Aarogya Care | 5 min read

Ayushman Bharat Scheme: How Does This Plan Help in Managing Medical Expenses?

Medically reviewed by

Table of Content

Key Takeaways

- You can avail cashless treatment by using the PMJAY golden card

- This scheme also covers COVID-19 pandemic treatment costs

- Visit the PMJAY website to check if you are eligible or not

Ayushman Bharat scheme, now known as Pradhan Mantri Jan Arogya Yojana or PMJAY, is an initiative launched by the Government of India in order to ensure that health coverage is provided to everyone alike [1]. This scheme aims to secure the healthcare requirements of low-income groups. With this flagship scheme, the government offers cover for individuals from both urban and rural areas of the country. It provides a total coverage of Rs.5 lakh that is inclusive of hospitalization expenses, diagnostic costs and critical illness to name a few.

With rising medical inflation, it becomes all the more vital to utilize the benefits of the Ayushman Bharat Health Account. This way no one is deprived of medical care especially during the pandemic. With the threat of the new variant increasing day by day, purchasing a healthcare plan has become the utmost priority. When you avail this scheme, you can enjoy cashless treatment in all network hospitals. To know more about how you can manage medical expenses using this scheme, read on.

Additional Read: Ayushman bharat registrationHow to avail cashless treatment under this scheme?

If you avail this scheme, you will be given a PMJAY golden card. This card contains all essential information such as your details. By using this card, you can avail cashless treatment at any of the network hospitals. To download the cashless card, follow these steps:

- Step 1: Login to the PMJAY website using your registered mobile number

- Step 2: Generate an OTP after entering the captcha code

- Step 3: Choose the HHD code or household ID number

- Step 4: Enter the code and provide it to common service center of PMJAY

- Step 5: Your details will be checked and verified

- Step 6: The remaining application will be completed by the representative

- Step 7: Pay Rs.30 to generate the Health ID card

This scheme also covers COVID-19 treatment costs. Submit this golden card or your unique identification number to avail cashless treatment. You can check if you are eligible or not by visiting PMJAY website.

How are the hospitalization treatment expenses covered under this scheme?

This scheme provides total coverage of Rs.5 lakh [2]. You can utilize these funds to cover surgical and general medical expenses in different specialties that include:

- Orthopedics

- Oncology

- Cardiology

- Neurology

- Pediatrics

This scheme doesn’t allow you to reimburse your surgical and medical expenses at the same time. Assuming you get hospitalized several times for multiple surgeries, you will get reimbursement for the surgery with the highest cost. After this, you will get a 50% waiver for your second surgery and a 25% discount on third surgery. The best part is that this scheme does not include a waiting period for your pre-existing illnesses.

What are the critical ailments usually covered in the Ayushman Bharat scheme?

The critical illnesses and procedures covered in the Ayushman Bharat scheme include:

- COVID-19 treatment

- Brain surgery

- Valve replacement

- Spine fixation

- Prostate cancer

- Angioplasty

- Burn treatment

How can you avail the benefits of this scheme?

To avail the benefits of abha card of this scheme, register on the PMJAY website. To check if you are eligible, follow these simple steps.

- Step 1: After visiting the website, click on the eligibility option

- Step 2: Give your contact details

- Step 3: You get an OTP number

- Step 4: Choose your state and provide the registered mobile number

- Step 5: You will get to know if you are eligible for the scheme

You can also contact a call center to check your eligibility.

To apply for this scheme, submit the following documents:

- Income certificate

- Your contact details

- Caste certificate

- Document confirming your identity and age

- Document showing the number of family members

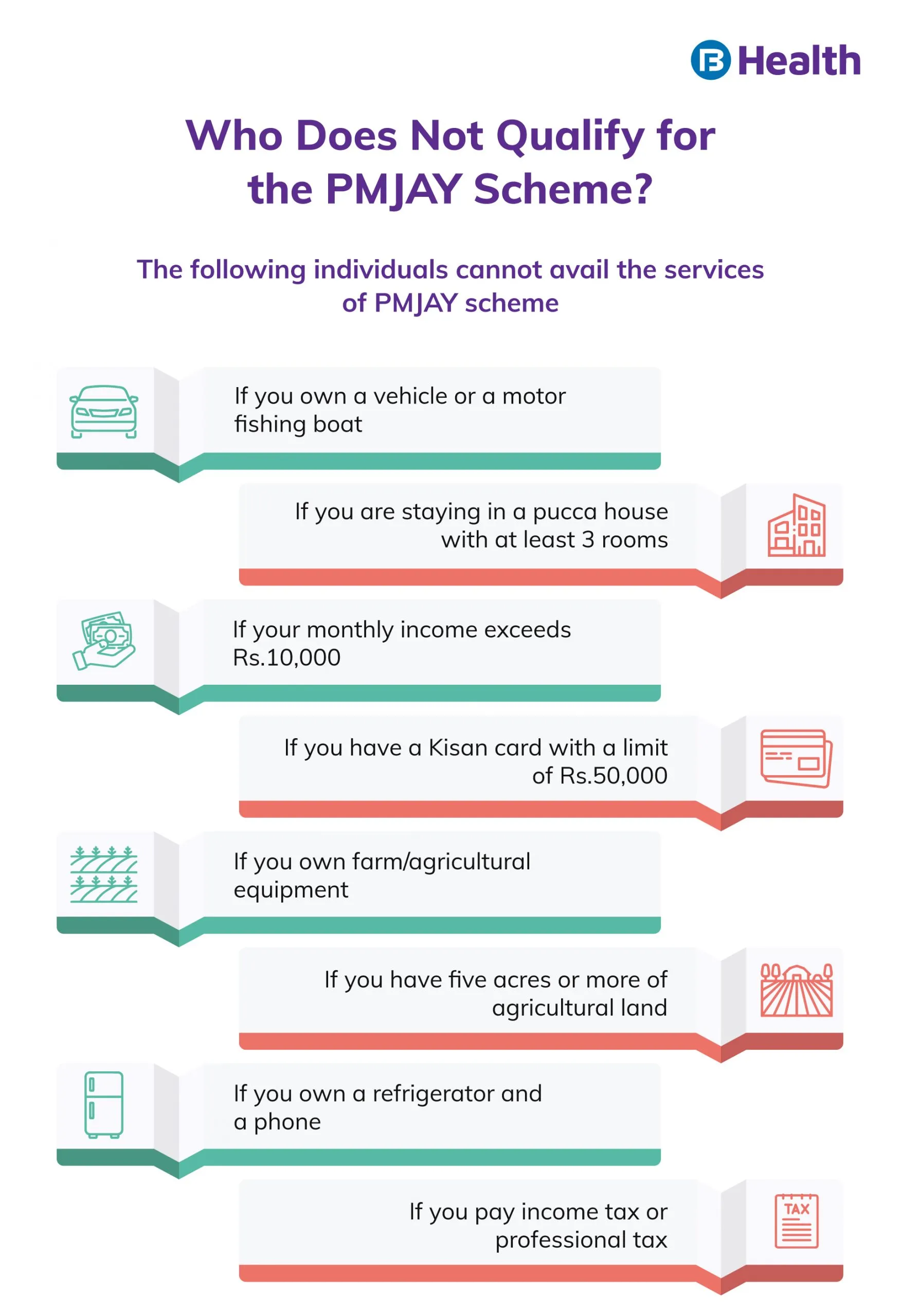

What is the eligibility criteria and exclusions of this scheme?

The Ayushman bharat yojana is specifically designed to cover the health insurance needs of low-income groups. The eligibility criteria depend on your living conditions.

If you are staying in rural areas, you are eligible for this scheme only if you fulfill these conditions:

- You belong to an SC or ST family

- You are working as a bonded laborer

- Your family has no member with age between 16 and 59 years

- Your household has no healthy individual but one physically challenged member

- You don’t own a land and work as a manual laborer

If you are residing in urban areas, you can qualify for this scheme if you are one of the following:

- Domestic help

- Tailor

- Cobbler

- Transport worker

- Sanitation worker

- Electrician

- Rag picker

This scheme covers the following:

- Pre- and post-hospitalization expenses

- Diagnostic investigations

- Medical examination

- Medicines

- Accommodation

- Complications that occur during the treatment

The following aspects are excluded from coverage:

- Organ transplant

- Fertility procedures

- Drug rehabilitation

- Cosmetic procedures

The Ayushman bharat yojana has become one of the most effective healthcare schemes of the country. Its introduction also saw a growth in the health insurance market as low-income groups are also able to access medical cover. If you have availed this scheme, you are eligible for cashless treatment at any of the empaneled public or private hospitals. However, since this scheme is mainly intended to cover low-income groups, you may not be eligible. If you are planning to invest in health insurance, check out Aarogya Care Complete Health Solution plans from Bajaj Finserv Health. Apart from this Bajaj Finserv health offer Health Card which converts your medical bills into easy EMI.

With four different variants at your fingertips, you can choose the right one based on your requirements. Right from doctor consultation benefits to preventive health checkups, these plans cover all your health requirements. With a total insurance cover of Rs.10 lakh, you also get to enjoy the huge network discounts at any of the listed hospitals on the Bajaj Finserv Health network. Invest in a plan today and manage your medical expenses without any hassle.

References

- https://pmjay.gov.in/about/pmjay

- https://pmjay.gov.in/benefits-of-pmjay

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.