has been diagnosed with a critical illness

- Disease-specific policy if you or your family is at risk or has been diagnosed with a disease not covered in your current policy

No matter which phase of life you are in, a medical insurance policy will help ease your worries when it comes to health matters. Buy your policy after a careful analysis of what you and your family may need. Planning your policies according to your life phases will help ensure that your cover is adequate for your needs.

The Aarogya Care Complete Health Solution plans available on Bajaj Finserv Health can help you meet your requirements during all phases of your life. You can select from 4 plans: Silver, Silver co-pay, Platinum, and Platinum co-pay. These plans provide cover for up to 6 family members. In the co-pay plans, you can also enjoy the benefit of paying only a part of your expenses and reduced premiums.

References

- https://www.niti.gov.in/sites/default/files/2021-10/HealthInsurance-forIndiasMissingMiddle_28-10-2021.pdf

- https://www.incometaxindia.gov.in/Pages/tools/deduction-under-section-80d.aspx

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.