General Health | 5 min read

Wedding Bells Set to Ring in the New Year? Don't Forget About Health Insurance!

Medically reviewed by

Table of Content

Key Takeaways

- Investing in a health insurance policy before marriage is essential

- Purchase a <a href="https://www.bajajfinservhealth.in/articles/group-health-vs-family-floater-plans-what-are-their-features-and-benefits">family floater plan</a> to include your spouse in it

- You may also invest in an individual plan where both of you are proposers

With 2022 around the corner, you may have planned to start your year in a new way with your soulmate. After all, this is the season for weddings in India, and there’s nothing like the thrill of wedding bells to kick off the new year. A marriage is a beautiful celebration where two souls come together. It’s not only about two individuals but also an amalgamation of two families. Undoubtedly, it is a major milestone in everyone’s life.

Apart from companionship and love in a marriage, there are myriad responsibilities in a couple’s life. Right from emotional and physical well-being to financial requirements, there are many things you need to take care of. Most often, you tend to get so busy starting this new chapter of your life that you may forget to make important decisions about your future security.

One of the most common things that gets overlooked is investing in a health insurance policy. If you have an existing policy and your spouse does not or vice versa, you can include the other in your respective plans. Purchasing a policy with a higher coverage in combination with a maternity cover may be an ideal option for newly married couples. To understand how to plan your health insurance after marriage, consider these different situations.

Additional read: Different Types of Health Insurance Plans for Family: Are They Important?

When Your Wife Has an Individual Health Policy

Your wife may already have an existing individual health insurance policy, no matter whether she is employed, has her own business, or is completing her higher education. After marriage, all she needs to do is change her maiden name in the plan. Your wife can continue with her existing plan. There is also another option that she can choose. Your wife can purchase a new individual health plan that has her new surname and port her existing plan to this new plan. Knowing different features of individual plans can help you select a plan better.

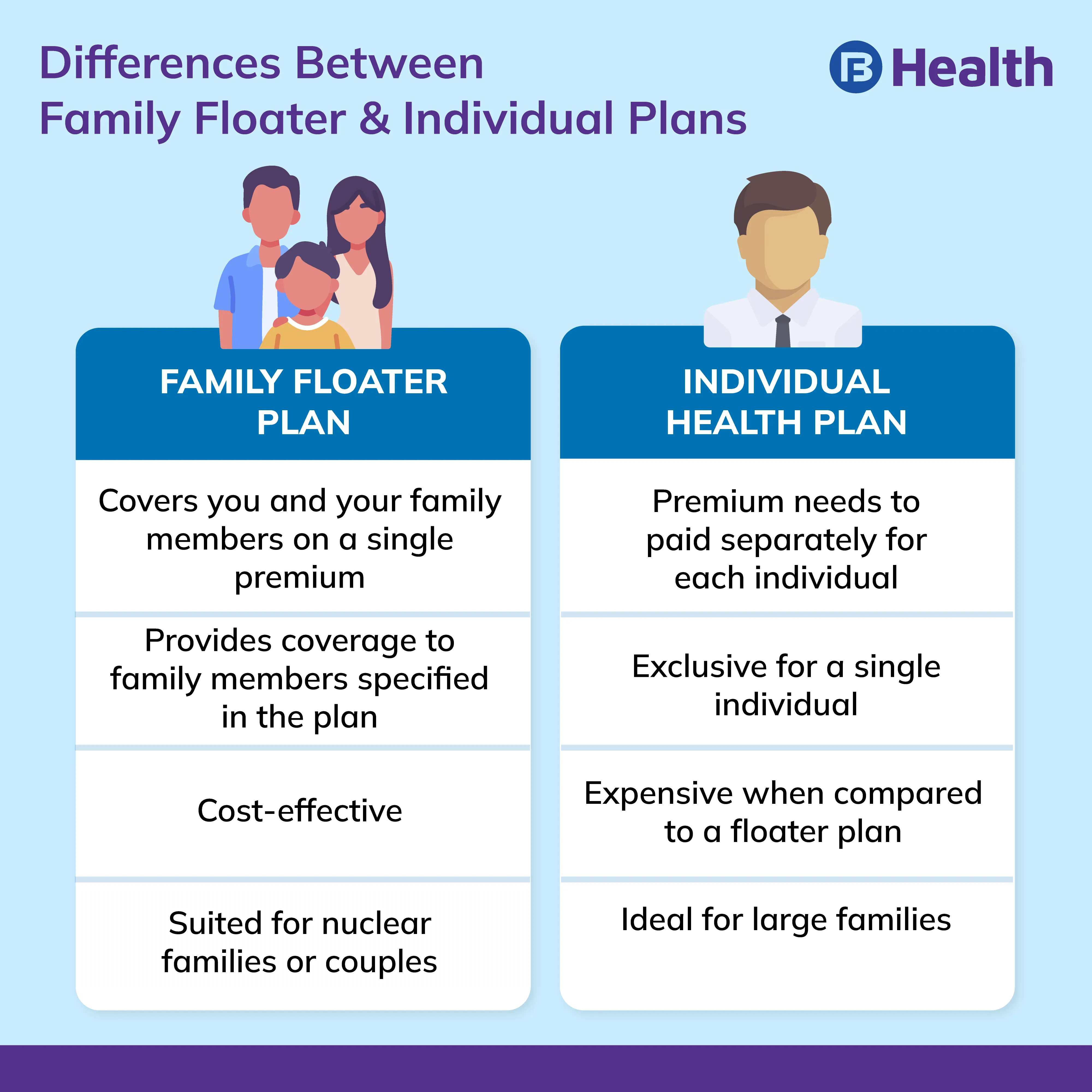

Individual health plan is the coverage you get on an individual basis. This means that you pay separate premiums for each family member. By availing this plan, you can customize the plan as per your individual requirements. The solo coverage feature enables you to utilize the sum exclusively for yourself.

Individual plans offer a wider cover that spans pre- and post-hospitalization charges, daycare and ambulance services to name a few. You get the option for buying riders like maternity benefits or add-ons like critical illness cover. These can be linked to your existing plan. One of the most striking features of an individual plan is that you are allowed to make multiple claims as long as your total coverage amount is not exhausted. In case you don’t make a claim in previous year, you get a discount on the premium when you renew it the next time [1].

When You Have a Family Floater Plan

Let us assume that your wife has not purchased any health insurance policy but you have a family floater plan for your parents and yourself. After marriage, you can add your spouse to this floater plan and pay the additional premium. If your policy is due for renewal, you may add your partner’s name during this time as well. A family floater policy provides the option of covering several members by paying a single premium annually.

You can utilize the total cover whenever required by any member included in the plan. This provides a cost-effective approach rather than purchasing separate policies for family members. You can thus distribute the sum insured among your family members. Though many health insurance plan allow you to cover only immediate members like spouse, children and self, other policies provide coverage even for dependent parents or siblings. By opting for the cashless facility, you can get required medical care at any of the network hospitals of your insurer without any hassle [2].

When Your Wife Has a Family Floater Plan

In case your wife is already a part of a floater policy before marriage, she can include your name into her existing policy after marriage. There is another option where you and your wife can invest in a new family floater policy for both of you. The existing floater plan need not be discontinued as it includes her parents and other family members. She can simply choose to remove herself from this plan.

Additional read: Why is It Important to Choose the Right Health Insurance Plans for a Family?When Both of You Have Not Availed Any Health Insurance Plan

In this scenario, you can purchase a family floater plan and include yourself and your spouse in the plan. This way both of you are covered under a single plan. The one purchasing the plan can be the proposer. You may also invest in separate individual plans. In this case, both you and your spouse can be proposers in your respective plans.

A marriage marks the beginning of a journey where your partner and you walk the paths of life together, protecting each other. Purchasing health insurance is important so that both of you can start your life stress-free. Now that you have understood the different scenarios, you can discuss the right policy for yourselves.

Choose an ideal policy that best suits your requirements as a couple. For budget-friendly plans with all-around benefits, browse through the range of Aarogya Care plans on Bajaj Finserv Health. With features like online doctor consultations, preventive health checkups and huge network discounts, they can add value to your life. They include both individual and family plans and offer financial support from wellness to illness. So, plan your health insurance without delay before your wedding bells ring!

References

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.