Aarogya Care | 4 min read

Health Plans for Chronic Diseases: 3 Crucial Facts to Know

Medically reviewed by

Table of Content

Key Takeaways

- Chronic diseases require long-term management and treatment

- The list of chronic diseases includes conditions like cancer and diabetes

- Coverage for chronic diseases is one of the benefits of Aarogya Care plans

Chronic diseases are severe health disorders that require prolonged treatment, management, and frequent medical check-ups. As per a recent report, more than 7.5 crore Indians over 60 have a chronic disease. These diseases can hinder your day-to-day activities if left untreated.

Some of the significant contributors to chronic diseases are as follows:

- Exposure to tobacco (both direct and indirect)

- Excessive use of drugs or alcohol

- Lack of proper physical exercise

- Poor diet

It includes both curable and incurable diseases, and their treatment can go on for years, leading to high expenses or depleted savings. This can cause a financial burden for you and your family. The treatment cost of critical illness and chronic diseases points to the importance of a chronic health care plan. Read on for a list of chronic diseases and how a chronic health care plan can come to your aid.

Additional Read: Benefits of Aarogya Care Health PlansWhat health disorders come under the list of chronic diseases?

Here are a few types of disorders that come under the category of chronic diseases [1]:

- Arthritis

- ALS

- Alzheimer’s and other kinds of dementia

- Asthma

- Cancer

- Crohn's disease

- Chronic Obstructive Pulmonary Disease

- Cystic fibrosis

- Irritable bowel syndrome

- Ulcerative colitis

- Diabetes

- Heart disease

- Eating disorders

- Obesity

- Osteoporosis

- Autoimmune diseases

- Reflex Sympathetic Dystrophy Syndrome

- Infection from tobacco

Is it essential to disclose any chronic diseases before taking health insurance?

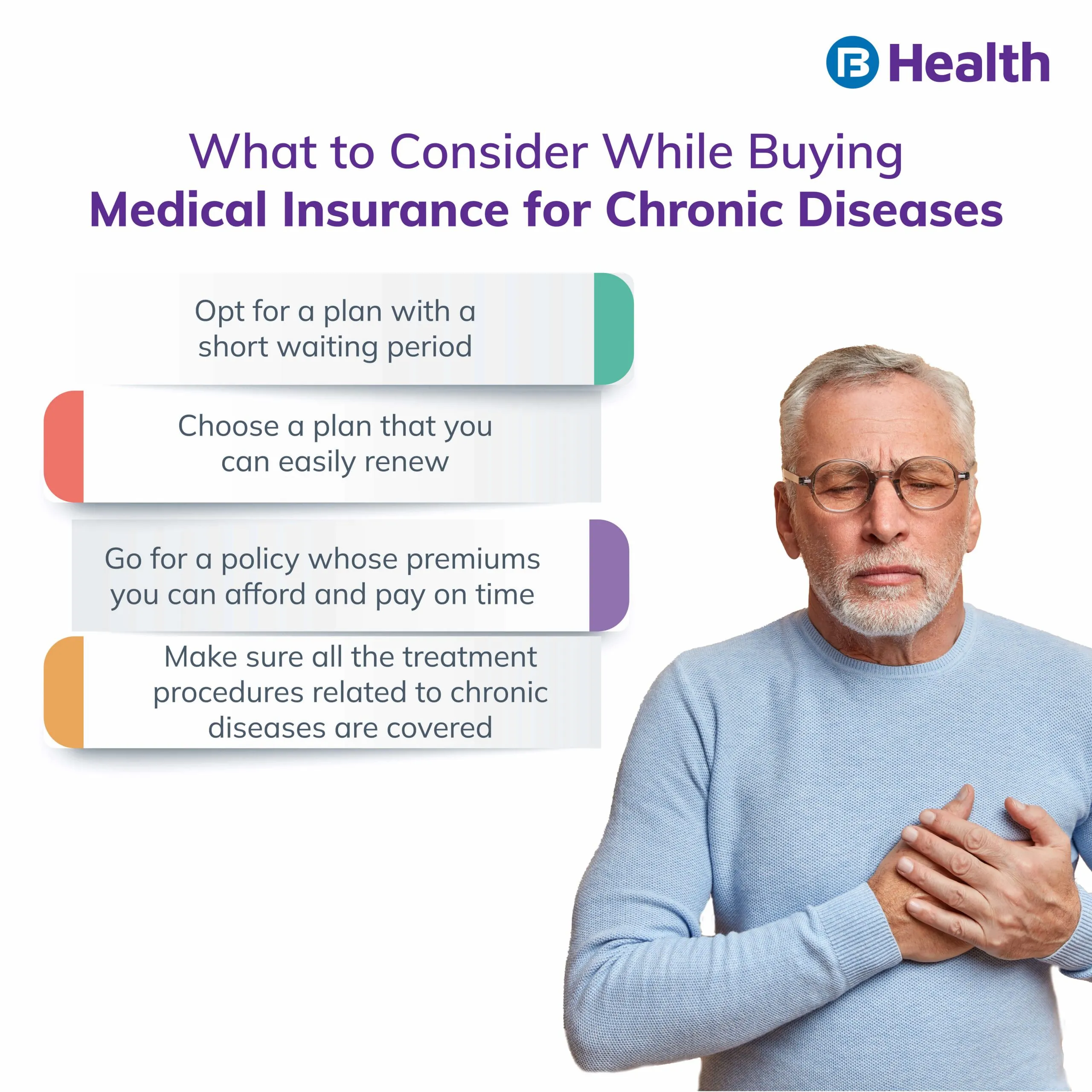

When buying a health insurance policy, it is necessary to let your insurer know about any pre-existing chronic diseases you are suffering from. Failure to do so can result in your policy being canceled. When you raise a claim for treatment or management of chronic diseases, the health insurance provider will verify your medical reports and check your medical history.

If you try to hide such pre-existing diseases from your insurer, they will find out about it, and your claim will be rejected. So, even if your insurance premium shoots up or the waiting period increases, make sure not to hide any pre-existing conditions.

Are chronic diseases covered by Aarogya Care health insurance?

Complete Health Solution Plans under the umbrella of Bajaj Finserv Health Aarogya Care cover the treatment of chronic diseases. This includes treatment for diabetes, prosthetics, chemotherapy, and more.

Apart from these, Aarogya Care Health Plans cover the following too:

- In-patient hospitalization

- ICU room rent and ICU boarding

- Preventive health check-ups

- Unlimited teleconsultations

- Radiology and lab benefits

- Pre- and post- hospitalization cover

- Free doctor consultations

- Network discounts at partner hospitals and labs

- Hospital care and testing fees

- COVID coverage

- Cost of medical appliances for use in surgery

- Cost of transplants and implants

- Day-care procedures like daytime and minor surgeries

- Organ donor expenses

- Homeopathic and Ayurvedic treatment expenses during the hospital stay

With Bajaj Finserv Health’s medical insurance solutions, the treatment of chronic diseases becomes much more convenient. Here are the things that set Aarogya Care health insurance plans apart:

- 3-in-1 health plans: With these plans, you get health insurance coverage for treatment of health issues, unlimited teleconsultations, wellness benefits with free preventive health check-ups, and reimbursement for lab tests and doctor visits altogether.

- Easy EMI options: Pay premiums affordably by splitting them into monthly installments.

- 98% claim settlement ratio: Invest in a health plan stress-free and make cashless or reimbursement claims with ease too!

- Large network: Avail network facilities in 5,550+ hospitals and 3,400+ lab centers in 1000+ cities

Usually, one cannot avail of the benefits of a life insurance policy in their lifetime, whereas investing in a health insurance policy helps us lead a long and healthy life. Both policies are a must-have in your life’s toolkit. So, be aware of chronic diseases and start prioritizing your health by signing up for a chronic health care plan.

References

- https://www.health.ny.gov/diseases/chronic/

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.