Aarogya Care | 5 min read

Learn about 3 Tax Benefits You Can Avail with a Health Insurance Plan

Medically reviewed by

Table of Content

Key Takeaways

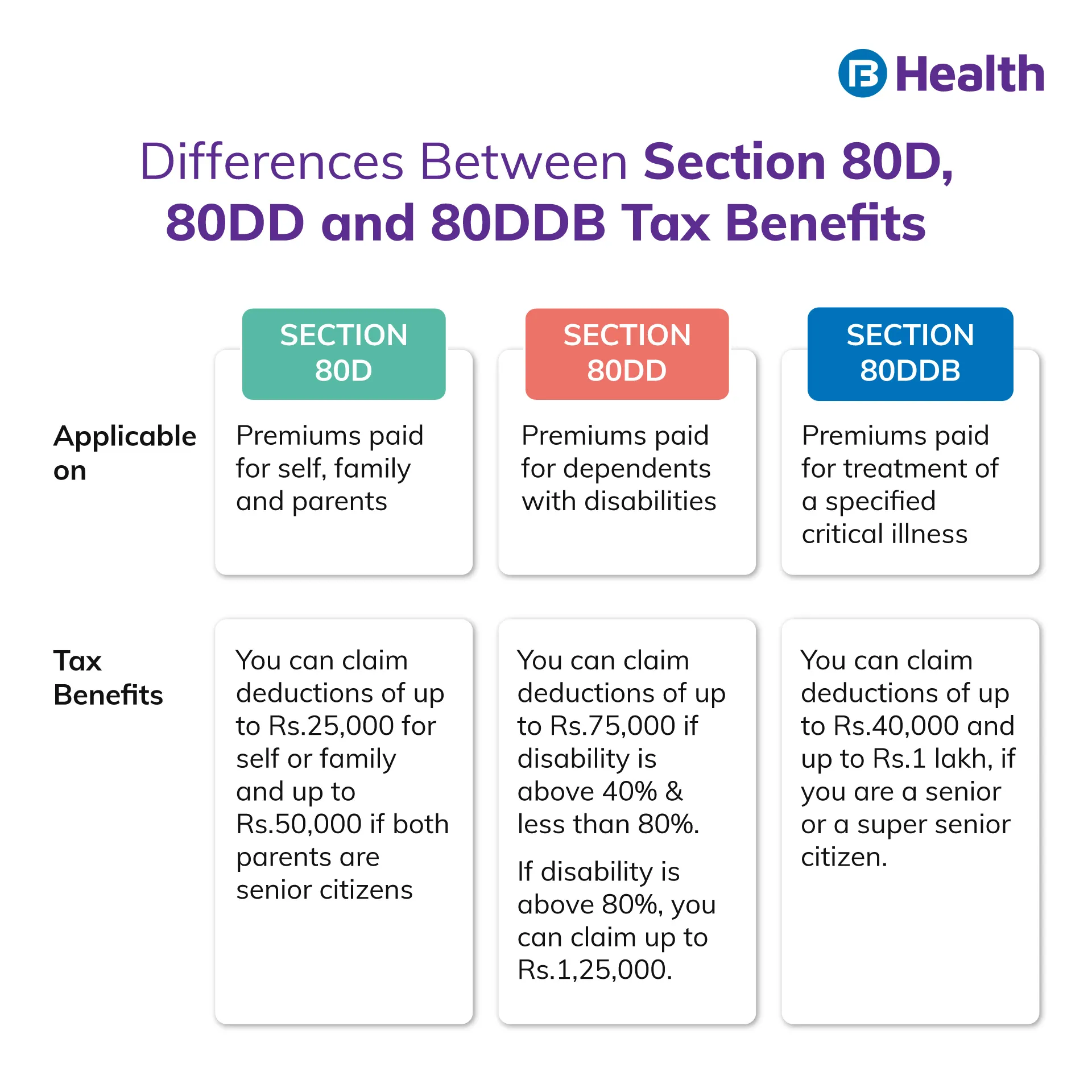

- Under Section 80D, you can save taxes on premiums paid for a health policy

- It also covers tax benefits on preventive check-ups and insurance riders

- Section 80DD allows claim tax deductions for differently abled dependents

Are you aware that the premiums you pay towards health insurance policies for yourself, your parents or your family are eligible for tax deductions? While health insurance helps you manage medical emergencies with ease, it also can reduce your tax liability. This way you can save money while tackling rising medical costs. Whether you avail a plan for yourself or for your family, you can get tax benefits as per the Income Tax Act of India. Knowing the details can help you claim tax deductions under the right section.

Read on to learn more about the tax benefits you can avail by investing in health insurance.

What is Section 80D of the Income Tax Act?

This section explains the available tax deductions you can get on premiums paid for medical insurance policies. If you are less than 60 years old, you can claim a maximum deduction of up to Rs.25,000. This applies to premiums for yourself and your parents if everyone is under the age of 60. The total deduction in this case is Rs.50,000.

In case your parents are above 60 years and you pay for their health insurance, you can claim deductions of up to Rs.50,000 [1]. With yourself under the age of 60, this comes to a benefit of Rs.75,000 in total. In case you and your parents are seniors, this benefit extends to Rs.1 lakh.

If you are a member of HUF or an NRI, you are eligible for tax deductions of up to Rs.25,000. However, the premium you pay for your siblings does not qualify for tax benefits.

Ensure that you pay premiums via the digital mode or by cheques or a demand draft. If you pay your premium with cash, it is not eligible for tax deductions. The only exemption here is that you can pay with cash for preventive health check-ups that also qualify for tax deductions.

Additional Read: How Section 80D of Income Tax Act: Health Insurance Tax Benefits

Does Section 80D Cover Preventive Health Check-Ups and Insurance Riders?

Many hospitals offer preventive health check-up packages as a way to help deal with an increase in lifestyle ailments. Monitoring your vitals using these check-ups can reduce the risk of health ailments. According to Section 80D of the Income Tax Act, you are also eligible for tax benefits on preventive health check-ups. You can get an exemption of up to Rs.5,000 for this. For instance, say that you are paying a premium of Rs.21,000 and you had to pay Rs.4,000 for your health check-up. In this case, you can declare a deduction of Rs.25,000 as per 80D. Remember that this benefit is within the overall limit of Rs.25,000 for those under 60 and Rs.50,000 for those over 60.

Any premium you pay towards critical illness or other medical insurance riders also qualifies for tax deductions. A rider is an add-on benefit you can include in your basic health insurance policy. When you add riders, you can expand your total medical coverage at lower costs. A few common riders include:

- Maternity cover

- Critical illness rider

- Hospital cash

- Room rent waiver

Are You Aware of the Section 80DD of the Income Tax Act?

This section caters to HUF or individuals who have a differently-abled dependent. In such cases, there are certain conditions you have to fulfil before you can avail tax benefits. This tax deduction is applicable only for the dependent of taxpayer and not the taxpayer himself or herself. Here, dependents can be children, spouse, siblings and parents of the taxpayer, and they ought to have about 40% disability or more. If you want to be eligible for tax deductions under section 80DD, you have to bear the complete medical treatment expenses of your dependent.

Upon fulfilling the above conditions, you can claim a deduction of up to Rs.75,000 if your dependent has a disability of more than 40% and less than 80%. You are also eligible for deductions of up to Rs.1,25,000 if the disability exceeds 80% [2].

How Is a Deduction Under Section 80DDB of the Income Tax Act Beneficial to You?

According to this section, HUF and individuals are eligible for tax deductions on expenses towards certain health conditions. If you are paying premiums for medical expenses towards a listed condition, you can avail tax rebates.

A few conditions specified in the list that are eligible for tax deductions include:

- Dementia

- Parkinson’s disease

- Ataxia

- Chorea

- Chronic renal failure

- Malignant cancer

- Hemophilia

- Thalassemia

- AIDS

You can avail tax benefits if these medical treatment expenses are for an individual, spouse, children, parents and dependent siblings. You can claim a deduction of up to Rs.40,000. However, if you are a senior citizen between 60 and 80 years of age, you can claim up to Rs.1 lakh. Even if you are above 80 years, you are still eligible for tax deductions of up to Rs.1 lakh.

For availing tax benefits under Section 80DDB, it is mandatory to submit a medical certificate with the details about the particular disease. Make sure the certificate also includes information like name and age of the patient, and the details of the doctor.

Now that you are familiar with the different tax benefits you get with a health insurance plan, do not think twice before investing in one. Think of it as a win-win where you have funds to deal with medical expenses and get tax rebates as well. For investing in a health insurance policy with comprehensive benefits, check out the Complete Health Solution plans on Bajaj Finserv Health. There are 4 subtypes under this namely, Silver, Silver Pro, Platinum and Platinum Pro.

While Platinum copay option provides OPD consultation reimbursement benefits of up to Rs.11,000, you can claim up to Rs.17,000 benefits with a Silver copay plan. All these plans provide preventive health check-ups by including more than 45 lab tests. With a total medical insurance coverage of up to Rs.10 lakh, you can all your pre- and post-hospitalization expenses. Select the best plan that suits your requirements and save money on tax deductions!

References

- https://www.incometaxindia.gov.in/Pages/tools/deduction-under-section-80d.aspx

- https://www.incometaxindia.gov.in/Communications/Circular/Circular20_2015.pdf

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.