Aarogya Care | 6 min read

Top 6 Medical Services Covered in a Health Insurance Plan

Medically reviewed by

Table of Content

Key Takeaways

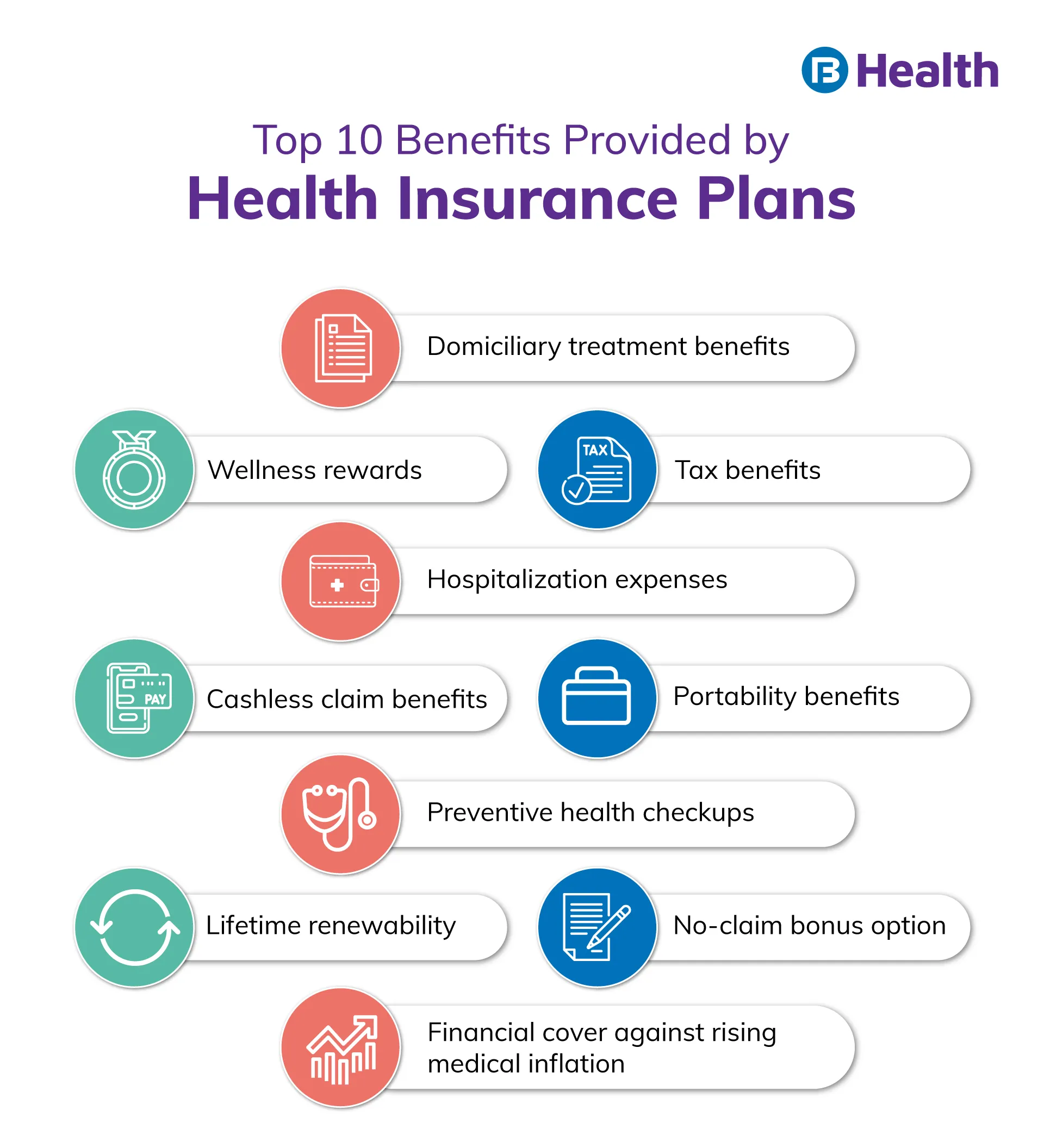

- Hospitalization expenses and domiciliary costs are covered in a health plan

- Telehealth benefits and ambulance expenses are a few other inclusions

- Cosmetic surgeries and infertility treatment costs are usually excluded

With the increasing number of active COVID-19 cases, having a health insurance policy plays a vital role in ensuring you get comprehensive care when you need it. Though statistics reveal more than 4 crore active cases in India, the infection from the current variants is not that alarming, unless you have comorbidities [1]. The vaccination program rolled out by the central government has helped in this regard. However, meeting COVID-19 treatment costs during and after infection is easier if you invest in an affordable health insurance policy. Be it testing for infection or the recovery phase, this helps you be well-prepared to manage medical costs.

While you can understand the importance of a health insurance policy, are you aware of what medical services are covered in it? Knowing the services that you can claim expenses for helps you plan your finances better. This also enables you to choose the right health policy as every plan has different inclusions. Read on to know more.

What Are the Different Types of Health Insurance Coverage?

Here are a few types of health insurance plans available in India [2].

- Individual health insurance: As the name suggests, this is meant for one person. Only the policyholder can enjoy its coverage benefits. The premium you pay depends on your age and medical history.

- Family health insurance: Family health insurance covers your entire family under a single plan. You can include your kids, spouse and parents. Only the main member has to pay the premium while the entire family is insured.

- Critical illness insurance: Critical illness insurance provides coverage for life-threatening diseases such as stroke, cancer, heart attack and more.

- Senior citizen health insurance: Senior citizen health insurance is specially designed for individuals above the age of 60 years.

- Group health insurance: This plan is taken by a company for its employees.

What Medical Services Are Covered in a Health Plan?

Pre- and Post-Hospitalization Expenses

Pre-hospitalization expenses include all those costs you incur before you are admitted. Whether it is a medical check-up or a diagnostic test to analyze your condition, your policy covers you. Post-hospitalization includes medical bills you need to pay after you get discharged. This includes follow-up visits with your doctor, stitch removal or other routine tests that you may be asked to take. Top insurers also offer coverage for it up to a certain time. Check the terms of the policy to understand this better.

Day-Care and OPD Procedures

There are certain treatments that may not require hospitalization beyond 24 hours. In case of a minor surgery like arthroscopy, you can go home the same day. With advancement in science, it is possible for you to be back to normal life within a few hours of undergoing a minor surgery. Be it a treatment to get your ear wax removed or cataract operations, these are all included in OPD or day-care procedures. Your health insurance cover includes expenses of these procedures as per the terms.Domiciliary Treatment

This is nothing but home treatment expenses, which are included as a part of your health coverage. In some situations, your loved ones may prefer being treated in the comfort of the home rather than a hospital. In other cases, due to lack of mobility, you or your family member may need treatment at home. Also, if there are not enough resources in your insurer’s network hospitals to accommodate a patient, you get the option of domiciliary facility. Here treatment is covered for a specific number of days.

Cash Allowance

This is a unique feature that some insurance companies offer. When your loved one is hospitalized, you may have to pay a hefty amount for food and accommodation while taking care of the patient. It can get even tougher if the hospitalized person is the sole breadwinner of the family. To help you during such times, your policy may include a pre-determined amount for you to manage your daily expenses when a member is hospitalized.

Annual Health Check-UPs

This is a preventive option that helps you prioritize your health. When you have frequent diagnostic tests and full body check-ups, you can identify illnesses before they spread or become severe. You can also make lifestyle changes once you know you are at risk of a disease.

You can get these tests done once a year via the right health policy. All members covered in your plan can avail this benefit. Some of the common tests offered here include:

- ECG

- Blood tests

- Sugar test

- Routine urine analysis

- Kidney function test

Additional Value-Added Services

Your health insurance policy may provide cover for other services too. These include free ambulance pickup, ICU charges, second opinion from other specialists and other alternate treatments.

Additional Read: Are Lab Tests Covered in a Health Insurance Policy?What Are Other Services Covered Under the Umbrella of Health Care?

- Telehealth includes all medical services that are provided using video and audio technology. The pandemic has witnessed an increasing demand for telehealth benefits. Without the need for stepping out of your home, you can get medical advice from experts. Right from remote patient monitoring to routine patient consultations, telehealth was actually a boon during COVID-19 [3]. Given the importance of telehealth, many insurance providers include online doctor consultation benefits as a part of their policies.

- You may also wonder, ‘Are medicine expenses covered in health insurance?’ Yes! You can claim expenses towards medicines provided you keep the pharmacy bills. This also depends on your policy terms.

- To encourage you to lead a healthy life, many insurers offer wellness rewards in the form of discount vouchers.

- All additional expenses of a surgery are also covered as a part of most comprehensive plans. Right from pre-and post-operative tests to the surgeon’s fees, medications and OT costs, all are covered.

- Costs for medical equipment such as crutches and hearing aids are also included in certain plans.

What Are Medical Expenses Not Covered by Insurance?

Take a note of the services not usually included in a health policy.

- Cosmetic surgeries like implants, liposuction and Botox

- Infertility treatment costs and pregnancy-related complications

- Cost for health supplements like tonics and vitamins

- Diseases caused by excessive alcohol consumption

By understanding inclusions and exclusions before you finalize a healthcare plan, you can make a wiser decision. For affordable coverage with the maximum medical services, you can browse through the Complete Health Solution plans on Bajaj Finserv Health. With a wide range of comprehensive features like online doctor consultation reimbursements, preventive health check-ups and a medical coverage up to Rs.10 lakh, these plans are perfectly designed to suit your healthcare requirements. There are so many health insurances available in the market Ayushman health account is one of them provided by the government.

On availing these plans, you can enjoy coverage for the following.

- Pre-and post-hospitalization expenses

- Preventive and wellness check-ups

- 45+ lab tests

- COVID-19 hospitalization costs

- Day-care procedures

- Ambulance charges up to Rs.3,000

Say yes to your health, choose the most suitable plan and sign up without delay!

References

- https://www.worldometers.info/coronavirus/country/india/

- https://www.policyholder.gov.in/you_and_your_health_insurance_policy_faqs.aspx

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7577680/

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.