Aarogya Care | 4 min read

5 Top Reasons Why You Must Buy Medical Insurance for Parents

Medically reviewed by

Table of Content

Key Takeaways

- Buy the best health insurance for parents to tackle rising medical costs

- Get cashless coverage at network hospitals with parent’s health insurance

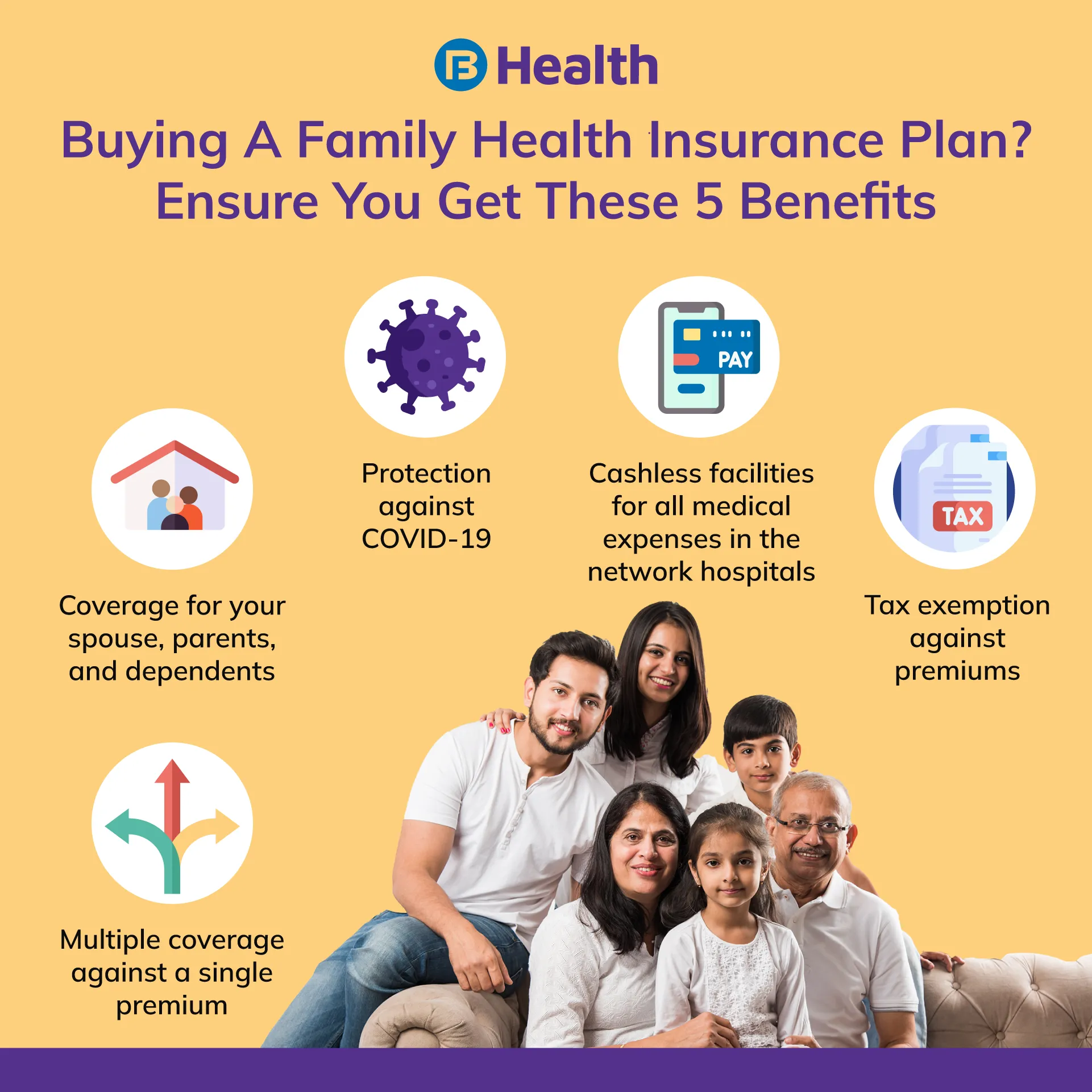

- Claim tax deductions of up to Rs.75,000 with medical insurance for parents

As your parents age, they go through many alterations in their immune system [1]. These lead to a lot of changes on the cellular level, and can be the root cause of many age-related diseases. Treatment for these can be expensive, given the rising healthcare costs in India. To offer your parents the right treatment for all their geriatric or lifestyle problems without worrying about finances, you need a separate medical insurance for parents.

When you have a senior citizen health insurance policy in hand, you do not have to worry about such expenses or fear the unexpected. Choosing the best health insurance for parents is easy, provided you know their specific concerns and have compared policies before buying one. Here are the top benefits of buying your parent’s health insurance as they near the age of 60.

A senior citizen insurance policy helps you tackle age-related medical needs

Advanced medical treatment offers seniors a better quality of life but the use of the latest technology hikes the costs involved. When added to medical inflation, this is enough to make a big dent in your savings in the event of an unexpected medical emergency. This coupled with the risk of your parents falling ill more frequently with age will only worsen the situation further. To avoid all this, you should invest in a senior citizen health insurance policy for your parents at an early age.

Additional Read: Why the Aarogya Care Health Protection Plans Offer the Best in Health Insurance

The best health insurance for parents helps you cover the rest of the family more affordably

Today, the human population is aging much faster as compared to the past [2]. Insurers determine the premium on your parent’s health insurance considering your family’s health history, as well as your parent’s age, fitness, and more. After including the risk of hospitalisation arising due to pre-existing ailments, your insurer may quote a higher premium. Adding your full family and yourself in this plan will reduce the individual cover for each one of you and cost more too. Instead, you can get separate policies for comprehensive coverage on an affordable premium by opting for a separate policy for your parents.

A good health insurance plan can offer you comprehensive benefits

The best medical insurance for parents is the one that goes beyond covering hospitalization costs. With a comprehensive cover, you can get a range of benefits such as:

- OPD cover

- Dialysis cover

- Domiciliary hospitalization cover

- Consumable cover

- Pre and post-hospitalization cover

These are just some of the key covers, which you can get as per your requirement and the policy you choose. However, with most insurance providers, you can get these covers only in an add-on plan, as they are usually not included in base policies. That is why it is better to buy a comprehensive policy that is all-inclusive. You can select suitable add-ons and get optimal coverage for your parents through the right health plan or you can buy a individual parents health insurance.

Your parent’s health insurance allows you to claim tax deductions

The premium you pay for your parent’s health insurance is allowed for tax exemption under section 80D of the Income Tax Act. You can claim up to Rs.50,000 in a year on health insurance premiums paid for yourself and your parents below the age of 60 years. In case your parents are above 60, the claim limit extends to Rs.75,000. This tax deduction helps you plan your other expenses, without letting the premium become a burden.

Additional Read: How are Bajaj Finserv Health’s Aarogya Care Health Insurance Plans Beneficial?

Medical insurance for parents helps your loved ones get treated at reputed hospitals

About 92% of seniors have at least one chronic disease and 77% have at least two [3]. Given this fact, when you have seniors at home it is important to be ready for hospitalisation, if need arises. This is why it is good to have a health plan with which you can avail cashless treatment for your parents. When searching for the best medical insurance for parents, consider a policy that has the following benefits.

- Access to the maximum number of hospitals across India

- Cashless treatment in most of these network hospitals

With a mediclaim policy for parents having these facilities, you can get speedy treatment for your parents. While this only works for hospitalization, you can also choose a comprehensive plan for all their recurring or emergency ailments.

Along with these benefits, buying your parent’s health insurance can actually bring you peace of mind! With a reliable policy, you do not have to constantly worry about your parents falling ill. You can route your savings to fulfil other goals and pressing issues. However, before buying a health plan, weigh your options by comparing health policies.

To avail great features at a premium you can afford, go for Aarogya Care plans from Bajaj Finserv Health. With them, you can address your and your family’s health concerns with ease and get value for money. Check them out today and take care of your parents as they approach their golden years!

References

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5732407/

- https://www.who.int/news-room/fact-sheets/detail/ageing-and-health

- https://www.ncoa.org/article/get-the-facts-on-healthy-aging#intraPageNav0

Disclaimer

Please note that this article is solely meant for informational purposes and Bajaj Finserv Health Limited (“BFHL”) does not shoulder any responsibility of the views/advice/information expressed/given by the writer/reviewer/originator. This article should not be considered as a substitute for any medical advice, diagnosis or treatment. Always consult with your trusted physician/qualified healthcare professional to evaluate your medical condition. The above article has been reviewed by a qualified doctor and BFHL is not responsible for any damages for any information or services provided by any third party.