Aarogya Care | 8 min read

Parents Health Insurance Tax Benefit: Know All About It

Medically reviewed by

Table of Content

Synopsis

For people who make a living wage, a health insurance plan for parents under an employer's plan is a comfort. While protecting your health should always be your top priority when buying health insurance, the tax deduction is a great side benefit.

Key Takeaways

- One of the best tax benefits in India is Section 80D, which allows a deduction from taxable income

- The GST paid on your insurance premiums may also be claimed as a tax deduction under section 80D

- In addition to these, buying parental health insurance provides many other advantages

Do you have any plans to purchase health insurance for your parents? Well, there are many healthcare plans specifically created for parents who are older than 50 years old in the Indian insurance market currently. Furthermore, many insurance companies provide family healthcare floater plans with tax benefits specially created for families with senior individuals.

A health insurance plan specifically designed to cover parents' medical expenses is called Parents health insurance. It provides comprehensive protection against age-related illnesses that could cause costly medical bills. In addition to offering attractive features like annual health checks and cashless medical care, it also has a greater insured amount to help people properly manage their medical costs. [1]

Why is it necessary to have health insurance for your parents?

You must purchase comprehensive health insurance coverage for your parents to receive the greatest medical care without financial stress. Consequently, you can consider the following factors while choosing the best health insurance plan for your parents.

Insurance Coverage for Health

You should carefully review the benefits of the policy's coverage. Consider certain important aspects, such as the length of the policy, the pre-and post-hospitalization coverage, the critical illness coverage, the daycare procedures, the in-patient hospitalization, the Ayush treatment, the domiciliary hospitalization, etc.

Amount Insured in Adequate Sum

You must choose a greater total insured amount because your parents are older and more susceptible to health hazards. It will guarantee that they may receive the greatest care possible without facing any financial limitations.

Pre-existing Illness Insurance

It won't be covered until the waiting period, typically between two and four years, has passed if your parents have pre-existing medical conditions. It may change depending on the plan chosen and the differences between insurers. Check the time period after which your family health insurance plan will cover the pre-existing conditions.

Co-payment Clause is the percentage of the amount

you will be responsible for paying on your own. The health insurance company covers any remaining medical costs. For instance, if your policy has a 20% co-pay clause, you would be responsible for paying Rs. 2 lakh out of your personal funds for a claim of Rs. 10 lakh, with the remaining Rs. 8 lakh being covered by the insurance provider. You can also choose a "no co-pay" clause.

Tax Exemptions

Section 80 D of the tax code allows you to deduct the cost of your parent's health insurance premiums. Your total tax benefit on health insurance premiums is limited to Rs 50,000 if you are paying for yourself, your parents, and any other dependents under the age of 60. Additionally, if your parents are older than 60, the limit is raised to Rs 75,000. As a result of the applicable tax limitations, this might, however, change.

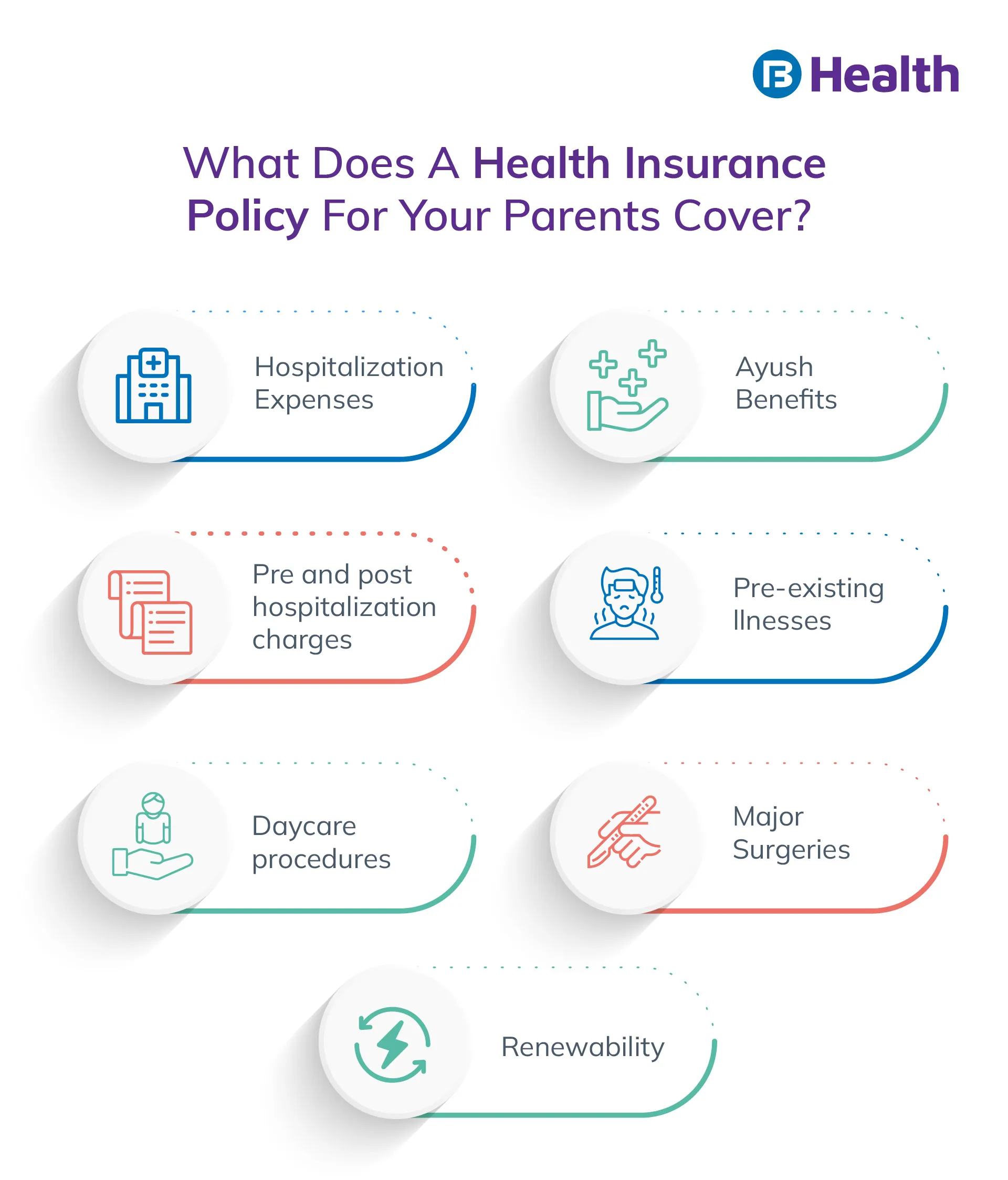

Additional Read: What is a Deductible?What Does a Health Insurance Policy for Your Parents Cover?

Hospital bills can undoubtedly cause a hole in anyone's wallet. You can obtain insurance coverage for the following costs with a health insurance policy:

- Hospitalization Expenses: A serious illness or an incident can result in high hospitalization costs. A comprehensive health insurance plan will allow you to have your insurer pay for your medical care up to the coverage limit, even while hospitalization is becoming increasingly expensive.

- Pre and post-hospitalization charges: Health insurance policies also cover medical expenses before and after hospitalization. It is typically between 30 and 60 days. However, it can differ from one insurance to another.

- Daycare procedures: The insurance company also covers daycare procedures like varicose vein surgery and cataract surgery that don't require a 24-hour hospital stay. The chosen plan determines how many daycare procedures there can be.

- Ayush Benefits: In the modern era, the majority of health insurance plans pay for costs associated with Ayush treatments, such as Ayurveda and homeopathy.

- Pre-existing Sickness: Pre-existing diseases are also covered after a waiting period. However, you can pick a plan with a shorter waiting period that covers the widest range of conditions, including diabetes, heart conditions, and other ailments.

- Major Surgeries: Most health insurance policies include coverage for expensive major surgeries, including open heart surgery, bariatric operations, etc. If the plan allows it, you can arrange for your parents to have treatment from famous surgeons in some of India's top hospitals and other countries.

- Renewability: Lifetime renewal is a common feature of health insurance policies, and when it comes to your parents, lifetime renewal is the best choice.

What is Not Covered by Your Parent's Health Insurance?

Understanding the health insurance coverage the policy provides is essential. There are a few situations where the insurer won't cover the medical bills, as listed below:

- Non-allopathic medications, cosmetics, aesthetics, or related therapies are not covered.

- Any illness contracted within the first 30 days of the policy's purchase is not covered.

- AIDS and associated diseases are not included.

- Self-inflicted injury-related costs are not included.

- The insurance does not pay for any costs associated with drug or alcohol addiction or other mental or psychiatric conditions.

Parental Health Insurance Premium Tax Exemption

According to domestic tax law, if a person is paying the premium for their parent's health insurance, they are eligible for a tax deduction of up to Rs. 15,000. The deduction is up to Rs. 20000 for parents who are 60 years or older, i.e., senior citizens. And in such instances, the last premium payer is not considered for any process. As a result, even if your parents are pensioners, you can still pay for their health insurance and receive a tax refund.

Additional Read: How to Claim Tax BenefitsExemption from Income Tax Under Section 80D

Under Section 80D of the Income Tax Act, the premium for your parent's health insurance policy is deductible. The benefit is accessible to anyone who pays for their health insurance and their spouse, children, and parents. It is important to note that it makes no difference if the parents or children depend on you.

However, the amount of the tax advantage is based on the person's age and level of medical insurance. The maximum deduction of Rs 25,000 per year on premiums paid for oneself, one's spouse, children, and parents is only available if the person is under 60 years old. The most an individual can pay for a health policy for a parent who is a senior citizen (60 years of age or older) is Rs 30,000.

Therefore, if the taxpayer is below 60, but the taxpayer's parents are over 60, the taxpayer may maximize the tax benefit under Section 80D to a total of Rs 55,000. The highest tax advantage under section 80D would thus be a total of Rs 60,000 for those taxpayers who are 60 years or above and are paying health insurance premiums for their parents.

Health Insurance GST

In accordance with current laws, a GST of 18% is applied to the premium paid for health insurance [2]. Under section 80D of the Income Tax Act, tax benefits for the cost of health insurance policies can be claimed. A basic premium of Rs 7,843 and GST of Rs 1,412 would be required if, for instance, you were to get a health insurance policy from Bajaj Allianz General Insurance Company at the age of 30 with a sum insured of Rs 10 lakh (18 percent GST applied on basic premium). It will cost Rs 9,255 in total for the premium.

Similar to the above, a person who buys the same policy at the age of 50 will be required to pay a basic premium of Rs 17,782 and a GST value of Rs 3,200. It will cost Rs 20,983 for the entire premium. Remember that the Tax Benefit is based on current Tax Laws and is not guaranteed.

Therefore, when claiming a tax deduction under section 80D, the sum of GST paid on your insurance premiums may also be included. The total premium of Rs 9,255 or Rs 20,983 is therefore deductible in each case under section 80D. The investment limit corresponding to the specific section pertains to this tax-saving deduction amount.

Insurance is subject to the solicitation. Before making a purchase, carefully read the sales brochure or policy wording for more information on the benefits, exclusions, limits, and terms and conditions.

Additional Read: Health Insurance BenefitsBenefits of Using Tax Deductions for Health Insurance

The advantages of tax deductions for health insurance are listed below.

- Saves cost

- Raises the take-home pay for salaried individuals

- Up to Rs. 1 lakh in tax benefits may be claimed

It's commonly argued that investing shouldn't be done solely to reduce taxes. In the case of health insurance, which is not an investment, the premium paid not only allows you to purchase health coverage for your parents but also helps you to reduce your tax burden. Health insurance for your parents is undoubtedly beneficial in light of the escalating costs of hospitals.

Bajaj Finance and its partners provide health insurance plans designed with your needs in mind. Individuals, families, and senior citizens can choose from various health insurance plans from Bajaj Finserv Health to get the right coverage.

References

- https://cleartax.in/s/medical-insurance

- https://www.bajajallianz.com/blog/health-insurance-articles/gst-on-health-insurance.html

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.