Tax Saving Health Insurance: Section 80D and Its Benefits

- Legal procedures

- Difference between Sections 80C and 80D

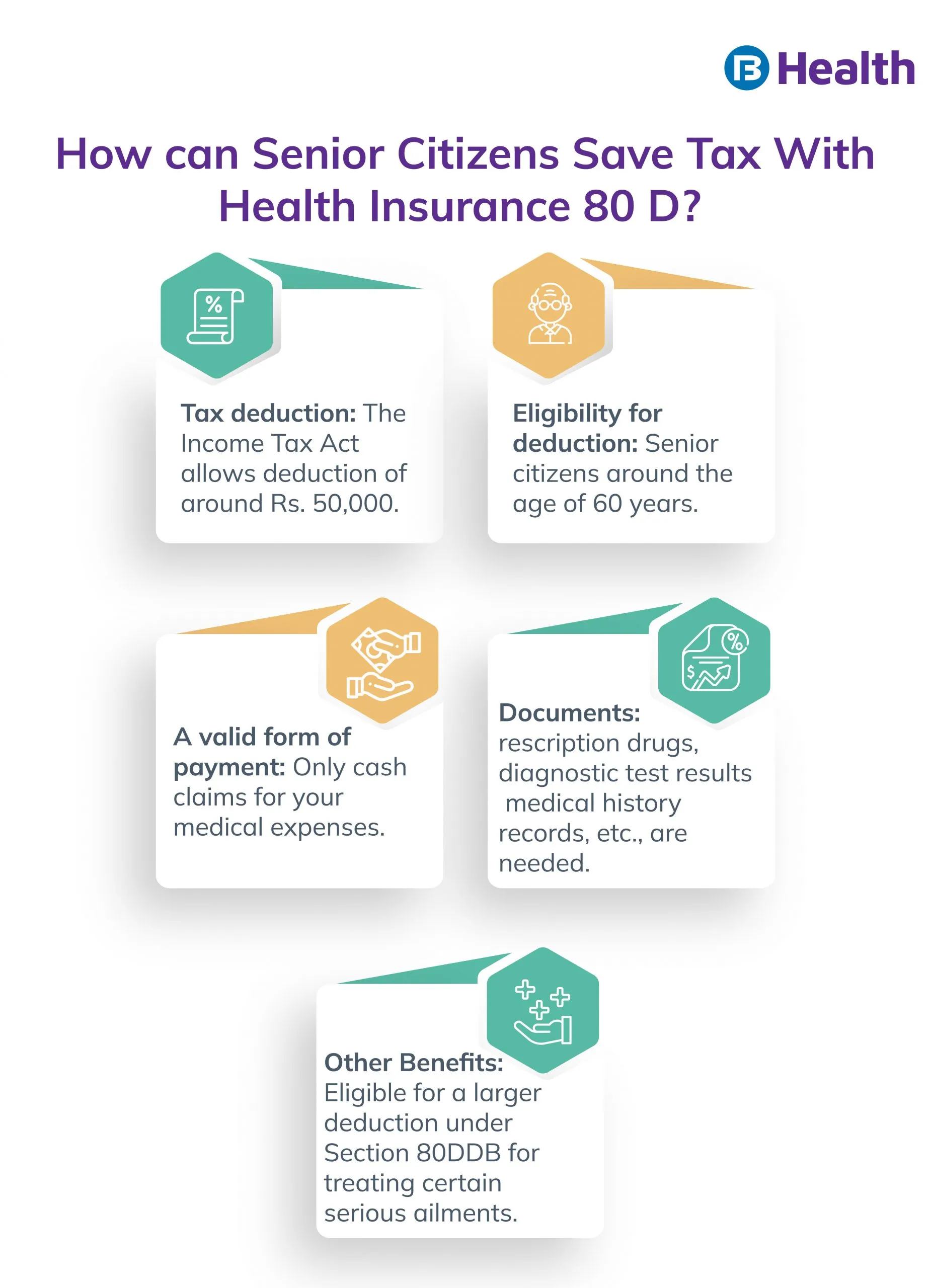

- The Tax Deduction Limit for Senior Citizens

- Who is Eligible for Such a Deduction?

- Tax Deduction Limits in Different Scenarios Under Section 80D

- What is the Valid Form of Payment?

- Senior and Super Senior Citizen Income Tax Exemptions

- What are the Exemptions Under Section 80D?

- Rebate of Income Tax for Seniors and Super Senior Citizens

- Documentation Necessary to Claim Tax Benefits

- Other Benefits of Health Insurance

Synopsis

Long-term insurance is an option for seniors. To account for the insurer's risks, senior tax-saving health insurance premiums are often higher.

Key Takeaways

- Due to their higher risk of age- and lifestyle-related illnesses, medical expenses of senior citizens are typically high

- Seniors who have health insurance can live comfortably in their later years

- In most cases, insurers are reluctant to offer medical insurance to older persons with pre-existing problems

India's history is steeped in a rich cultural heritage where respect and love are shown to elders. They are looked after to inform future generations about both joyful and odd happenings. The government provides special income tax benefits for seniors to preserve culture and moral principles. Reducing their tension at this stage of life is their goal. Senior citizens are faced with several health ailments. As the age increases, they have more chronic diseases. Muscle wear and tear, along with bone resorption, is very common. This paves the way for even further sickness. Since they are weak, diseases take longer to heal. Read more this tax saving health insurance and it's benefits for senior citizen.

Along with the rise in sickness, there is also an evident rise in the cost of treatment and hospital billings, that is, medical inflation. With the increasing economy, medicine and treatment have taken a surge. But unfortunately, the savings of our elders is still the same. Hence, getting a health insurance plan for senior citizens is not only right but a necessary plan of action.

Legal procedures

ITR-1 is a form that senior citizens can use to file their income tax returns and can be used if they have a salary, a pension, income from rental property, or income from other sources. Except for a few situations, people must file their returns using the ITR- 2 forms if their income consists of both long- and short-term capital gains.

Additional Read: Tax Saving Health Insurance Plan for senior citizenDifference between Sections 80C and 80D

Section 80C and Section 80D are occasionally mixed up. Section 80D enables deductions up to Rs. 65,000, subject to limitations, whereas Section 80C offers deductions up to Rs. 1.5 lakhs annually. Another point of distinction is that although Section 80D is intended just for deductions on health insurance premiums paid, Section 80C includes investments made in various financial instruments like small savings plans, life insurance premiums, mutual funds, etc.

The Tax Deduction Limit for Senior Citizens

The Income Tax Act allows you to deduct up to Rs 50,000 (as of FY 2021-22) from your taxable income for medical costs paid during a fiscal year for the care of older citizens (qualified parents). As a result, if you are 60 years of age or older, you can deduct up to Rs 50,000 from your taxable income for medical costs or tax-saving health insurance premiums.

However, there is an additional limit of Rs. 50,000 if medical expenses for elderly parents are covered. As a result, if you are over 60, you are eligible to deduct up to Rs. 50,000 from your medical expenditures. Additionally, you are eligible for an extra deduction of up to Rs. 50,000 if you paid for your parent's medical expenses (if they are 60 years old or older). The entire limit for section 80D is Rs. 50,000. Therefore, you may deduct up to Rs. 50,000 from the cost of health insurance, the CGHS (Central Government Health Scheme), preventative health exams, and medical costs for yourself or senior members of your family, plus an extra Rs. 50,000 if such expenses are incurred for senior parents.Who is Eligible for Such a Deduction?

Under section 80D, any person may deduct medical expenses they pay for themselves or senior members of their family. Medical expenses that the person paid for his elderly parents are likewise deductible. A senior citizen is someone who is at least 60 years old. Also included as family members are a husband and any minor children. The deduction is only permitted if these people do not have access to medical insurance.

The rule primarily benefits senior individuals who incur medical costs but lack secondary tax-saving medical insurance coverage due to prohibitively high health insurance charges. They will therefore be exempt from paying income taxes thanks to the new rule. The act does not specify the kinds of medical expenses that are covered. However, in the expert's opinion, hospitalization and routine medical costs, such as prescription drugs and consultation fees, should be considered for this purpose.

Additional Read: Section 80D: Enjoy Combined Benefits of a Tax Rebate and Medical CoverageTax Deduction Limits in Different Scenarios Under Section 80D

- Individuals and parents younger than 60 years old must pay a premium of Rs. 25,000 and may deduct Rs. 50,000 as allowed by Section 80D.

- Individuals and families under 60 years must pay a premium of Rs. 25,0000 and may deduct Rs. 50,000.

- Parents above 60 years must pay a premium of Rs. 50,000 and may deduct Rs. 75,000.

- Individuals, families, and parents above 60 years of age are obligated to pay a premium of Rs.50,000, and the deductions would be Rs.1,00,000.

What is the Valid Form of Payment?

Only when payment is made using a method other than cash may you claim medical expenses. Therefore, you are qualified to file a claim if you paid your medical costs with a debit card, credit card, internet banking, UPI, or wallet payment. Section 80DDB also covers specific diseases or medical problems for a defined age range in addition to Section 80D. You may file a claim under section 80DDB if your medical condition falls under that heading. If the limit has been reached or the medical condition does not fit into that category, you may still be able to deduct the remaining medical costs under section 80D.

Senior and Super Senior Citizen Income Tax Exemptions

The three main tax exemptions that apply to those over 60 are outlined in the following three sections.

The healthcare industry is one of the crucial sectors where you can especially profit from these exemptions. The government has provided tax incentives on health insurance policies in response to the nation's escalating healthcare costs, which can substantially lower treatment costs.

The tax benefits that individuals can take advantage of, as proposed by the Union Budget, are as follows:

- The Income Tax Act's Section 80D allows people between the ages of 60 and 80 to deduct up to Rs 5,000 from the cost of their health insurance premiums.

- The deduction for interest income from bank and post office deposits has increased from Rs. 10,000 to Rs. 50,000 under Section 194A. The interest received from various fixed and recurring deposit programs is also eligible for this benefit.

- Individuals are eligible for a deduction of up to Rs. 1 lakh under Section 80DDB for the cost of treating certain serious illnesses. Previously, the senior citizen and super senior citizen deduction limits were set at Rs. 60,000 and Rs. 80,000, respectively.

With such a senior income tax exemption threshold, Indian seniors and super seniors now have considerably easier access to healthcare.

What are the Exemptions Under Section 80D?

You cannot claim a deduction under Section 80D in the following cases:

- If cash is used to pay the tax-saving health insurance premium. Medical expenses can be paid in cash.

- If payment is paid on behalf of a working child, sibling, grandmother, or other families

- The employer paid the employee's group health insurance premium.

Rebate of Income Tax for Seniors and Super Senior Citizens

Senior and super-senior individuals who meet the below requirements may be eligible for tax exemptions under Section 87A of the Income Tax Act of 1961:

- A person who resides in the area.

- After any relevant deductions, their combined income cannot exceed Rs. 5 lakh.

- The total tax rebate cannot be greater than Rs. 12,500. The amount will be the whole exemption if the person's total taxable liability is less than Rs. 12,500.

But before figuring out your tax obligation, you need also be aware of the income tax exemptions for seniors, which can greatly simplify your life.

Documentation Necessary to Claim Tax Benefits

The Income Tax Act does not specify the documents that must be presented to obtain a tax deduction. Documentary evidence should be kept, including invoices for prescription drugs, diagnostic test results, medical history records, and other items. Your primary priority should be getting your elderly parent's tax-saving health insurance since they deserve to live long lives with a complete health solution in their golden years.

Other Benefits of Health Insurance

In the year that they do not create any commercial income, they are likewise exempt from advance tax payments. The interest generated on various bank deposits and securities is exempt from TDS. Senior citizens are eligible for a larger deduction under Section 80DDB for the treatment of certain serious ailments. For people over 60, the money received under a reverse mortgage plan is also tax-free.

In a nutshell, senior and super senior citizens get better income tax benefits when compared to people under 60. Senior citizens are eligible for a reduction on their tax-saving health insurance premiums of up to Rs. 50,000. The government has implemented several income tax incentives to lessen the tax burden on the nation's senior and super senior citizens. To guarantee a financially independent life in your senior years, familiarize yourself with the applicable tax slabs, exemptions, and perks before filing your income taxes. Apart from Aarogya care Bajaj Finserv Health Offers a Health card that converts your medical bill into easy EMI.

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.