Aarogya Care | 6 min read

3 Things That Can Help to Manage Small Surgery Expenses

Medically reviewed by

Table of Content

Key Takeaways

- A small surgery is less invasive and has a reduced risk of complications

- Small surgery cost can be in lakhs of rupees depending on the type of surgery

- Health insurance plans cover small surgery expenses depending on the type

Healthcare expenses, including small surgery, are rising every day. Though common small surgery is less invasive and relatively quick, the cost for it can go to lakhs of rupees. These may be difficult to manage without a health insurance plan. However, there are some health insurance plans which may not cover certain small surgery expenses. As a result, simply having a health insurance plan is not as effective as having the right kind of health insurance.

To have an adequate health insurance plan, check your coverage amount and the type of policy you have. After that, understand the inclusions and exclusions of your policy. Unless it is a specific plan, like a critical illness plan, insurers mention whether costs like small surgery expenses are covered or not. Knowing this can help you better prepare for the costs you may have to bear.

Amongst a wide range of features, cover for common small surgery expenses is one of the benefits of having an Aarogya Care plan. These health plans can help protect your health without burdening your finances. Read on to know what small surgery entails and the general small surgery costs you may incur.

How is Small Surgery Different from Other Medical Procedures?

A small surgery is different from other medical procedures in the sense that it is quicker and often does not require extensive care. Medical procedures such as major surgeries usually require the surgeon to perform highly invasive surgery. These surgeries often need extra care after as well as before the surgery.

Moreover, major surgeries also come with a high risk of infection and post-op complications. Some common major surgeries are c-section, bypass, hysterectomy, organ transplant, replacement of the joints, heart transplant, and others.

Surgeries that do not require an extremely invasive procedure are generally termed minor or small surgery. It is important to remember that many major surgeries can be minimally invasive, but that does not eliminate the risk factors. Small surgery, along with less risk, also does not require extensive care because they are less invasive and damaging to your tissues.

Moreover, in small surgery, a local anesthetic is administered as the procedure is mainly limited to surface tissues. A small surgery is often known as in-patient surgery if it requires hospitalization for a day. Common small surgery types include biopsy, circumcision, dental surgery, appendectomy, and cataract.

The cover for major or small surgery expenses in an insurance policy is at the discretion of the insurer and the type of policy you choose. You should also talk to your insurer about the waiting period for certain medical conditions so that you can avoid sudden medical expenses.

Additional Read: Organ Transplant Cost with Aarogya Care

Which Type of Small Surgery is Generally Covered?

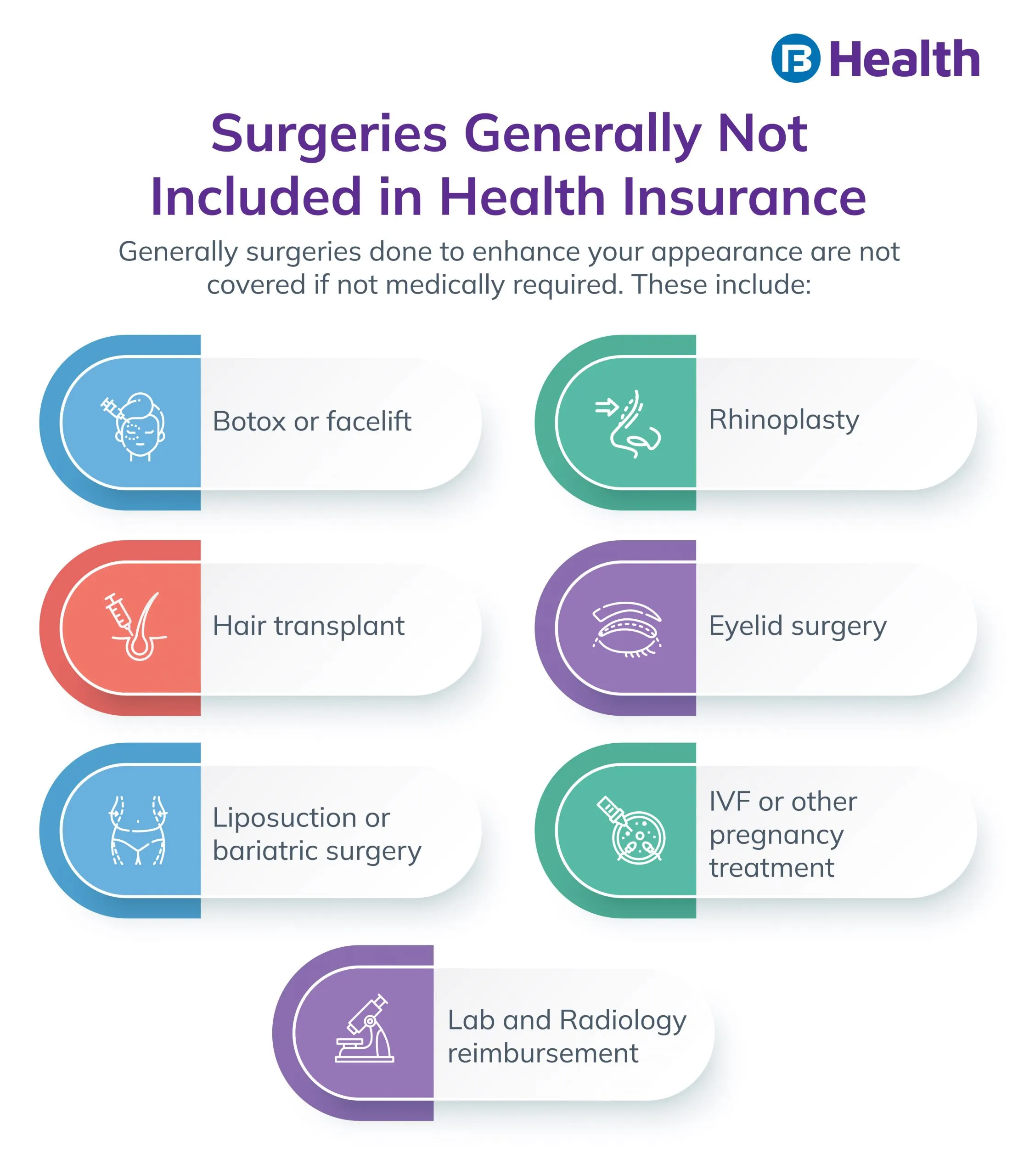

According to IRDAI, cover for certain surgeries is only offered if it is a medical necessity and not an appearance-enhancing procedure [1]. This means that your small surgery should fall under the category of a necessity where it would improve your health and standard of living. Basis this, surgeries can be generally classified as preventive, treatment, and health improvement.

Preventive Small Surgery

As the name suggests, these are small surgeries that can help prevent the condition from developing or progressing further. A common preventive small surgery is to reduce the risk of cancer spreading all over your tissues. A common small surgery under this category includes a biopsy.Small Surgery for Treatment of Conditions

The treatment of certain conditions requires surgery. If the surgery is less invasive and has a reduced risk of infection, it can be termed a small surgery. This may also be known as a curative surgery as it provides a cure for a certain condition. Cataracts or appendectomies are some examples of small surgery that help treat health conditions.

Small Surgery that Improves Health

Surgeries that can improve your living conditions and health come under this category. These are also generally known as cosmetic or plastic surgery. But since these can help improve your life, IRDAI specifies the cover for such a small surgery under a general health insurance plan. One example of this is rhinoplasty, which restructures your nose. Insurers may offer to cover this common small surgery if the shape of your nose affects your breathing.

Common Small Surgery Costs Incurred

Small surgery costs are usually the same as other medical procedures. This commonly includes the following:

Pre- and Post-hospitalization Expenses

This refers to the expenses that you incur before and after your small surgery. It includes tests done to determine your health before and after the procedure. Blood reports, x-rays, other scans, and tests are generally done before and after the surgery to determine your vitals. According to IRDAI, pre- and post-hospitalization expenses are generally covered for up to 30 and 60 days, respectively [2].

Surgeon, Attendant, OT fees

These fees refer to the surgeon and co-surgeons of your small surgery, the attendants, and the nurses who assisted in the procedure. OT, operation theater, costs are the cost that the hospital will levy for your procedure. The cover for these small surgery expenses is dependent on the types of policy you have and your insurer.

In-patient Care

In-patient care is applicable if your small surgery requires overnight admission to the hospital. The costs incurred during this period are generally covered under a health insurance policy. However, it depends on whether the small surgical procedure is covered or not.

Medicine and Equipment for Recovery

Whether it is a small surgery or a major surgery, you will require medication to ensure your health and avoid complications. Apart from this, you may also require a brace or crutch if your procedure limits your mobility for a while. You should talk to your insurance provider to understand whether or not this is a part of your insurance cover.

Additional Read: Benefits of Suburban MedicardThough many consider small surgery as something that can be postponed, they are often necessary to maintain your health. Having an insurance plan that offers cover for small surgery expenses can help you focus on the procedure and recovery rather than on your finances. Check out the Health Protect Plans available on Bajaj Finserv Health. You can find these plans under the umbrella of Aarogya Care and select the one that best suits your needs.

Health Protect Plans offer cover for up to Rs. 10 lakh with benefits such as preventive health checkups, doctor consultations, lab test reimbursement, and more. You can check out the Health Card available on the platform too. This virtual membership card has preventive health checkup benefits along with lab test benefits. Combining a Health Card with Health Protect Plans can help you address your and your loved one's health with ease. So, sign up now and take key steps towards protecting your health.

References

- https://www.policyholder.gov.in/you_and_your_health_insurance_policy_faqs.aspx

- https://www.irdai.gov.in/admincms/cms/uploadedfiles/Guidelines%20on%20Standard%20Individual%20Health%20Insurance%20Product.pdf

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.